Do you intend to save money each month, but often find there’s little or nothing left by the time bills are paid and expenses are covered? Does saving feel like an afterthought, something you’ll do if there’s money remaining? If so, you’re experiencing a common financial struggle. But what if you could flip the script entirely, making saving automatic, effortless, and your top financial priority? That’s the simple genius behind the Pay Yourself First principle.

This isn’t just another budgeting trick; it’s a fundamental mindset shift that can revolutionize your ability to build wealth and achieve financial security. This guide will break down exactly what the Pay Yourself First strategy entails, why it’s incredibly effective from a behavioral standpoint, how much you should aim to “pay yourself,” and provide a step-by-step plan to implement it using the power of automation. Get ready to prioritize savings and make building your future wealth non-negotiable.

Table of Contents

What Does “Pay Yourself First” Actually Mean?

Let’s clearly define this foundational concept.

The Core Concept: Savings as a Bill, Not Leftovers Pay Yourself First (PYF)

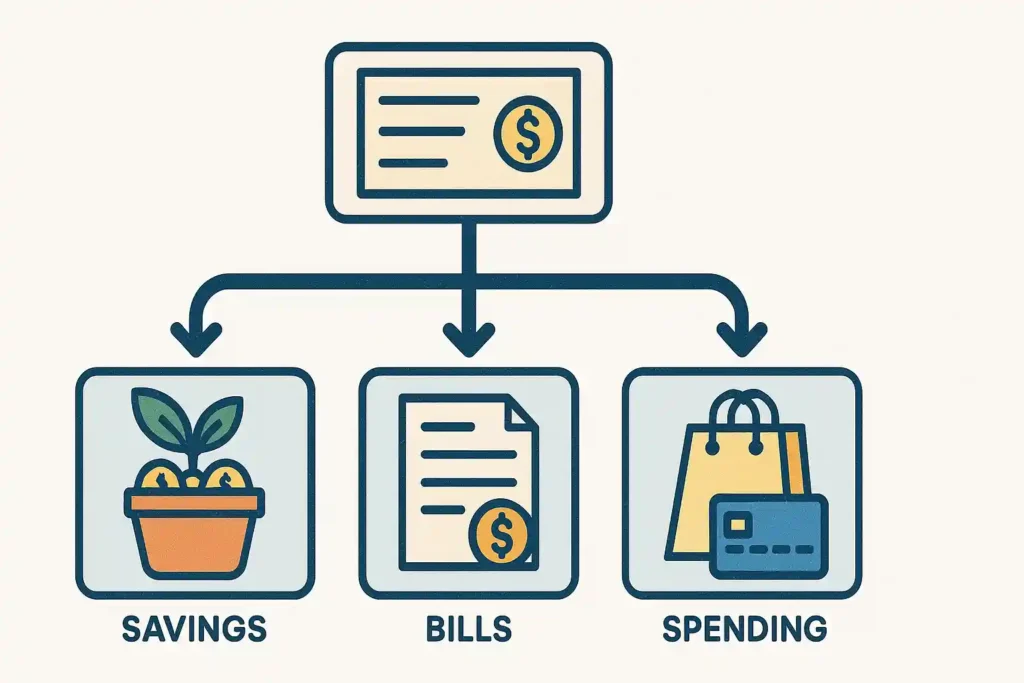

means treating your savings and investment contributions as the most important bill you have. Before you pay rent, utilities, credit cards, or spend anything on discretionary items, you allocate a predetermined amount of your income directly towards your financial goals (savings, investments, significant debt reduction).

Essentially, you prioritize your future self before allocating money to your present expenses or wants. The money is set aside first, and you then live off the remainder.

Shifting Your Mindset: From Spender to Saver/Investor First

Most people operate on an “Income – Expenses = Savings (Maybe)” model. PYF fundamentally changes this to: Income - Savings/Goals = Expenses (What's Left to Spend)

This simple shift forces savings to happen consistently, rather than relying on leftover funds that may or may not materialize. It changes your identity from someone who hopes to save to someone who actively prioritizes saving and investing.

Where Did This Idea Come From? (Brief Context)

The concept isn’t new. Variations of the “pay yourself first” idea have been around for decades, famously popularized in George S. Clason’s 1926 book, “The Richest Man in Babylon,” which advocated saving at least 10% of all earnings before anything else. Its enduring popularity stems from its simplicity and effectiveness.

The Transformative Power of Prioritizing Savings

Why is this simple concept considered a cornerstone of personal finance? Its benefits are profound.

- Benefit 1: Ensures Consistent Savings & Investment Growth: By making saving the first action you take with your income, you guarantee it happens every single pay period, regardless of other spending temptations. This consistency is crucial for long-term progress.

- Benefit 2: Builds Wealth Automatically Over Time (Leveraging Compounding): When you consistently save and invest early, you give your money more time to benefit from compound interest – where your earnings start generating their own earnings. PYF fuels this wealth-building engine automatically. (Explore compound interest effects using calculators like the one on Investor.gov:

https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator). - Benefit 3: Reduces Reliance on Willpower & Discipline: Let’s be honest, relying on willpower to manually save money after seeing tempting spending opportunities is hard. PYF, especially when automated, bypasses this struggle. The saving happens before you have a chance to spend it.

- Benefit 4: Lowers Financial Stress & Increases Security: Knowing you are consistently building savings, an emergency fund, or retirement assets provides immense peace of mind and reduces anxiety about unexpected expenses or future uncertainties.

- Benefit 5: Helps Avoid Lifestyle Inflation: As your income increases, the PYF principle encourages you to increase your savings contribution first, rather than automatically inflating your lifestyle spending to match the new income level.

How Much Should You Pay Yourself First?

This is a common question, and there’s no single magic number.

Common Recommendations (Percentage of Gross Income):

- 10%: Often cited as a bare minimum starting point (from “The Richest Man in Babylon”). Better than nothing, but likely insufficient for robust long-term goals alone.

- 15%: Frequently recommended by financial experts as a solid target for retirement savings specifically.

- 20% or More: Often considered ideal for accelerating wealth building, paying down debt aggressively, and reaching financial independence sooner.

Factors to Consider:

- Your Income: Higher incomes generally allow for higher PYF percentages.

- Your Essential Expenses: High cost of living or necessary high expenses might limit your initial PYF percentage.

- Your Financial Goals: Aggressive goals (like early retirement) require higher PYF rates.

- Your Debt Level: High-interest debt might temporarily require prioritizing extra debt payments as part of your PYF strategy.

Starting Small and Increasing Over Time:

Don’t feel discouraged if you can’t hit 15-20% immediately. Start where you are. Even paying yourself first 1%, 3%, or 5% builds the habit. The crucial part is establishing the system of saving first. Aim to increase the percentage gradually over time, especially when you get raises or pay off debts.

Calculating Based on Goals vs. Percentage:

Alternatively, work backward from your goals. How much do you need to save monthly for your emergency fund target, retirement goal, or down payment? Calculate that amount and make that your PYF target, ensuring it fits within your overall income.

Putting PYF into Action: Your Practical Guide

Here’s how to implement the pay yourself first strategy effectively:

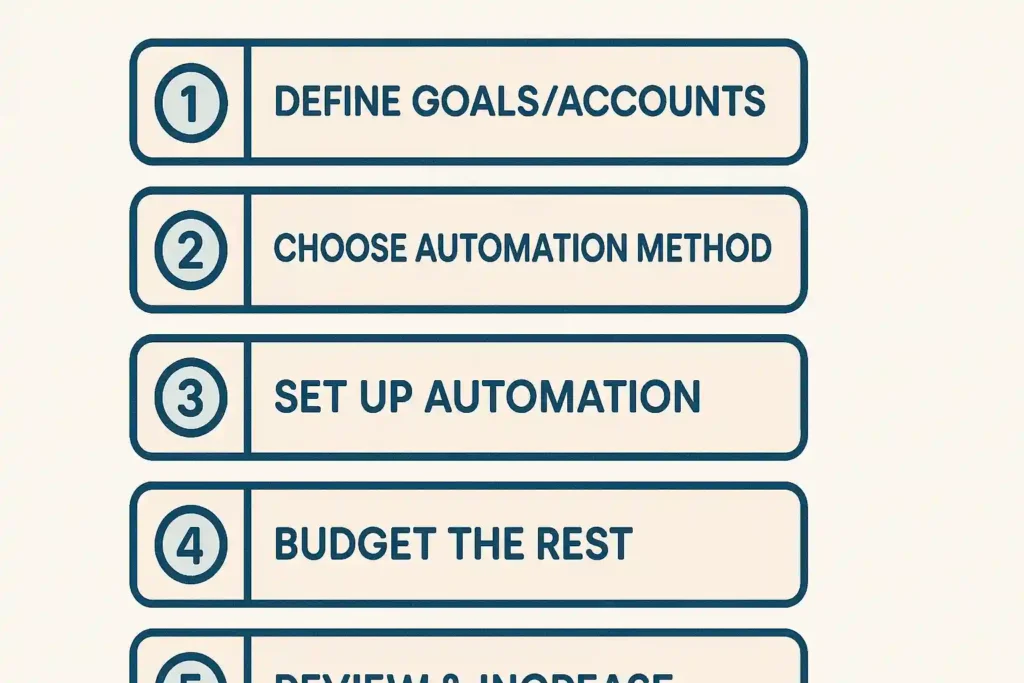

Step 1: Define Where the Money Will Go (Goals & Accounts)

Before you automate, decide where your PYF money is destined. Common priorities include:

- Emergency Fund: Aim for 3-6 months of essential living expenses in a separate, easily accessible high-yield savings account. This is usually the FIRST priority.

- Retirement Contributions: Take full advantage of any employer match in your workplace plan (e.g., 401(k) in US, occupational pension schemes elsewhere). Contribute to personal retirement accounts (e.g., IRA in US, SIPP in UK, etc. – types vary greatly by country).

- Investment Accounts: Taxable brokerage accounts for long-term goals beyond retirement (index funds, ETFs are common starting points).

- Specific Savings Goals: Separate savings accounts (sometimes called “sinking funds”) for goals like a house down payment, new car, travel fund.

- Aggressive Debt Paydown: Allocating extra funds specifically towards high-interest debt (credit cards, personal loans) can be considered a form of PYF, as it frees up future cash flow.

Step 2: Choose Your Automation Method(s)

This is the core of making PYF effortless:

- Direct Deposit Splitting (Ideal): Check if your employer allows you to split your direct deposit across multiple bank accounts. You can designate a percentage or fixed amount to go directly into your savings/investment accounts, bypassing your checking account entirely.

- Automatic Transfers (Most Common): Set up recurring automatic transfers from your primary checking account to your designated savings, investment, or debt payment accounts. Schedule these for payday or the day after.

Step 3: Set Up the Automation (The Crucial Action)

Don’t just plan it – do it. Log into your payroll system or bank account(s) today and set up the direct deposit split or automatic transfers. Make it happen now before you talk yourself out of it.

Step 4: Adjust Your Budget for the Rest (Live off the remainder)

Once your PYF amount is automatically whisked away, create your monthly spending budget based on the money remaining in your checking account. This forces you to adjust your spending to fit what’s left, rather than adjusting savings based on spending.

Step 5: Review and Increase Periodically

- Check your accounts periodically to ensure transfers are working correctly.

- Crucially: Whenever you get a raise, bonus, or pay off a debt (freeing up cash flow), make it a habit to increase your automated PYF amount before you get used to spending the extra money.

Allocating Your PYF Funds: Prioritizing Destinations

Okay, you’re automating savings – but where should that money go first? Here’s a common priority framework (adjust based on your personal situation):

- Priority 1: Building Your Emergency Fund: Get at least a starter emergency fund ($1,000 or equivalent) established ASAP. Then continue building it to 3-6 months of essential living expenses. This prevents unexpected costs from derailing everything else.

- Priority 2: Capturing Retirement Matches: If your employer offers a match on retirement contributions, contribute at least enough to get the full match – it’s free money!

- Priority 3: Paying Down High-Interest Debt: Debt with interest rates significantly higher than potential safe investment returns (think credit cards, payday loans, often >8-10%) costs you dearly. Attacking this aggressively is often a top priority after securing a basic emergency fund and match.

- Priority 4: Increasing Retirement Contributions: Aim for that 15%+ target (or more) for long-term security. Utilize tax-advantaged accounts available in your country first.

- Priority 5: Saving for Mid-Term Goals / Taxable Investing: Once high-interest debt is gone and retirement contributions are solid, allocate PYF funds towards goals like house down payments, car replacements, or building wealth in taxable investment accounts.

Tailoring Allocation to Your Specific Goals and Situation:

Your priorities might shift based on age, income, debt load, and specific life goals. The key is making a conscious plan for your PYF allocation.

Automate Savings: The Engine of Paying Yourself First

Let’s double down on why automation is the secret sauce.

Why Automation Works (Behavioral Science)

Humans are prone to inertia, procrastination, and present bias (valuing now over later). Automation:

- Removes Friction: Makes saving happen without active effort each payday.

- Reduces Decision Fatigue: You don’t have to decide to save each time.

- Leverages Inertia: Once set up, it continues working for you by default.

- Makes Savings Less Visible (Initially): By moving money out of your primary checking, you’re less tempted to spend it. (Concepts from behavioral economics highlight how defaults and removing friction drastically influence financial behavior. Resources from think tanks or university behavioral science centers sometimes explore these principles).

Setting Up Auto-Transfers: Practical Tips

- Timing: Schedule transfers for the day of or the day after your payday.

- Frequency: Match your pay cycle (e.g., monthly, bi-weekly).

- Amount: Start with a comfortable amount and increase over time.

- Destination: Ensure you have the correct account numbers for your target savings/investment accounts.

Overcoming Technical Hurdles:

Most modern online banking platforms make setting up recurring transfers straightforward. Explore your bank’s website or app under “Transfers,” “Payments,” or “Automatic Savings.” Call customer service if you need help.

Consistency is Key: Let Automation Do the Heavy Lifting:

The beauty of automate savings is that it enforces consistency, which is paramount for achieving long-term financial goals through the pay yourself first method.

PYF in Context: How it Complements Other Strategies

It’s important to understand where PYF fits.

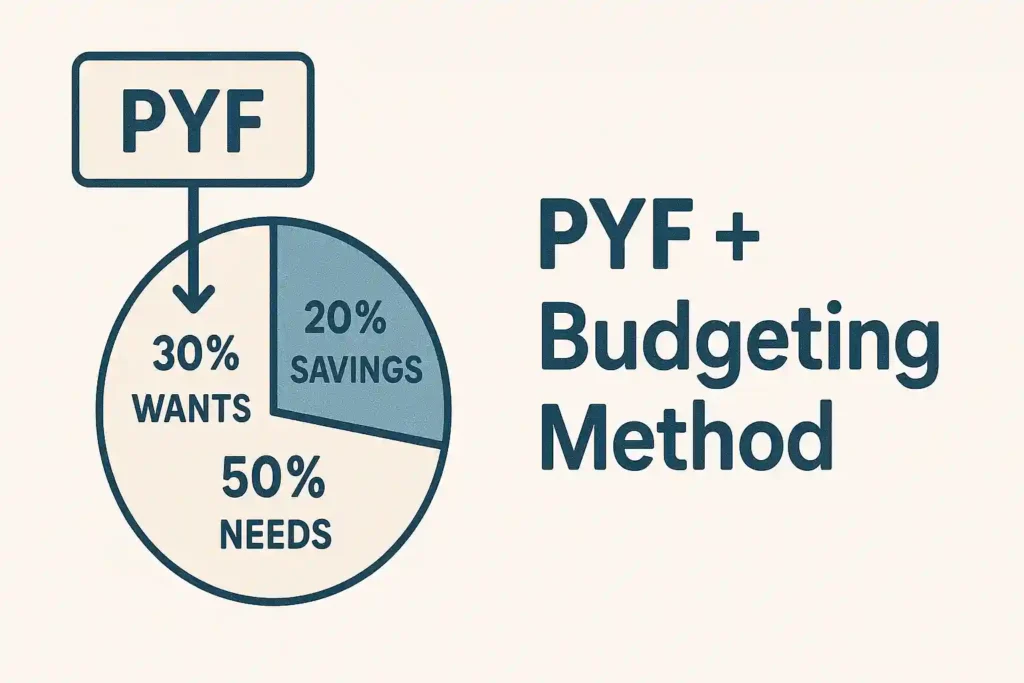

- PYF is a principle, not a Full Budget: Paying yourself first ensures savings happen, but you still need a plan for the remaining money. You need to know if what’s left is sufficient for your needs and wants.

- Combining PYF with 50/30/20 or Zero-Based Budgeting: PYF works beautifully with these methods. Your PYF amount becomes the non-negotiable “Savings & Debt” category (the 20% in 50/30/20, or a primary allocation in ZBB). You then budget the remaining funds within the Needs and Wants categories.

- Why PYF is Often More Sustainable than Strict Deprivation: Because it focuses on automating the positive action (saving) rather than solely on restricting the negative (spending), many find it psychologically easier to maintain long-term. It builds wealth in the background while you manage your day-to-day spending.

Pay Yourself First FAQs

Let’s answer some common questions about this strategy:

- What if I truly have nothing left to pay myself first after essential bills? First, track your spending meticulously to see if there are any cuts possible (even small ones). Second, focus on increasing income (side hustle, asking for a raise). Third, even automating $5 or $10 builds the habit. Start tiny and increase as soon as possible. The habit matters.

- Does paying extra on debt count as paying myself first? Yes, absolutely! Especially for high-interest debt. Reducing debt frees up significant future cash flow and provides a guaranteed “return” equal to the interest rate saved. Many include aggressive debt paydown as a key part of their PYF allocation.

- Should I use a percentage or a fixed amount for PYF? Percentages automatically scale with income changes (good for raises), making them ideal. However, fixed amounts are simpler to set up initially. You could start fixed and switch to percentage-based automation later or simply increase your fixed amount whenever your income rises.

- Is Pay Yourself First only for people with high incomes? Not at all! It’s arguably more important for those on tighter budgets because it ensures some savings happen consistently, preventing the “nothing left over” cycle. The amount will differ, but the principle of prioritizing savings applies universally.

- What if an unexpected expense comes up? Do I stop paying myself first? Ideally, you use your Emergency Fund (which you built using PYF!). If the EF is depleted, you might need to temporarily pause or reduce your PYF contributions while you handle the emergency and then focus on rebuilding the EF as your top PYF priority once stable. Don’t abandon the system permanently.

The Simplest Path to Consistent Saving

The Pay Yourself First rule is deceptive in its simplicity. It sounds basic, yet consistently applying it – treating your future self as your most important creditor through automated savings – is one of the most reliable and stress-free ways to build wealth and achieve financial security.

It bypasses the need for constant willpower, leverages behavioral psychology in your favor, and ensures progress towards your goals happens month after month, year after year. Stop waiting for leftovers. Decide what your future is worth, set up the automation, and then learn to live happily on the rest. It’s time to prioritize savings and let the power of automate savings work for you.

CTA:

Ready to make saving effortless? Your challenge this week: Log into your bank account and set up just one automatic transfer – even $10, €10, or £10 – from your checking to your savings account scheduled for your next payday. What’s your target “Pay Yourself First” percentage? Share your goal or questions in the comments below!

If this guide clarified the pay yourself first strategy, please share it with anyone who wants to build better savings habits! For general saving tips, check out resources from the Consumer Financial Protection Bureau (CFPB) (https://www.consumerfinance.gov/consumer-tools/saving/).