Does looking at your bank account sometimes feel… scary? Do you get paid, cover some bills, spend a little here and there, and then suddenly wonder where all the money vanished before your next paycheck? If you feel like you’re just guessing with your finances or constantly stressed about making ends meet, you’re not alone. The good news is there’s a simple, powerful tool to change that: a budget. And learning how to make a budget is easier than you think.

Forget complicated spreadsheets or feeling restricted. Think of a budget as a roadmap for your money – a plan you create to tell your money where you want it to go. This guide is designed specifically for beginners. We’ll break down exactly how to create a budget in 7 clear, manageable steps. No confusing jargon, just practical advice to help you gain control, reduce stress, save more, and finally feel confident about your finances. Let’s learn how do you make a budget that truly works for you.

Table of Contents

More Than Just Numbers: Why You Absolutely Need a Budget

Before diving into the “how-to,” let’s quickly cover the “why.” Why bother making a budget? The benefits are huge:

- Gain Control: Telling Your Money Where to Go: A budget puts YOU in the driver’s seat. Instead of reacting to expenses, you proactively decide how your money will be used. This sense of control is incredibly empowering.

- Reduce Stress & Anxiety About Money: Uncertainty breeds anxiety. Knowing you have a plan, that your bills are covered, and that you’re working towards goals significantly reduces financial stress.

- Reach Your Financial Goals Faster: Want to save for a vacation, pay off debt, build an emergency fund, or buy a car? A budget helps you find the money and allocate it consistently towards those goals, making them achievable much faster.

- Identify Wasteful Spending Habits: Tracking your expenses (a key part of budgeting) often reveals surprising areas where money is leaking out unintentionally (e.g., forgotten subscriptions, excessive dining out).

- Build Strong Financial Foundations: Budgeting is a fundamental skill for long-term financial health, helping you live within your means and prepare for the future.

Before You Start: Simple Budgeting Terms Explained

Let’s define a few key terms you’ll encounter:

- Income (Gross vs. Net):

- Gross Income: Your total earnings before any taxes or deductions.

- Net Income (Take-Home Pay): The actual amount deposited into your bank account after taxes, insurance premiums, retirement contributions, etc., are taken out. You build your budget based on your Net Income.

- Expenses: Fixed vs. Variable:

- Fixed Expenses: Costs that generally stay the same each month (e.g., rent/mortgage, car payment, loan payments, set subscription fees). They are usually predictable.

- Variable Expenses: Costs that fluctuate from month to month (e.g., groceries, gas/petrol, utilities like electricity, dining out, entertainment). These require estimation and tracking.

- Needs vs. Wants:

- Needs: Essential items for survival and basic functioning (e.g., housing, essential groceries, utilities, essential transportation, insurance).

- Wants: Non-essential items that improve quality of life but aren’t strictly necessary for survival (e.g., dining out, entertainment, hobbies, new clothes beyond basics, vacations). Distinguishing helps prioritize.

- The Goal: Making Income Cover Expenses AND Savings: A successful budget ensures your income covers not just your spending but also your savings goals and debt reduction plans.

Your 7 Simple Steps: How to Construct a Budget from Scratch

Okay, let’s get practical. Here’s how to make a budget, step-by-step:

Step 1: Calculate Your Monthly Net Income (Your Starting Point)

- Gather Your Info: Look at your pay stubs or bank deposits for the last few months.

- Stable Income: If you have a regular salary, this is easy – just use your consistent take-home pay per month.

- Variable Income: If your income fluctuates (hourly work, freelance, gig work), calculate your average monthly net income over the last 3-6 months. It’s often safer to budget based on your lowest anticipated monthly income and have a plan for any extra earned.

- Include ALL Sources: Don’t forget side hustles, government benefits, regular family contributions, etc.

- Write Down Your Total Monthly Net Income. This is the amount you have to work with.

Step 2: Track Your Spending (The Crucial Reality Check)

- Why? You can’t plan where your money should go until you know where it is going. This step is often eye-opening!

- How Long? Track meticulously for at least one full month, but even 2-4 weeks gives valuable insight.

- Methods:

- Apps: Many apps (some free) link to your bank/cards and automatically categorize spending (Mint, PocketGuard, local banking apps).

- Notebook/Spreadsheet: Manually log every single purchase (even small cash ones!). Keep receipts.

- Bank/Card Statements: Review past statements line by line.

- Be Honest! Don’t fudge numbers. The goal is accurate awareness.

Step 3: Categorize Your Expenses (Give Spending a Name)

- Group Similar Spending: Based on your tracked expenses from Step 2, group them into logical categories.

- Common Categories: Housing (Rent/Mortgage), Utilities (Electric, Water, Gas, Internet), Groceries, Transportation (Gas, Public Transit, Insurance), Debt Payments (minimums), Insurance (Health, Renters), Phone, Food (Dining Out/Takeaway – separate from groceries!), Personal Care, Entertainment, Shopping (Clothes/Other), Savings, Miscellaneous. (See Section 5 for more detail).

- Subcategories (Optional): You can get more granular if needed (e.g., under Entertainment: Streaming, Movies, Hobbies). Start simple, add detail later if required.

- Calculate Monthly Totals: Add up your spending in each category for the period you tracked. Use averages for variable categories.

Step 4: Set Realistic Financial Goals (What Are You Budgeting For?)

- Define Your ‘Why’: Budgeting is easier with purpose. What do you want to achieve?

- Examples: Build a $1,000 emergency fund in 6 months? Pay off a $500 credit card in 3 months? Save $50/month towards a holiday?

- Make Them SMART: Specific, Measurable, Achievable, Relevant, Time-Bound.

- Treat Goals Like Expenses: Include your savings goals as categories in your budget plan (Step 5).

Step 5: Build Your Budget Plan (Allocate Income – The Core Step!)

- Start Fresh: Take your Total Monthly Net Income (Step 1).

- Allocate to Categories: Assign a specific amount of money to each expense category you identified (Step 3), including your savings goals (Step 4).

- Use your tracked spending (Step 2) as a starting guide, but adjust amounts based on your goals and where you want to cut back.

- Prioritize Needs first.

- Ensure Savings/Goal categories are funded intentionally (Pay Yourself First principle – see Section 7).

- Allocate remaining funds to Wants.

- The Zero-Based Goal: Ideally, aim for Income – Planned Expenses/Savings = $0 / €0 / £0. This means every unit of currency has an assigned job (even if it’s just “Fun Money” or a small “Buffer”). This is the essence of zero-based budgeting, a very effective method for control.

- Make Adjustments: If your planned expenses exceed your income, you MUST reduce spending in some categories (usually starting with Wants) until it balances to zero. If you have money left after allocating to Needs and Goals, decide intentionally where it goes (more savings? more fun money? buffer?).

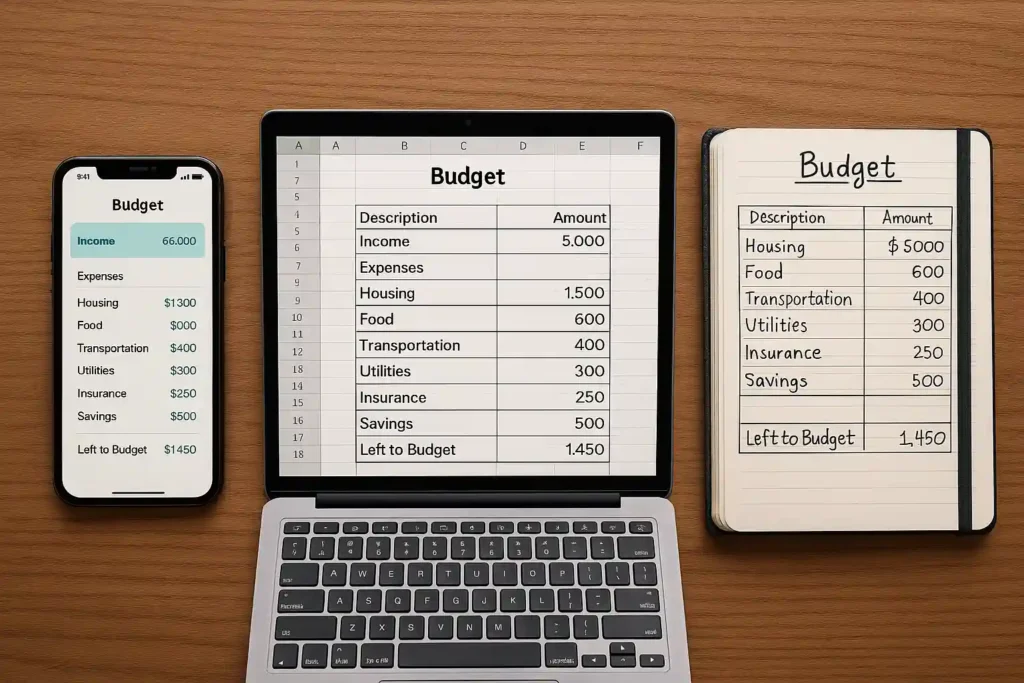

Step 6: Choose Your Budgeting Tool (How Will You Manage It?)

- Spreadsheet: Great for customization (Excel, Google Sheets – free templates available).

- Budgeting App: Convenient for tracking, often links accounts, provides reports (many free/paid options).

- Pen and Paper/Planner: Simple, tactile, effective for some.

- Select the tool you find easiest to use consistently.

Step 7: Review and Adjust Regularly (Budgeting is Dynamic!)

- Track Throughout the Month: Check in regularly (daily/weekly) to see how your actual spending compares to your budgeted amounts.

- Adjust Mid-Month if Needed: If you overspend in one category, try to compensate by spending less in another (e.g., less dining out if groceries cost more).

- Monthly Review is CRUCIAL: Before the next month starts, review the past month. What worked? What didn’t? Adjust categories, goals, or allocations for the upcoming month based on reality and changing priorities. A budget is a living document!

Getting the Numbers Right: Precisely Tracking Income & Spending

Accurate numbers are the foundation of a working budget. Let’s refine tracking:

- Methods for Tracking Income:

- Pay Stubs: Your primary source for net income calculation. Note frequency (weekly, bi-weekly, monthly).

- Bank Deposits: Verify amounts hitting your account.

- Irregular Income Log: If freelancing or gig working, keep a running log of all payments received. Calculate monthly totals carefully.

- Detailed Expense Tracking Techniques:

- Apps Linking Accounts: Easiest way for many. Automatically imports transactions. Review and correct categorization regularly! (Mint, PocketGuard, YNAB – check regional availability).

- Manual App Entry: Apps where you manually input each expense (Goodbudget, spending trackers). Requires more discipline but gives high awareness.

- Spreadsheet/Notebook: Log expenses daily or every few days. Keep receipts.

- Dealing with Cash Spending: If you use cash, get receipts or immediately log the expense in your chosen tool/notebook. Cash is easiest to lose track of!

- The Importance of Consistency: Whichever method you choose, track consistently. Daily or every-other-day tracking is often best to avoid forgetting expenses.

Organizing Your Money: Effective Budget Categories & Allocation

Setting up the right categories makes budgeting much clearer.

Common Budget Categories for Beginners (Examples):

- Income: Salary, Side Hustle, Other

- Housing: Rent/Mortgage, Property Tax/Insurance (if separate)

- Utilities: Electricity, Water, Gas/Heating, Internet, Phone

- Food: Groceries, Restaurants/Cafes/Takeout

- Transportation: Fuel, Public Transit, Car Payment, Car Insurance, Maintenance/Repairs (Sinking Fund!)

- Personal: Clothing, Toiletries, Haircuts, Gym, Hobbies

- Health: Insurance Premiums (if not pre-tax), Co-pays, Prescriptions

- Debt: Credit Card Payments (Min + Extra), Student Loans (Min + Extra), Other Loans

- Savings: Emergency Fund, Retirement, Specific Goals (Vacation, Car, House)

- Giving: Donations, Gifts

- Entertainment: Streaming, Movies, Concerts, Books

- Buffer/Miscellaneous: Small amount for unexpected minor costs.

Customize this list! Add/remove/combine categories to fit YOUR life.

How Much to Allocate? (Using 50/30/20 as a Guideline):

The 50/30/20 rule (50% Needs, 30% Wants, 20% Savings/Debt) is a popular starting point for allocation after calculating category totals.

It’s a guideline, not a strict rule. Adjust based on your income, location (COL), goals, and debt. You might need 60% for Needs in an expensive city, or you might aim for 30%+ Savings if possible.

Prioritizing Needs, Then Goals, Then Wants:

When allocating in Step 5, fully fund your essential Needs first. Then allocate intentionally to your Savings/Debt goals. Finally, distribute the remainder among your Wants categories.

Planning for Irregular Expenses (Sinking Funds Explained Simply):

Estimate annual costs for things like holidays, birthdays, car registration/insurance, annual subscriptions.

Divide the annual total by 12.

Save this monthly amount in a specific “sinking fund” category (or separate savings account).

Example: Gifts cost ~$600/year. Save $50/month ($600/12) in your “Gift Fund.”

Building in a Small Buffer for Flexibility:

A small buffer ($50-100 or 1-2% of income) helps absorb minor overspending without breaking the entire budget. Track what you use it for.

Making it Easier: Tools to Help You Create and Stick to Your Budget

You don’t have to do it all manually (unless you want to!).

- Budgeting Apps: Many options offer features like bank linking, auto-categorization, goal tracking, reports, and alerts. Explore popular options available in your region. Some require subscriptions, others offer free tiers.

- Spreadsheet Software: Highly flexible. Use pre-made templates (search online for “budget spreadsheet template”) or build your own in Excel or Google Sheets (free). Great if you like control and customization.

- Pen and Paper / Budget Planners: Simple, effective, and forces manual engagement. Many printable worksheets and dedicated budget planners are available.

- Choosing Based on Your Personality: Tech-savvy? Try an app. Like control/customization? Spreadsheet. Prefer tactile/simple? Pen and paper. The best tool is the one you use consistently.

Sticking With It: Tips to Make Your Budget Work Long-Term

Creating the budget is half the battle; consistency is the other half.

- Be Realistic, Not Overly Restrictive: Don’t cut out all fun, or you’ll likely rebel and abandon the budget. Allow for reasonable spending on Wants.

- Give Yourself Grace (Don’t Quit After One Mistake!): You will overspend sometimes. It happens! Don’t view it as failure. Acknowledge it, adjust if needed for the rest of the month, and recommit to the plan next month.

- Automate Savings (“Pay Yourself First”): Set up automatic transfers to your savings/investment accounts on payday. This makes saving effortless and prioritizes your goals. (See our guide on [Pay Yourself First] ).

- Review Your Budget Before Each Month Starts: Adjust for known upcoming expenses or income changes. Proactive planning prevents surprises.

- Find an Accountability Method: Tell a trusted friend/partner, use app reminders, or join a supportive online community.

- Celebrate Small Wins! Did you stick to your grocery budget? Save that extra $50? Acknowledge your success to stay motivated!

Your Budgeting Questions Answered

Let’s tackle some common questions for beginners:

What’s the very first step if I want to make a budget today?

Start tracking your spending immediately! Grab a notebook or app and just write down everything you spend for the next few days. Awareness is step zero. Then, calculate your net income (Step 1).

How long does it take to get good at budgeting?

It’s a skill that improves with practice. Give yourself 2-3 months of consistently creating and tracking your budget to feel more comfortable and get accurate category estimates. Be patient!

What if my income changes every month? How can I make a budget?

Budget based on your lowest expected income for your essential needs. When higher income arrives, allocate it based on a pre-set priority list (e.g., buffer, savings, debt, then wants). It requires more active management month-to-month.

Is it better to use an app or a spreadsheet?

Neither is inherently “better” – it depends entirely on your preference! Apps offer convenience and automation. Spreadsheets offer customization and control. Try both if unsure!

Does budgeting mean I can’t have any fun?

Absolutely not! A good budget includes planned spending for fun, hobbies, and entertainment within your ‘Wants’ categories. It actually enables guilt-free fun because you know your needs and goals are covered.

How often should I review my budget?

Check in briefly (daily or weekly) to track spending against categories. Do a more thorough review and plan for the next month at the end of each month. Adjust annually or after major life changes (new job, move, etc.).

Your Roadmap to Financial Control Starts Now

Learning how to make a budget might seem daunting at first, but it’s one of the most empowering financial skills you can develop. It’s your personal roadmap for telling your money where to go, reducing stress, and making tangible progress towards the life you want to live.

Remember the simple steps: understand your income, track your spending, categorize, set goals, allocate your funds (aiming for zero leftover), choose your tool, and review regularly. Don’t strive for instant perfection; focus on consistent progress. The best budget is the one you create for your life and, most importantly, the one you use. You absolutely have the ability to create a budget and take control of your financial future.

CTA:

Ready to take the first step? Your challenge this week: Calculate your total monthly net income (Step 1) OR start tracking your spending for just 3 days (Step 2). What’s one question you still have about how to make a budget? Share it in the comments below!

If this guide helped demystify budgeting, please share it with anyone who could benefit from gaining financial control! For more resources, check out the budgeting tools and information available from the Consumer Financial Protection Bureau (CFPB) (https://www.consumerfinance.gov/consumer-tools/budgeting/).