Does the sheer size of your student loan balance feel overwhelming? Are monthly payments consuming a huge chunk of your budget, making it hard to save, invest, or even breathe financially? You’re definitely not alone. Millions in the United States grapple with significant student loan debt, often feeling trapped and unsure of the path forward. But here’s the crucial reality: there are strategies, programs, and pathways available to help you manage, reduce, and potentially even eliminate your student debt burden. Knowing how to get out of student loan debt starts with understanding your options.

Important Note: This guide focuses primarily on student loans within the United States (both federal and private), as loan systems, repayment options, and forgiveness programs vary drastically in other countries. If you have loans from outside the US, please consult your specific national resources.

This comprehensive guide will walk you through the major strategies available to US borrowers – from aggressive repayment tactics and income-driven plans that lower payments, to refinancing considerations and potentially life-changing forgiveness programs like PSLF. We’ll break down complex options into actionable steps so you can build your personalized plan for tackling student debt and reclaiming your financial future.

Table of Contents

Know Your Enemy: Decoding Your US Student Loan Portfolio

Before you can devise a plan, you need a crystal-clear picture of exactly what you owe. This is the non-negotiable first step.

Federal vs. Private Loans: Key Differences (It Matters A LOT!)

This is the most critical distinction:

- Federal Student Loans: Originated by the U.S. Department of Education (e.g., Direct Subsidized/Unsubsidized, PLUS, Perkins loans before they were discontinued). Offer numerous borrower protections, flexible repayment plans (like IDR), deferment/forbearance options, and access to various forgiveness programs (PSLF, Teacher Loan Forgiveness, etc.).

- Private Student Loans: Originated by banks, credit unions, or other private lenders. Terms, interest rates, and repayment options are set by the lender and are generally far less flexible than federal loans. They are not eligible for federal IDR plans or federal forgiveness programs.

Identifying Your Loan Types (Using StudentAid.gov)

The best way to see all your federal student loans, balances, interest rates, and loan servicers is by logging into the official National Student Loan Data System (NSLDS) via StudentAid.gov (https://studentaid.gov/). This is your central hub for federal loan information. For private loans, you’ll need to check your credit report or contact the lenders directly.

Finding Your Loan Servicer(s)

Your loan servicer is the company contracted by the government (for federal loans) or the lender (for private loans) to handle your billing, payments, and communication. You might have multiple servicers if you have different loan types. Find yours on StudentAid.gov for federal loans or on your statements/credit report for private loans.

Understanding Your Balances, Interest Rates, and Terms

For each loan, note down:

- Current principal balance

- Interest rate (and whether it’s fixed or variable)

- Repayment term (e.g., 10 years, 25 years)

- Current monthly payment amount

A Note on International Loans:

Student finance systems in Canada, the UK, Europe, Australia, etc., have entirely different structures, interest rate calculations (often income-contingent), and repayment terms. This guide’s specifics on IDR, PSLF, etc., do not apply outside the US system.

Tackling the Balance: Strategies for Active Repayment

If your goal is to pay off the debt as quickly as possible (and you have the means), these strategies focus on accelerating repayment:

The Standard Repayment Plan (The Default)

Most federal loans default to a 10-year standard repayment plan. This typically results in paying the least amount of interest over time if you stick with it and can afford the payments. Private loans often have fixed repayment terms as well.

Aggressive Repayment: Paying More Than the Minimum

This is the core of paying off debt early. Any amount you pay above your minimum required payment goes directly towards the principal balance (after covering accrued interest), reducing the total interest paid and shortening the loan term.

- Finding Extra Money: Requires careful budgeting. Cut unnecessary expenses, reduce ‘wants’, consider a side hustle or temporary extra work purely to funnel cash towards your loans.

- Using Debt Snowball or Avalanche: If you have multiple student loans (or other debts), apply these methods. Snowball: Pay minimums on all, attack the loan with the smallest balance first with extra funds. Avalanche: Pay minimums on all, attack the loan with the highest interest rate first with extra funds. Avalanche saves more interest; Snowball provides quicker motivational wins. Choose the one you’ll stick with.

Bi-Weekly Payments (Use Caution)

Making half your monthly payment every two weeks results in 26 half-payments, or 13 full monthly payments per year. This extra payment accelerates payoff. Important: Check with your servicer first! Some may not apply the extra payment correctly to principal unless specifically instructed or enrolled in a bi-weekly program. Simply making two payments a month might just pre-pay the next month’s bill.

Lump-Sum Payments

Use windfalls like tax refunds, bonuses, inheritances, or gifts to make significant extra payments directly towards the principal of your highest-interest loans. Ensure the servicer applies it as an extra payment, not towards future bills.

Making Payments Manageable: Federal Income-Driven Repayment (IDR) Options

If standard payments are unaffordable, federal loans offer valuable Income-Driven Repayment (IDR) plans. These calculate your monthly payment based on your discretionary income and family size.

What Are IDR Plans?

IDR plans aim to make federal student loan payments more manageable. Payments are typically capped at 10-20% of your discretionary income (the difference between your adjusted gross income and 150% or 225% of the poverty guideline for your family size and state – formulas vary by plan).

Overview of Key Plans (SAVE, PAYE, IBR)

The main federal IDR plans include:

- SAVE (Saving on a Valuable Education): Often the newest and most beneficial plan for many, potentially offering the lowest payments, interest subsidies preventing balance growth for many, and faster forgiveness for smaller original balances. Payments typically 5-10% of discretionary income.

- PAYE (Pay As You Earn): Payments usually 10% of discretionary income, capped at the Standard plan amount. 20-year forgiveness term. Specific eligibility requirements.

- IBR (Income-Based Repayment): Payments 10% or 15% of discretionary income depending on when you borrowed, capped at the Standard plan amount. 20 or 25-year forgiveness term.

- ICR (Income-Contingent Repayment): Payments are the lesser of 20% of discretionary income or what you’d pay on a 12-year fixed plan. 25-year forgiveness term. Only option for Parent PLUS loan consolidation.

- Action: Use the Loan Simulator tool on StudentAid.gov (https://studentaid.gov/loan-simulator/) to estimate payments under different plans based on your specific situation. The official IDR plan details are also crucial reading: (https://studentaid.gov/manage-loans/repayment/plans/income-driven).

Pros of IDR Plans

- Lower Monthly Payments: Can significantly reduce payments, freeing up cash flow.

- Potential Forgiveness: Any remaining loan balance is forgiven after 20 or 25 years of qualifying payments (duration depends on the plan and loan type).

- Interest Subsidies (Especially SAVE): Some plans, notably SAVE, prevent or reduce interest capitalization, meaning your balance might not grow even if your payment doesn’t cover all the accruing interest.

Cons of IDR Plans

- Longer Repayment Term: You’ll likely be paying for 20-25 years instead of the standard 10.

- More Interest Paid Overall: Although monthly payments are lower, paying for longer often means paying more total interest over the life of the loan unless you receive forgiveness.

- Potential Tax on Forgiven Amount: Currently (as of early 2025), federal student loan forgiveness is not federally taxed through 2025, but state tax implications may vary, and federal law could change. This “tax bomb” is a major consideration for long-term IDR users.

- Annual Recertification Required: You must recertify your income and family size each year to stay on the plan.

How to Apply for IDR Plans

Apply directly through StudentAid.gov. It’s free. Be wary of companies charging fees to help you apply – you can do it yourself easily.

Should You Refinance? Exploring Private Loan Options

Refinancing means taking out a new private loan to pay off your existing student loans (federal and/or private).

What is Student Loan Refinancing?

A private lender (bank, credit union, online lender) pays off your old loans, and you begin making payments to the new lender under new terms (interest rate, repayment period).

Potential Pros

- Lower Interest Rate: If you have good credit and income, you might qualify for a lower interest rate than your current loans, potentially saving money.

- Single Monthly Payment: Consolidates multiple loans into one.

- Different Term Length: You might choose a shorter term to pay off faster or a longer term to lower monthly payments (though potentially paying more interest overall).

Major Cons/Risks (Especially for Federal Loans) – CRITICAL WARNING!

- Loss of ALL Federal Loan Benefits: When you refinance federal loans into a private loan, you permanently lose access to:

- Income-Driven Repayment (IDR) plans (SAVE, PAYE, IBR)

- Federal Forgiveness Programs (PSLF, Teacher Loan Forgiveness, IDR forgiveness)

- Generous Deferment and Forbearance options offered by the federal government

- Potential future government relief actions (like past payment pauses)

- This is an irreversible decision. Refinancing federal loans should only be considered with extreme caution if you are absolutely certain you won’t need these federal protections.

Who Should Consider Refinancing?

- Primarily borrowers with existing private student loans seeking better terms.

- Borrowers with high-interest federal loans (like Grad PLUS) who have very stable, high incomes, excellent credit, significant emergency savings, and are 100% certain they will not need or qualify for federal IDR plans or forgiveness programs.

How to Compare Refinancing Offers

Shop around with multiple private lenders. Compare interest rates (fixed vs. variable), loan terms, fees, and lender reputation. Use pre-qualification tools which typically don’t impact your credit score.

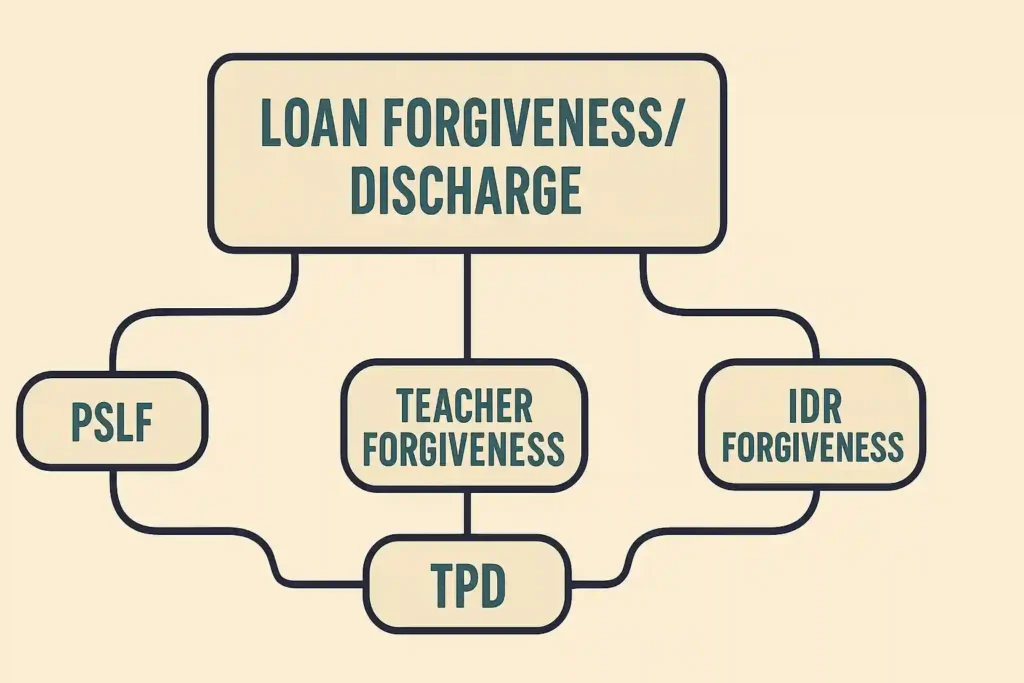

Pathways to Elimination: Forgiveness, Cancellation & Discharge Programs (Mainly Federal)

For certain borrowers in specific situations, parts or all of their federal student loans may be forgiven, cancelled, or discharged.

- Public Service Loan Forgiveness (PSLF): Forgives remaining balance on Direct Loans after 120 qualifying monthly payments made while working full-time for a qualifying employer (government or non-profit organizations). Strict requirements apply. Action: Use the PSLF Help Tool on StudentAid.gov (https://studentaid.gov/pslf/) to certify employment and track progress.

- Teacher Loan Forgiveness Program: Forgives up to $17,500 on Direct/FFEL loans for eligible teachers working five consecutive years in low-income schools.

- Forgiveness Through IDR Plans: As mentioned, remaining balances are forgiven after 20-25 years of qualifying payments on an IDR plan.

- Perkins Loan Cancellation: For borrowers with older Federal Perkins Loans working in certain public service fields (teaching, nursing, law enforcement, etc.). Program is winding down.

- Discharge Due to Total and Permanent Disability (TPD): If you become totally and permanently disabled, you may qualify for discharge of your federal loans.

- Discharge Due to School Closure or Fraud (Borrower Defense): If your school closed while you were enrolled or misled you, you might be eligible for discharge.

- Discharge in Bankruptcy: Extremely difficult to achieve for student loans, requires proving “undue hardship” in court. Not a common or easy path.

Important: Eligibility for all these programs is specific and often requires meticulous documentation and application processes. Rely on official information from StudentAid.gov.

When You Can’t Pay: Options Before Default (Federal Loan Focus)

If you’re struggling to make payments right now, ignoring the problem is the worst thing you can do. Federal loans offer temporary relief options:

- Deferment vs. Forbearance: Both allow you to temporarily postpone payments.

- Deferment: Available for specific situations (e.g., unemployment, economic hardship, in-school). Interest typically does not accrue on subsidized federal loans during deferment.

- Forbearance: Generally easier to qualify for but interest usually accrues on ALL loan types, increasing your total balance. Use forbearance sparingly.

- The Dangers of Student Loan Default: Defaulting on federal loans (typically after 270 days of missed payments) has severe consequences: damaged credit, wage garnishment, seizure of tax refunds/social security benefits, collection fees, ineligibility for further aid/IDR/forgiveness. Avoid it at all costs!

- Getting Out of Default: Options like loan rehabilitation or consolidation exist but have specific requirements. Contact your loan servicer or the Dept. of Education’s Default Resolution Group.

- Communicating with Your Loan Servicer is Key: If you anticipate trouble making payments, contact your servicer immediately. They can explain your options (like switching to an IDR plan, deferment, forbearance) before you miss payments or default.

Putting It All Together: Building Your Escape Plan

Okay, that’s a lot of information. Here’s how to create your strategy for how to get out of student loan debt:

- Assess Your Loans: Log into StudentAid.gov. List every loan, noting if it’s Federal or Private, the balance, and the interest rate. Identify your servicer(s).

- Evaluate Your Goals & Situation: What’s your priority? Lowest monthly payment? Fastest payoff possible? Eligibility for forgiveness? What is your income, job stability, credit score?

- Explore Relevant Options:

- Can you afford standard payments? Consider aggressive repayment (snowball/avalanche).

- Are standard payments too high? Explore IDR plans on StudentAid.gov using the Loan Simulator.

- Do you work in public service? Investigate PSLF eligibility thoroughly.

- Do you have high-interest private loans? Cautiously explore refinancing options if you don’t need federal benefits.

- Make a Decision and Take Action: Choose the strategy that best fits your loans and goals. Apply for IDR, set up extra payments, start certifying PSLF employment, or begin comparing refinance rates.

- Re-evaluate Your Strategy Periodically: Review your plan annually or if your income or job situation changes significantly. A different IDR plan might become better, or you might become eligible for forgiveness.

Student Loan Debt FAQs (US Focus)

Let’s answer some quick questions:

- What is the absolute fastest way to get out of student loan debt? Aggressively paying much more than the minimum payment each month, potentially using the debt avalanche method (targeting highest interest rates first) and finding significant extra income to throw at the loans. Forgiveness programs like PSLF can be “fast” in terms of eliminating the balance after 10 years of service, but require specific employment.

- Can all student loans be forgiven? No. Most forgiveness programs (PSLF, IDR forgiveness, Teacher Loan Forgiveness, TPD discharge) apply only to federal student loans. Private student loans generally do not have forgiveness options, except in rare cases like disability discharge offered by the specific lender or sometimes through settlement in default (which heavily damages credit).

- Should I consolidate my federal student loans? Consolidation combines multiple federal loans into one new Direct Consolidation Loan with a weighted average interest rate. Pros: Single payment. May be necessary to make older FFEL/Perkins loans eligible for PSLF or certain IDR plans (like ICR for Parent PLUS). Cons: Doesn’t lower your interest rate (might slightly increase it due to rounding). Resets any qualifying payment counts towards IDR or PSLF forgiveness unless specific waivers apply (check current rules!). Carefully weigh pros and cons on StudentAid.gov before consolidating.

- Does refinancing hurt my credit? Applying for refinancing typically involves a hard credit inquiry, which can temporarily dip your score by a few points. Successfully managing the new refinanced loan with on-time payments will generally be positive for your credit long-term. However, the main risk is losing federal protections.

- What if I inherited student loans from a parent or spouse? Generally, federal student loans are discharged upon the death of the borrower (or the student, for Parent PLUS loans). Private loan policies vary greatly by lender; some discharge upon death; others may attempt to collect from the estate or a cosigner. Co-signer responsibility is key here. Verify policies directly with the lender/servicer.

Your Path Forward: Taking Control of Student Debt

Navigating how to get out of student loan debt in the US can feel complex, but viable strategies exist. Whether it’s aggressively repaying, leveraging federal protections like Income-Driven Repayment plans, pursuing forgiveness through programs like PSLF, or carefully considering refinancing for private loans, the key is to understand your specific loans and choose a plan aligned with your goals and circumstances.

Ignoring the debt or feeling paralyzed by overwhelm won’t make it disappear. Taking the first step – logging into StudentAid.gov, understanding your options, making one extra payment, or applying for an IDR plan – is incredibly empowering. You can create a path forward.

CTA:

What’s the first step you will take this week to tackle your student loan debt? Will you log into StudentAid.gov, use the Loan Simulator, or calculate how much extra you could pay? Share your goal or your biggest question about getting out of student loan debt in the comments below!

If this guide provided valuable information, please share it with others facing the challenge of US student loans. Remember to consult official resources like StudentAid.gov and the Consumer Financial Protection Bureau (CFPB) (https://www.consumerfinance.gov/consumer-tools/student-loans/) for the most current and detailed information.