Are those high credit card balances casting a shadow over your finances? Does the thought of compounding interest keeping you trapped feel suffocating? You’re certainly not alone. Credit card debt, with its often-sky-high interest rates, can feel like financial quicksand – the more you struggle with just minimum payments, the deeper you seem to sink. But here’s the crucial truth: you can break free. Learning how to get out of debt, specifically crippling credit card debt, is achievable with the right knowledge and a dedicated plan.

This guide is designed to be your clear, actionable roadmap. We’ll move beyond just wishing the debt away and dive into proven strategies. We’ll cover how to get out from credit card debt by first gaining control of your spending, choosing an effective payoff method (like the popular Debt Snowball or Debt Avalanche), exploring tools like balance transfers and consolidation loans, and knowing when and how to seek reputable help. It’s time to stop paying endless interest and start building your path to financial freedom.

Important Note: While the principles discussed apply broadly, specific financial products (like balance transfer offers), regulations, interest rate caps, and consumer protection laws vary significantly by country. This guide focuses on common strategies, particularly relevant in systems like the US, but always investigate options available and regulations applicable in your specific location.

Table of Contents

The Credit Card Debt Trap: Why It’s Easy to Fall In & Hard to Escape

Understanding why credit card debt is uniquely challenging helps motivate you to tackle it:

The Power of Compound Interest (Working Against You):

Credit cards typically have high Annual Percentage Rates (APRs). When you carry a balance, interest accrues daily or monthly, and then you pay interest on that interest. This makes the balance grow much faster than the principal on lower-interest loans.

Minimum Payments: Designed to Keep You in Debt Longer:

Paying only the minimum amount due often means the vast majority of your payment goes towards interest, barely touching the principal balance. It can take decades and cost thousands in extra interest to pay off debt this way.

Identifying Your Credit Card Debt Reality:

Before you can make a plan, gather all your credit card statements. List each card, its current balance, and—most importantly—its APR. Knowing your interest rates is critical for choosing the best payoff strategy.

The Emotional Toll of High-Interest Debt:

Constant worry about balances, interest charges, and making payments significantly impacts stress levels, sleep, and overall well-being. Getting out of this debt isn’t just a financial win; it’s a mental health win.

Step 1: Stop the Bleeding: Control Your Spending

You cannot effectively pay off debt if you continue adding to it. This foundational step is non-negotiable.

- Create a Realistic Budget: You need to know where your money is going. Use a budgeting method (Zero-Based, 50/30/20, etc.) to track income and all expenses. (See our guide on [How to Make a Budget]).

- Track Your Spending Diligently: Use an app, spreadsheet, or notebook to see exactly where you spend. This highlights areas where cuts are possible.

- Cut Unnecessary Expenses: Identify ‘wants’ versus ‘needs’. Temporarily reduce or eliminate non-essential spending (subscriptions you don’t use, frequent dining out, impulse shopping) to free up cash specifically for debt payoff. Every extra dollar/euro/pound makes a difference.

- Consider Pausing Credit Card Use Temporarily: While paying down debt, it can be incredibly effective to stop using credit cards altogether. Switch to using a debit card or cash for your budgeted expenses to prevent adding new debt. You might even physically remove the cards from your wallet.

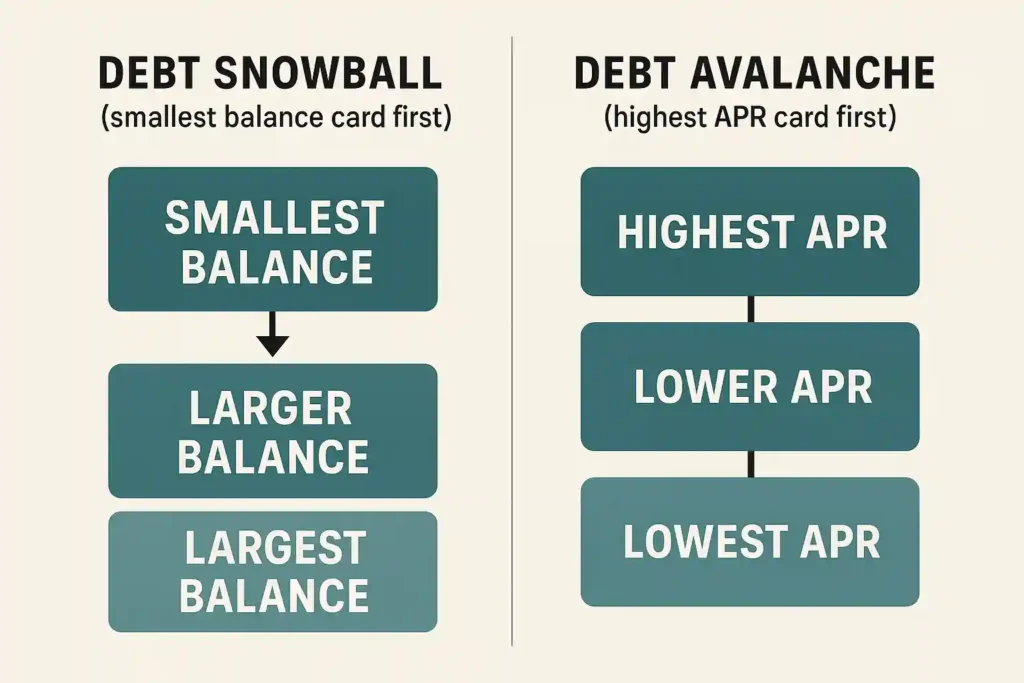

Step 2: Choose Your Payoff Strategy: Snowball vs. Avalanche

With spending under control, select a methodical approach to attack the balances:

- Listing Your Credit Cards (Balance Order vs. APR Order): Create two lists of your credit cards (and any other high-interest consumer debt you want to include):

- Ordered by smallest balance to largest balance.

- Ordered by highest APR (interest rate) to lowest APR.

- The Debt Snowball Method Explained:

- Pay minimums on all cards except the one with the smallest balance.

- Throw all extra money at the smallest balance card until it’s paid off.

- Take the full amount (minimum + extra) you were paying on the eliminated card and add it to the minimum payment of the next smallest balance card.

- Why? Quick wins provide powerful psychological motivation.

- The Debt Avalanche Method Explained:

- Pay minimums on all cards except the one with the highest APR.

- Throw all extra money at the highest APR card until it’s paid off.

- Take the full amount (minimum + extra) you were paying on the eliminated card and add it to the minimum payment of the next highest APR card.

- Why? Saves the most money on interest over time because you eliminate the most expensive debt first.

- Which is Best for Credit Card Debt? Because credit card APRs are often very high and can vary significantly, the Debt Avalanche method is usually mathematically superior and recommended if you can stay disciplined. Tackling that 25% APR card before the 15% APR card saves substantial interest costs. However, if you need those quick motivational wins to stay on track, the Debt Snowball is still a very effective strategy. The best plan is the one you stick with.

- Executing Your Chosen Method Consistently: Whichever method you choose, commit to it. Make those extra payments diligently every single month.

Step 3: Explore Acceleration Tools: Balance Transfers & Consolidation

These tools don’t eliminate debt but can restructure it, potentially lowering interest costs and accelerating payoff IF used wisely.

- Balance Transfer Credit Cards:

- How They Work: You apply for a new credit card offering a 0% introductory APR on balance transfers for a specific period (e.g., 12-21 months). You transfer your high-interest balances to this new card.

- Pros: Gives you an interest-free window to aggressively pay down the principal balance. Can save significant money on interest if you pay off most or all of the balance before the intro period ends.

- Cons: Usually requires good to excellent credit to qualify. Balance transfer fees (typically 3-5% of the transferred amount) are common and added to your balance. The interest rate jumps significantly (often to a high variable rate) after the introductory period expires. Crucially, you MUST avoid accumulating new debt on the old cards OR the new card.

- Debt Consolidation Loans:

- How They Work: You take out a new personal loan (from a bank, credit union, or online lender) with a potentially lower, fixed interest rate to pay off multiple credit card balances. You then have one fixed monthly payment for the loan.

- Pros: Simplifies payments to one lender. Can lower your overall interest rate compared to high credit card APRs. Fixed rate provides predictability.

- Cons: Doesn’t erase the debt, just changes its form. Requires good credit to qualify for a favorable rate. Loan may have origination fees. Doesn’t address the underlying spending habits that led to the debt. You MUST stop using the paid-off credit cards irresponsibly.

- Important Note: Availability, terms, interest rates, fees, and regulations for balance transfers and consolidation loans vary significantly by country and lender. Research local options carefully.

Step 4: Stick With It: Staying Motivated & Disciplined

Getting out of significant credit card debt is often a marathon, not a sprint. Staying motivated is key.

- Automate Extra Payments When Possible: Set up automatic extra payments towards your target card each month alongside your minimum payments.

- Celebrate Milestones: Paying off each credit card is a HUGE accomplishment! Celebrate these wins (with free or low-cost rewards) to keep morale high.

- Revisit Your Budget Regularly: Ensure you’re staying on track with spending cuts and maximizing the extra payments towards debt.

- Find Accountability: Tell a supportive friend or family member about your goal. Use a debt payoff app that tracks progress. Seeing the finish line get closer is motivating.

- Visualize Debt Freedom: Regularly imagine how life will feel without those credit card payments – the reduced stress, the extra cash flow, the ability to pursue other goals. Keep your “why” front and center.

Knowing When to Ask for Help with Credit Card Debt

Sometimes, DIY methods aren’t enough, especially if you’re deeply overwhelmed or falling behind.

- Signs You Might Need Professional Assistance:

- You consistently can’t afford even minimum payments.

- Your debt balances keep increasing despite payments.

- You’re relying on cash advances or payday loans to make ends meet.

- You’re receiving calls from debt collectors.

- You feel completely overwhelmed and hopeless about the situation.

- Reputable Non-Profit Credit Counseling: These organizations offer budgeting help, financial education, and can potentially set up a Debt Management Plan (DMP). Look for accredited agencies (like those affiliated with NFCC in the US or equivalent bodies elsewhere). Their goal is to help you manage debt responsibly. (The CFPB provides guidance on choosing a credit counselor: https://www.consumerfinance.gov/ask-cfpb/how-do-i-find-a-credit-counselor-en-1351/)

- What is a Debt Management Plan (DMP)? In a DMP, you make one monthly payment to the counseling agency. They distribute it to your creditors, often after negotiating lower interest rates or waived fees. It typically takes 3-5 years to complete. It can impact your credit (often involves closing accounts) but is much less damaging than default or settlement.

- Understanding Debt Settlement (Use Extreme Caution): For-profit debt settlement companies negotiate with creditors to pay less than you owe, usually after you stop paying bills and save funds in an escrow account. This is very risky. It severely damages your credit score for years, creditors don’t have to agree to settle, forgiven debt may be taxable, and fees are often high. Explore all other options first.

- Avoiding Debt Relief Scams: Be wary of companies charging large upfront fees, guaranteeing results, or telling you to stop paying creditors immediately without explaining the consequences. Check resources from consumer protection agencies like the FTC (https://consumer.ftc.gov/articles/debt-relief-services-scams).

- Note: Regulations surrounding credit counseling and debt relief vary significantly by country. Research reputable, accredited non-profit options in your specific location.

Beyond Zero Balance: Maintaining Financial Health

Getting out of credit card debt is a massive victory! Here’s how to stay free:

- Rebuilding Your Credit Score: Consistently paying bills on time and keeping credit utilization low (ideally below 30%, even better below 10%) after paying off debt will gradually improve your score.

- Using Credit Cards Responsibly Moving Forward: If you choose to use credit cards again, treat them like debit cards. Pay the statement balance IN FULL every single month to avoid interest charges. Use them for convenience or rewards, not to spend money you don’t have.

- Building an Emergency Fund: Having 3-6 months of living expenses saved prevents you from needing to rely on credit cards for unexpected costs in the future.

- Setting New Financial Goals: Redirect the money you were putting towards debt into savings and investments for your future goals!

Credit Card Debt FAQs

Let’s answer common questions about how to get out of debt credit card:

- What’s the absolute fastest way to pay off credit cards? Aggressively cut expenses, earn extra income, and throw every spare cent at the cards using the Debt Avalanche method (highest APR first) to minimize interest costs and speed up payoff. Balance transfers can help if used strategically to pause interest.

- Should I close credit cards after I pay them off? It depends. Closing cards (especially older ones) can potentially lower your credit score slightly by reducing your average account age and increasing your overall credit utilization ratio (if you have balances on other cards). However, if having the open card tempts you to spend, closing it might be the better choice for your financial behavior. Keeping one or two long-standing cards open and using them responsibly (paying in full monthly) is often recommended for credit health.

- Are balance transfer cards worth the fee? Calculate the potential interest savings versus the transfer fee. If you can pay off a significant portion (ideally all) of the transferred balance during the 0% intro period, the interest saved might far outweigh the 3-5% fee. If you won’t make much progress during the intro period, it might not be worth it.

- Is it better to get a consolidation loan or use a DMP? A consolidation loan is a new loan you manage yourself. A DMP is a structured program managed through a credit counseling agency, often with negotiated lower rates from creditors. If you have good credit and discipline, a low-interest consolidation loan might be simpler. If you need structure, accountability, and potentially lower rates negotiated for you, a DMP from a reputable non-profit agency might be better (though it may impact credit initially).

- How do I get out of $10,000 (or $20,000+) in credit card debt? The principles are the same, but the timeline is longer and requires more aggressive action. You absolutely MUST stop adding to the debt, create a strict budget, find significant extra money (potentially requiring major lifestyle changes or side income), choose an aggressive payoff method (likely Avalanche), and consider options like consolidation or a DMP if needed. Consistency and determination are paramount.

Your Escape Route from Credit Card Debt Starts Today

Feeling trapped by high-interest credit card debt is stressful and limiting, but it doesn’t have to be permanent. Learning how to get out of credit card debt involves understanding the challenge, taking control of your spending, choosing a dedicated payoff strategy (like the Snowball or Avalanche), exploring tools wisely, and seeking help when needed.

The journey requires commitment and discipline with money, but the feeling of paying off that last card, stopping the endless interest charges, and reclaiming your financial freedom is incredibly rewarding. Take the first step today – analyze your statements, make a spending cut, choose your payoff method. You can conquer this debt.

CTA:

What’s the first concrete action you’ll take this week to start tackling your credit card debt? Will you list out all your cards and APRs? Choose your payoff method? Identify one expense to cut? Share your commitment or biggest challenge in the comments below!

If this guide provided a clear path forward, please share it with anyone else struggling with how to get out of debt, especially credit card debt. Remember to check resources from trusted consumer agencies like the Consumer Financial Protection Bureau (CFPB) for more information on managing debt and your rights.