Let’s start with a definition: State income tax is a tax levied by most state governments directly on the income earned by individuals (and sometimes corporations) within their jurisdiction. Dreaming of a bigger paycheck without getting a raise? The idea of living in one of the states with no income tax holds a powerful appeal for many Americans looking to reduce their tax burden. But is moving to one of these zero income tax states truly the golden ticket to financial freedom? While the prospect of keeping more of your earned income is attractive, the reality is more complex. This guide provides the definitive list of states without income tax in 2025, explores how these states fund themselves, analyzes the real impact on your personal finance, and helps you understand the pros and cons before considering a move.

Table of Contents

Understanding State Income Tax: A Quick Primer

Before diving into the list, let’s quickly understand what we’re talking about. Most U.S. states (over 40 of them) levy a personal income tax to fund public services like schools, roads, public safety, parks, and state administration.

These taxes are typically calculated as a percentage of your taxable income and can be structured in different ways:

- Progressive Tax: Higher income levels are taxed at higher rates (like the federal system).

- Flat Tax: All income levels are taxed at the same rate.

The states we’re discussing here stand out because they do not levy a broad-based personal income tax on wages and salaries.

The Official List: States With No Income Tax on Wages in 2025

As of 2025, there are eight states that completely forgo a state income tax on wages:

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

The Special Case: New Hampshire

New Hampshire deserves a special mention. While it doesn’t tax earned wages (salaries, tips), it currently taxes interest and dividend income above certain thresholds. However, this tax is being phased out and is scheduled for full repeal effective January 1, 2027. So, while not completely tax-free on all income types just yet, it’s moving in that direction and doesn’t tax wages.

(Historical Note: Tennessee also used to tax interest and dividend income via its “Hall Tax,” but that was fully repealed effective January 1, 2021.)

This makes a total of nine states that either have no income tax at all or only tax specific types of unearned income (like New Hampshire currently). This is the commonly cited list of states without income tax on wages.

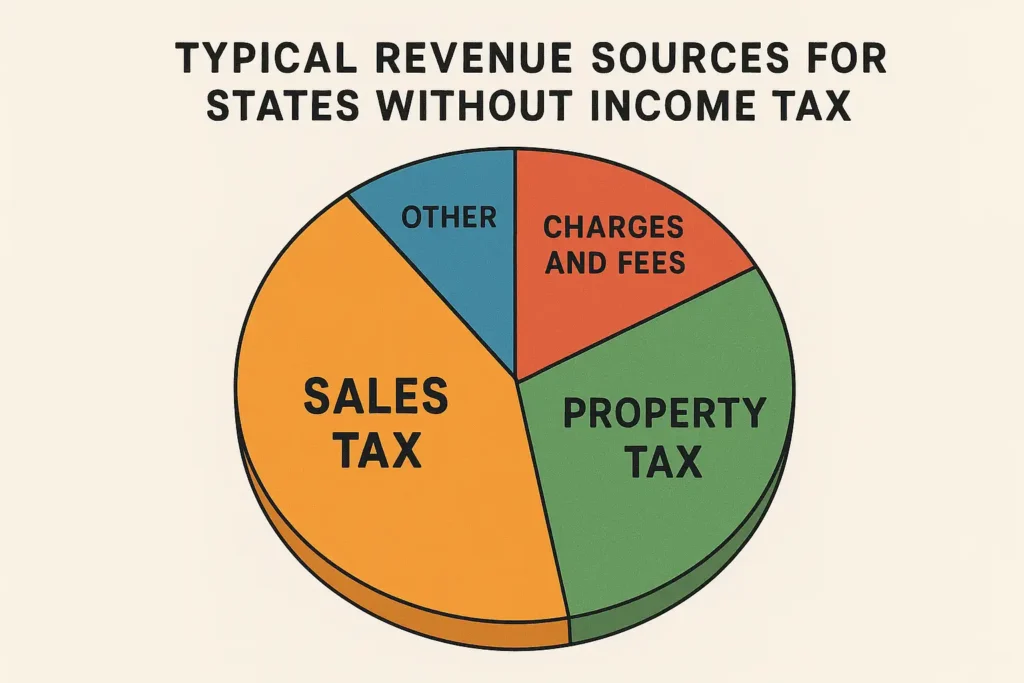

How Do States Without Income Tax Generate Revenue? The Trade-offs

If these states aren’t taxing income, how do they pay for state services? They rely more heavily on other forms of taxation and revenue streams. This is where the “no income tax” benefit might be offset. Common methods include:

- Higher Sales Taxes: Many no income tax states compensate with higher state and local sales taxes on goods and services. States like Washington, Tennessee, and Nevada often rank among those with the highest combined state and local sales tax rates.

- Higher Property Taxes: Property taxes (levied on homeowners and businesses based on property value) can be significantly higher in some states without income tax in US. Texas and New Hampshire, for example, are known for having some of the highest effective property tax rates nationwide. Florida’s property taxes can also be substantial depending on the location.

- Excise Taxes: These are taxes on specific goods like gasoline, alcohol, and tobacco. These rates can vary significantly but contribute to state revenue.

- Corporate Taxes & Franchise Taxes: While not taxing personal income, some of these states levy taxes on corporations. Texas, for instance, has a Margin Tax (a type of gross receipts tax), and Washington has a Business & Occupation (B&O) tax. South Dakota is known for its favorable trust and corporate tax laws, attracting financial institutions.

- Severance Taxes: States rich in natural resources rely heavily on severance taxes levied on the extraction of oil, gas, and minerals. Alaska, Wyoming, and Texas generate significant revenue this way.

- Tourism Revenue: States like Florida and Nevada benefit greatly from taxes related to tourism, such as lodging taxes, rental car taxes, and gaming revenue (in Nevada’s case).

- Federal Funding: All states receive funding from the federal government, but the proportion can vary.

- State-Specific Revenue: Alaska is unique with its Permanent Fund Dividend (PFD), where oil revenues are invested, and a portion of the earnings is distributed annually to eligible residents.

The key takeaway: Revenue has to come from somewhere. States without an income tax simply shift the tax burden to other areas.

States With No Income Tax and Personal Finance: What Does It Really Mean for Your Wallet?

This is the critical question. Does living in a state with no income tax automatically improve your personal finance situation? Not always. Here’s a breakdown of the financial implications:

Potential Savings: Keeping More Earned Income

The most obvious benefit is that your paycheck won’t have state income tax withheld (unless you work remotely for a company in a state that taxes based on employer location – a complex issue). This can mean significantly more take-home pay, especially for high earners.

The Total Tax Burden Factor (The Whole Picture!)

This is the most crucial consideration. A state’s lack of income tax doesn’t guarantee the lowest overall tax burden. You must consider the combined impact of:

- Income Tax (Zero in these states, except NH’s I&D tax)

- Sales Tax (Often higher)

- Property Tax (Often higher)

- Excise Taxes

- Other State and Local Fees

Organizations like the Tax Foundation publish rankings of states based on their total tax burden, which provides a much more realistic comparison of how tax-friendly a state truly is overall. You might find that while you save on income tax, higher property or sales taxes significantly offset those savings depending on your spending habits and whether you own property. (Consider linking to Tax Foundation’s state tax burden page).

Impact on Cost of Living

Many factors influence the cost of living besides taxes, including housing costs, healthcare, transportation, and utilities. Some no income tax states, particularly Florida and Texas, have seen significant population growth and rising housing costs in desirable areas, potentially negating tax savings. Alaska generally has a high cost of living due to its remote location.

Considerations for Retirees

For retirees, the focus shifts from earned income to retirement income (Social Security, pensions, withdrawals from retirement accounts) and property taxes.

- These nine states generally don’t tax Social Security benefits (which is common nationwide).

- Most also don’t tax pension income or withdrawals from 401(k)s/IRAs (as they lack a broad income tax). New Hampshire’s I&D tax might apply to certain retirement account distributions if they contain taxable interest/dividends, but this is complex and phasing out.

- However, retirees who own homes must carefully consider potentially high property taxes (e.g., Texas, New Hampshire, Florida).

Considerations for Remote Workers

The rise of remote work adds complexity. Generally, you pay income tax based on where you live and perform the work (your state of residency). Living in a state with no income tax is beneficial. However, some states have complex “convenience of the employer” rules or sourcing rules that might require you to pay income tax to the state where your employer is located, even if you live elsewhere. Consulting a tax professional specializing in multi-state taxation is essential for remote workers.

Impact on Public Services

Since these states rely on different, sometimes more volatile (like severance taxes or tourism taxes) revenue streams, the funding levels for public services like schools, infrastructure (roads, bridges), public transportation, and state parks can differ compared to states with a more diversified income tax base. This can impact quality of life factors.

Pros and Cons of Living in a State With No Income Tax

Let’s summarize the potential advantages and disadvantages:

Potential Pros:

- Higher Take-Home Pay: More money from each paycheck without state income tax deductions.

- Simpler Tax Filing: State income tax returns are not required (though NH residents with significant interest/dividend income may still need to file).

- Attractiveness for High Earners & Businesses: Can draw individuals and companies seeking lower tax environments.

- Retirement-Friendly (Income): Generally favorable tax treatment of retirement income sources.

- Potential Economic Growth: Lower tax burdens can sometimes spur economic activity (though this is debated).

Potential Cons:

- Higher Other Taxes: Often offset by higher sales, property, or excise taxes.

- Regressive Tax Systems: Reliance on sales and excise taxes can disproportionately affect lower-income individuals who spend a larger percentage of their income on taxed goods.

- Less Stable State Revenue: Revenue from sales, tourism, or severance taxes can be more volatile than income tax, potentially leading to budget fluctuations.

- Potential Impact on Public Services: Funding levels for schools, infrastructure, etc., may vary compared to income-tax states.

- Higher Cost of Living: Popular no-tax states may have higher housing and other living costs.

- Complexity for Multi-State Earners/Remote Workers: Determining residency and tax obligations can be tricky.

A Closer Look at Each State (Brief Overview)

Each state with no income tax has a unique profile:

- Alaska: No state income or sales tax. Revenue heavily reliant on oil (severance taxes). Offers the Permanent Fund Dividend (PFD) to residents. High cost of living, remote location.

- Florida: No state income tax. High sales tax, significant tourism revenue. Popular retirement destination, rapidly growing population, rising housing costs in many areas. Property taxes vary but can be high.

- Nevada: No state income tax. Heavy reliance on high sales taxes and gaming/tourism revenue. Volatile revenue stream tied to tourism health.

- New Hampshire: No state sales tax or tax on wages. Currently taxes interest & dividends (phasing out by 2027). Very high property taxes are the primary funding source.

- South Dakota: No state income tax. Relatively low sales tax compared to some others on this list. Known for business-friendly climate (no corporate income tax, favorable trust laws).

- Tennessee: No state income tax (Hall Tax on interest/dividends fully repealed). Relies heavily on high sales taxes. Growing population and economy.

- Texas: No state income tax. High property and sales taxes. Strong job growth, diverse economy, but significant reliance on property taxes for local funding (schools). Has a corporate Margin Tax.

- Washington: No state income tax. Very high state sales tax, plus local additions. Relies on sales tax and a Business & Occupation (B&O) gross receipts tax on businesses. Growing tech sector.

- Wyoming: No state income tax. Low population. Relies heavily on property taxes and severance taxes from mineral extraction (coal, oil, gas).

Important Considerations Before Moving

Thinking of relocating to one of these no income tax states in US? Do your homework:

- Establish Clear Residency: Each state has specific rules (physical presence, driver’s license, voter registration, etc.) to establish residency for tax purposes. You need to clearly sever ties with your old state and meet the new state’s requirements. Consult state Department of Revenue websites and potentially the IRS guidelines on residency.

- Calculate Your Total Potential Tax Bill: Don’t just focus on income tax savings. Estimate your potential spending on taxable goods (sales tax) and, if buying property, your potential property tax liability in the specific location you’re considering. Use online calculators or state resources.

- Research Cost of Living: Compare housing costs, utilities, groceries, transportation, and healthcare costs between your current location and potential new locations within the no-tax state. Websites like Numbeo or the Council for Community and Economic Research (C2ER) Cost of Living Index can help (though data sources vary).

- Assess Public Services and Quality of Life: Research school quality, infrastructure condition, healthcare access, crime rates, and other quality-of-life factors that matter to you. How states fund these services can impact their quality.

- Consult a Tax Professional: Especially if you have complex finances, own a business, work remotely, or are moving near retirement, consulting a qualified tax advisor familiar with multi-state taxation is highly recommended.

Conclusion: Is a No-Income-Tax State Right for You?

Living in one of the states with no income tax offers the clear advantage of keeping more of your earned income. However, it’s crucial to look beyond that single factor and analyze the complete personal finance picture. States compensate for the lack of income tax through other means, primarily higher sales and/or property taxes, which could significantly impact your overall total tax burden depending on your lifestyle, spending habits, and homeownership status.

The “best” state for taxes depends entirely on your individual financial situation, priorities, and preferences regarding public services and cost of living. Before making a move based solely on the absence of state income tax, conduct thorough research, calculate your potential total tax liability, and consider all the factors that contribute to your overall financial well-being and quality of life.

Frequently Asked Questions (FAQ)

How many US states have absolutely zero income tax on wages in 2025?

As of 2025, there are eight states with no state income tax on wages: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. New Hampshire doesn’t tax wages but currently taxes interest and dividend income (this tax is being phased out).

Does living in a state with “no income tax” mean I’ll pay lower taxes overall?

Not necessarily. States without income tax often rely more heavily on other taxes like sales tax and property tax, which can be quite high. Your total tax burden (the combination of all state and local taxes you pay) might be higher or lower depending on your income level, spending habits, and whether you own property, compared to living in a state with an income tax but lower sales/property taxes.

How do states without income tax pay for public services like schools and roads?

They primarily rely on revenue from other sources, such as state sales taxes, local property taxes, excise taxes (on gas, alcohol, etc.), corporate taxes, severance taxes (on natural resource extraction like oil and gas), tourism-related taxes, and federal funding.

Is New Hampshire considered a state with no income tax?

It’s a special case. New Hampshire does not tax earned wages or salaries. However, it currently does tax interest and dividend income above certain thresholds. This Interest and Dividends Tax is being phased out and is scheduled for full repeal by 2027. So, for wage earners, it functions like a no-income-tax state.

Which state has the absolute lowest overall taxes?

This is complex and changes based on methodology and individual circumstances. Organizations like the Tax Foundation calculate the total tax burden for each state, considering income, sales, property, and other taxes relative to state income. Rankings fluctuate, but states like Alaska and Wyoming often appear low on overall burden lists due to specific revenue structures (like oil revenue), though cost of living can be high. There isn’t one single “lowest tax” state for everyone; it depends on your specific financial profile.