Let’s define it: Student loans are funds borrowed specifically to cover the costs associated with higher education, including tuition, fees, room, board, books, and other related expenses, which must be repaid later, usually with interest. Feeling overwhelmed by the sheer scale of student loans debt in the US? Confused about the difference between federal and private options, repayment plans, or the latest student loan news? You’re certainly not alone. Student loans are a critical form of financial aid for millions, but navigating the system – from application to repayment, and understanding concepts like student loan forgiveness or debt collection – can be incredibly complex. This guide provides a comprehensive overview of student loans in 2025, breaking down the types of loans, explaining key processes managed by the Department of Education, and clarifying recent developments to help you manage your educational debt effectively.

Table of Contents

Understanding the Landscape: Federal vs. Private Student Loans

The most crucial distinction in the world of student loans is between federal and private options. They operate very differently.

Federal Student Loans: The Government Option

These loans are funded directly by the U.S. Department of Education (often referred to as the Education Department). They are the most common type and generally offer significant advantages for borrowers.

- Source: U.S. Federal Government (Department of Education).

- Application: Requires completing the Free Application for Federal Student Aid (FAFSA). Eligibility is often based on financial need for certain loan types.

- Interest Rates: Typically fixed for the life of the loan, set annually by Congress. Rates vary depending on the loan type and disbursement date but are often lower than private options, especially for undergraduates.

- Borrower Protections: Offer numerous benefits not usually found with private loans, including:

- Various repayment plans (including Income-Driven Repayment options).

- Options for deferment and forbearance (temporarily postponing payments).

- Potential eligibility for student loan forgiveness programs.

- No credit check required for most undergraduate loans (Direct Subsidized/Unsubsidized).

- Key Types: We’ll explore these more below (Direct Subsidized, Direct Unsubsidized, Direct PLUS).

Private Student Loans: The Non-Government Option

These loans are offered by private lenders like banks, credit unions, state agencies, or online lending companies.

- Source: Banks, credit unions, private lenders.

- Application: Requires applying directly to the lender. Eligibility is heavily based on the borrower’s (and potentially a cosigner’s) creditworthiness (credit score and history).

- Interest Rates: Can be fixed or variable. Variable rates often start lower but can increase significantly over time, making long-term costs unpredictable. Rates depend heavily on the borrower’s/cosigner’s credit profile.

- Borrower Protections: Offer far fewer protections than federal loans. Repayment options, deferment/forbearance policies, and forgiveness possibilities are limited and vary greatly by lender.

- Use Case: Often used to bridge the gap when federal loans don’t cover the full cost of attendance, or by borrowers with excellent credit who might secure a competitive rate (though often still less favorable than federal undergraduate loans overall).

General Recommendation: Always exhaust your federal student loan options first before considering private loans due to the superior borrower protections and generally more favorable terms offered by the Department of Education.

Diving Deeper: Types of Federal Student Loans

Understanding the specific types of federal student loans, all managed via StudentAid.gov, is key:

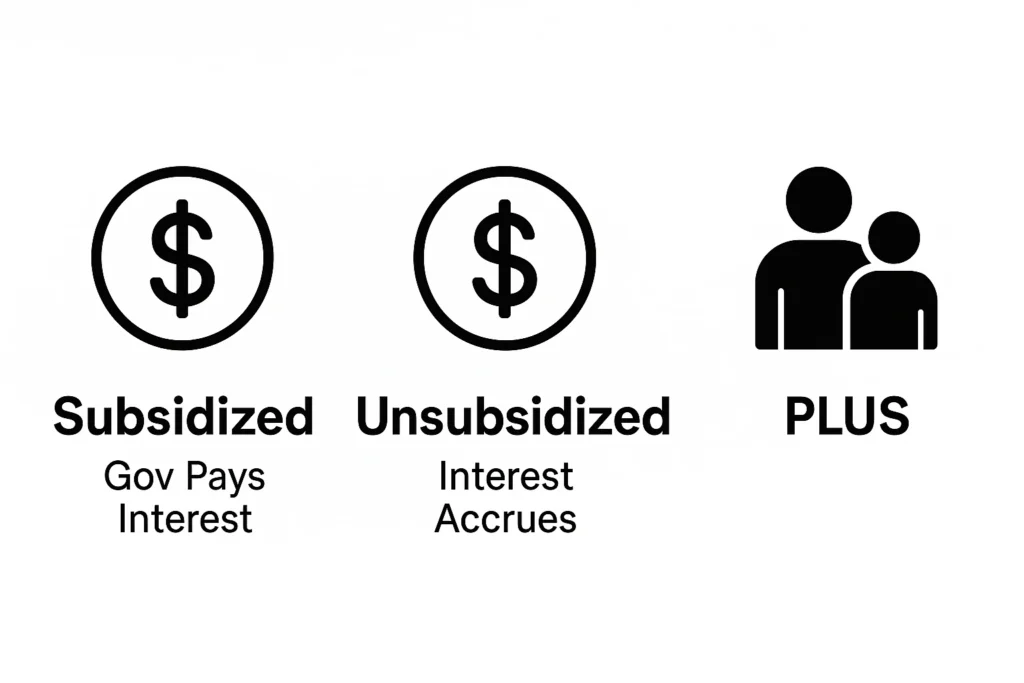

- Direct Subsidized Loans:

- Available to undergraduate students demonstrating financial need.

- The U.S. Department of Education pays the interest while you’re enrolled at least half-time, during the six-month grace period after leaving school, and during deferment periods. This is a significant benefit.

- Direct Unsubsidized Loans:

- Available to undergraduate, graduate, and professional students; financial need is not required.

- You are responsible for paying all the interest that accrues, starting from disbursement. If you don’t pay the interest while in school or during grace/deferment periods, it will capitalize (be added to your principal loan balance), increasing the total amount you repay.

- Direct PLUS Loans:

- Available to graduate or professional students (Grad PLUS) and parents of dependent undergraduate students (Parent PLUS).

- Financial need is not required, but a credit check is performed. Borrowers cannot have an “adverse credit history” (though there are options like obtaining an endorser if they do).

- Interest accrues from disbursement. Parent PLUS loans generally have higher interest rates than Direct Subsidized/Unsubsidized loans for undergraduates.

- Direct Consolidation Loans:

- Allows you to combine multiple eligible federal student loans into a single loan with one monthly payment and potentially a longer repayment period. The interest rate is a weighted average of the consolidated loans. Consolidation can sometimes be necessary to qualify for certain repayment plans or forgiveness programs (like PSLF for older FFELP loans).

You can find detailed information about all these loan types directly on the official Federal Student Aid website: https://studentaid.gov/

Understanding Private Student Loans

While generally less favorable, private student loans fill a funding gap for some. Key points:

- Lenders: Banks, credit unions, online lenders (e.g., Sallie Mae, SoFi, Discover Student Loans).

- Credit-Based: Approval and interest rates depend heavily on your credit score and history. Many students need a creditworthy cosigner (like a parent) to qualify.

- Variable Rates Common: Many private loans have variable interest rates tied to market indexes (like SOFR or Prime), meaning payments can increase unexpectedly. Fixed rates are available but may be higher.

- Fewer Repayment Options: Limited flexibility compared to federal loans. Income-driven plans are rare. Deferment/forbearance options are less generous and not guaranteed.

- No Federal Forgiveness: Private loans are not eligible for federal forgiveness programs like PSLF or IDR forgiveness.

If considering private loans, shop around carefully, compare APRs (Annual Percentage Rates), understand the terms (fixed vs. variable rate, repayment start date, fees), and borrow only what is absolutely necessary. The Consumer Financial Protection Bureau (CFPB) provides resources for understanding private loan options.

The Scope of Student Loans Debt

Student loans debt has become a significant national issue in the United States. As of early 2025, outstanding student loan debt totals approximately $1.77 trillion, second only to mortgage debt among consumer debt categories.

- Over 42 million Americans hold federal student loan debt.

- The average federal student loan balance per borrower is around $38,000-$41,000, though this varies greatly.

- Federal loans make up over 92% of all outstanding student debt. (Statistics based on recent data from sources like Education Data Initiative and Ramsey Solutions).

This substantial debt burden impacts individual financial well-being and the broader economy. Understanding repayment options is crucial.

Navigating Repayment: Options for Federal Loans

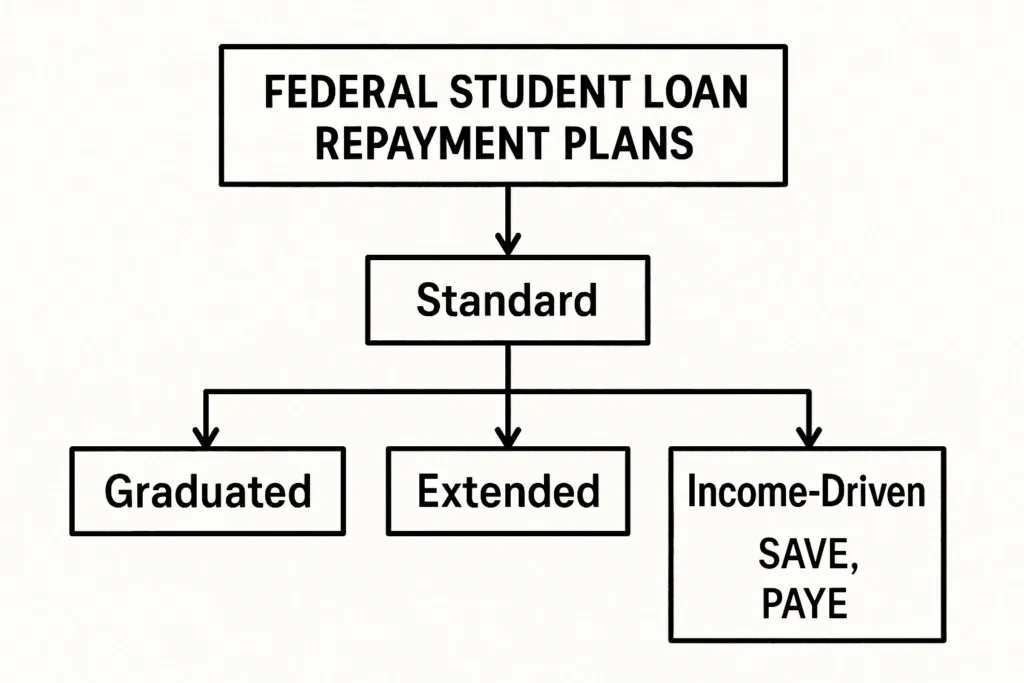

The Department of Education offers several repayment plans for federal student loans to help borrowers manage their student loans debt:

- Standard Repayment Plan: Fixed monthly payments over 10 years (up to 30 years for consolidation loans). Usually results in the least interest paid overall but has higher monthly payments initially.

- Graduated Repayment Plan: Payments start lower and increase every two years, typically over a 10-year term. You’ll pay more interest overall than the Standard plan.

- Extended Repayment Plan: Fixed or graduated payments over a longer period (up to 25 years). Requires a certain loan balance minimum. Lower monthly payments but significantly more interest paid long-term.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payment on your discretionary income and family size. Payments are typically recalculated annually. This is often the best option for borrowers struggling with payments. Major IDR plans include:

- Saving on a Valuable Education (SAVE) Plan: Often offers the lowest monthly payments, based on a smaller percentage of discretionary income. Features an interest subsidy that can prevent balances from growing if your payment doesn’t cover accrued interest. Generally offers forgiveness after 20-25 years of payments (or potentially sooner for smaller original balances).

- Pay As You Earn (PAYE) Repayment Plan: Payments typically capped at 10% of discretionary income. Forgiveness after 20 years.

- Income-Based Repayment (IBR) Plan: Payments typically 10% or 15% of discretionary income (depending on when you borrowed). Forgiveness after 20 or 25 years.

- Income-Contingent Repayment (ICR) Plan: Payments are the lesser of 20% of discretionary income or what you’d pay on a fixed 12-year plan. Forgiveness after 25 years. (Often the only IDR option for Parent PLUS loans if consolidated).

Applying for IDR plans and managing repayment details are done through StudentAid.gov and your assigned loan servicer.

Understanding these plans is key. For practical steps on tackling payments, see our guide on How to Get Out of Student Loan Debt.

Student Loan Forgiveness, Cancellation, and Discharge

Student loan forgiveness is a hot topic and subject to frequent student loan news and policy changes. It’s crucial to rely on official sources. Key federal programs include:

- Public Service Loan Forgiveness (PSLF): Forgives the remaining balance on Direct Loans after 120 qualifying monthly payments made while working full-time for a qualifying employer (government or non-profit organizations). Requires meticulous documentation and specific repayment plan enrollment. Visit StudentAid.gov’s PSLF section for exact requirements.

- Income-Driven Repayment (IDR) Forgiveness: Borrowers on IDR plans (SAVE, PAYE, IBR, ICR) may have their remaining loan balance forgiven after making payments for 20 or 25 years, depending on the plan and loan type.

- Teacher Loan Forgiveness: For eligible teachers working full-time for five consecutive years in low-income schools or educational service agencies. Offers forgiveness up to $17,500 on Direct or FFEL Program loans.

- Other Discharge Programs: Loans may be discharged due to death, total and permanent disability (TPD), school closure while enrolled, false certification by the school, borrower defense to repayment (if misled by the school), or bankruptcy (though difficult to achieve).

Policy Context (April 2025): The landscape around student loan forgiveness has seen significant debate and changes. While the Biden administration pursued broad forgiveness initiatives (largely blocked by courts) and implemented the SAVE plan and adjustments to IDR/PSLF counts, the current (as of April 2025) Trump administration, under Secretary of Education Linda McMahon, has signaled a shift. Recent student loan news indicates a focus on adhering strictly to existing legislation, opposing broad forgiveness, and emphasizing borrower repayment responsibility. For example, initiatives like restarting student loan debt collection (discussed next) reflect this approach. Some specific eligibility criteria for programs like PSLF have also been adjusted via executive action. Always check StudentAid.gov for the absolute latest, official information on eligibility and application processes for any forgiveness program.

Student Loan Default & Collections

Failing to make student loan payments leads to delinquency and eventually default (typically after 270 days of non-payment for federal loans). Default has severe consequences:

- Acceleration: The entire loan balance becomes immediately due.

- Damaged Credit Score: Default significantly harms your credit score, making it hard to get loans, rent apartments, or even get some jobs.

- Loss of Eligibility: You lose eligibility for further financial aid, deferment, forbearance, and federal repayment plans.

- Debt Collection Student Loans: Your loan may be turned over to a private debt collection agency.

- Aggressive Collection Actions: The government has strong powers for debt collection student loans, including:

- Garnishing Wages: Your employer may be required to withhold up to 15% of your disposable pay without a court order.

- Offsetting Tax Refunds: Your federal (and sometimes state) tax refunds can be seized.

- Offsetting Federal Benefits: Portions of Social Security benefits (including disability) can be withheld.

- Collection Fees: Significant fees can be added to your loan balance.

Recent News Context (April 2025): According to Department of Education announcements and related student loan news in late April 2025, after pauses initiated during the pandemic and extended previously, student loan collections activities for defaulted federal loans were scheduled to restart beginning May 5, 2025. This includes restarting the Treasury Offset Program and initiating processes for administrative garnishing wages later in the summer. Borrowers in default are urged by the Education Department to contact the Default Resolution Group immediately to explore options like rehabilitation or consolidation to get out of default before involuntary collections begin.

Dealing with default is stressful. Explore strategies in our guide: How to Get Out of Student Loan Debt. See also: Guide to Debt Management.

Staying Informed: Keeping Up with Student Loan News

The rules and policies surrounding federal student loans can change. It’s essential to stay updated:

- StudentAid.gov: This official U.S. Department of Education website is the primary, most reliable source for information on loan types, repayment plans, forgiveness programs, managing your account, and official announcements. Bookmark it and check it regularly.

- Your Loan Servicer: Stay in contact with the company managing your loan payments. Ensure your contact information is up-to-date.

- Reputable News Sources: Follow major news outlets or dedicated financial news sites for updates on potential policy changes or significant student loan news. Be critical of sources and look for official confirmation.

Budgeting and Managing Your Student Loans

Successfully managing student loans debt starts with incorporating payments into your overall financial plan.

- Create a realistic budget using a Student Budget Planner (or explore our Student Budget Planner Guide).

- Understand basic money management with our Beginner’s Guide to Personal Finance.

- Implement the Pay Yourself First Method to prioritize savings alongside debt repayment.

Conclusion: Navigating Your Student Loan Journey

Student loans are a significant financial tool that enables access to higher education for millions but also represents a substantial form of student loans debt. Understanding the difference between federal student loans (managed by the Department of Education with borrower protections) and private loans is the first step. Staying informed about repayment options, potential student loan forgiveness programs, the serious consequences of default like garnishing wages, and current student loan news is crucial for effective management.

While the policy landscape can shift, the fundamental principles remain: borrow wisely, understand your obligations, explore all available repayment options, and seek help from official sources like StudentAid.gov when needed. By taking proactive steps and integrating your student loan management into your overall personal finance strategy, you can navigate your repayment journey successfully.

Frequently Asked Questions (FAQ)

What is the main difference between federal and private student loans?

Federal student loans are funded by the U.S. Department of Education, offer fixed interest rates, various repayment plans (including income-driven options), forgiveness programs, and don’t usually require a credit check for undergraduates. Private student loans come from banks/lenders, often have variable rates, require credit checks (often needing a cosigner), and offer far fewer borrower protections and repayment options.

How do I apply for federal student loans?

You must complete the Free Application for Federal Student Aid (FAFSA) form. This application determines your eligibility for federal grants, work-study, and federal student loans based on financial need and other factors. Visit StudentAid.gov to complete the FAFSA.

What happens if I can’t afford my federal student loan payments?

Contact your loan servicer immediately! Don’t ignore the problem. You likely qualify for an Income-Driven Repayment (IDR) plan (like SAVE) which can significantly lower your monthly payment based on your income and family size. Options like deferment or forbearance might also temporarily pause payments, though interest may still accrue. Defaulting has severe consequences (garnishing wages, damaged credit).

Is widespread student loan forgiveness happening in 2025?

As of late April 2025, there is no widespread, automatic forgiveness program enacted for all federal borrowers. Existing targeted programs like Public Service Loan Forgiveness (PSLF) and forgiveness after 20-25 years on an IDR plan continue, with some adjustments made by different administrations. The current (Trump) administration has emphasized borrower repayment and signaled opposition to broad cancellation, restarting collection efforts. Always rely on StudentAid.gov for official information on current forgiveness eligibility.

What are the consequences of student loan default?

Defaulting on federal student loans (typically after 270 days of non-payment) can lead to serious consequences, including damage to your credit score, garnishing wages (up to 15% of disposable income), seizure of tax refunds and federal benefits, loss of eligibility for further financial aid or repayment plans, and potential legal action or collection fees. It’s crucial to avoid default by seeking help early.

Sources

- Durbin Reintroduces Bill to Create Student Loan Borrower Bill of Rights

www.durbin.senate.gov - Student loans in the United States – Wikipedia

en.wikipedia.org - Federal Student Loans

studentaid.gov - Interest Rates for New Direct Loans | Federal Student Aid

studentaid.gov - Federal Versus Private Loans | Federal Student Aid

studentaid.gov - Understanding Credit-Based Loans – Financial Aid

finaid.olemiss.edu - Fixed vs. variable student loan rates: Which is best? – Bankrate

www.bankrate.com - Take Action on a Time-Limited Student Loan Forgiveness Opportunity – PA Office of Attorney General

www.attorneygeneral.gov - Private Loan | Publications and Resources – The Institute for College Access & Success

ticas.org - Are private education loans eligible for Public Service Loan Forgiveness (PSLF)?

studentaid.gov - Average U.S. Student Loan Debt: 2025 Statistics | BestColleges

www.bestcolleges.com - 10 Key Facts about Student Debt in the United States – Peterson Foundation

www.pgpf.org - How Does Student Debt Affect the Economy? – Peterson Foundation

www.pgpf.org - Federal Student Loan Repayment Plans

studentaid.gov - Graduated Repayment Plan – Federal Student Aid

studentaid.gov - Extended Repayment Plan allows you to repay your loans over an extended period of time – Federal Student Aid

studentaid.gov - Student Loan Forgiveness (and Other Ways the Government Can Help You Repay Your Loans) – Federal Student Aid

studentaid.gov - As Student Loan Payment Pause Ends, Income-Driven Repayment Plans May Help Borrowers – GAO

www.gao.gov - What are income-driven repayment (IDR) plans, and how do I qualify?

www.consumerfinance.gov - What is the Income-Contingent Repayment (ICR) Plan? – Federal Student Aid

studentaid.gov - Public Service Loan Forgiveness Program | Office of Employee Relations – NY.Gov

oer.ny.gov - Repaying Student Loans 101 | Federal Student Aid

studentaid.gov - Default vs delinquency: How they impact credit – Chase Bank

www.chase.com - Student Loan Delinquency and Default | Federal Student Aid

studentaid.gov - Collections on Defaulted Loans – Federal Student Aid

studentaid.gov - Free Application for Federal Student Aid (FAFSA) | USAGov

www.usa.gov - Resolve student loan payment problems | USAGov

www.usa.gov - U.S. Department of Education to Begin Federal Student Loan Collections, Other Actions to Help Borrowers Get Back into Repayment

www.ed.gov