Let’s start with a clear definition: Credit card interest is the fee your credit card issuer charges you for borrowing money, typically expressed as an Annual Percentage Rate (APR). Ever stared at your credit card statement, seen the “interest charged” line, and felt a knot in your stomach? You’re not alone. High credit card interest can quickly escalate what started as a manageable balance into a significant financial burden. But what if you could pinpoint exactly how much that interest is costing you and, more importantly, understand how different payment strategies could save you substantial money and time? This page features a powerful cc interest calculator (or “credit card interest calculator”) and a comprehensive guide to help you understand the true cost of your debt, use the calculator effectively, and implement actionable strategies to minimize those interest charges and conquer your credit card debt.

Credit Card Interest Calculator

Table of Contents

Understanding Credit Card Interest: The “Why” Behind Using a Calculator

Before you punch numbers into our cc interest calculator, let’s demystify the often-confusing world of credit card interest. Understanding these concepts will help you appreciate the calculator’s output and make smarter financial decisions.

APR (Annual Percentage Rate): More Than Just a Yearly Figure

- What is APR? Your Annual Percentage Rate (APR) is the yearly cost of borrowing on your credit card, including interest and certain fees (though for most credit cards, the APR largely reflects the interest rate). It’s the standard way to compare the cost of different credit products. As of early May 2025, average APRs on new credit card offers can hover around 24%, while for accounts accruing interest, the average can be around 21-22%, according to sources like LendingTree and Forbes Advisor. However, rates vary wildly based on your creditworthiness and the specific card.

- How it’s Applied (Daily Periodic Rate – DPR): While APR is an annual rate, credit card interest is typically calculated and compounded daily. To do this, issuers convert your APR into a Daily Periodic Rate (DPR) by dividing the APR by 365 (or sometimes 360, depending on the issuer – check your cardholder agreement). For example, an APR of 21.9% would have a DPR of roughly 0.06% (21.9 / 365). This DPR is what’s applied to your balance each day.

How Credit Card Interest is Typically Calculated (Average Daily Balance)

Most credit card companies use the Average Daily Balance method to calculate interest charges for a billing cycle. Here’s a simplified breakdown:

- Daily Balances: They calculate the outstanding balance on your card at the end of each day in the billing cycle. This includes new purchases, payments, credits, and any interest accrued from previous days if you’re carrying a balance.

- Sum of Daily Balances: All these daily balances are added together.

- Average Daily Balance: The sum from step 2 is divided by the number of days in that particular billing cycle.

- Interest Charge Calculation: This Average Daily Balance is then multiplied by your Daily Periodic Rate (DPR), and that result is multiplied by the number of days in the billing cycle.

(Example of a single day’s interest if you had an average daily balance of $1,000 and a DPR of 0.06%): $1,000 * 0.0006 = $0.60 interest for that day (This would then be multiplied by days in cycle for monthly charge).

It sounds complex, and it is! That’s precisely why a cc interest calculator is so valuable – it does the heavy lifting for you.

The Power (and Peril) of Grace Periods

- A grace period is the timeframe between the end of your billing cycle (when your statement is generated) and your payment due date. This period is typically 21-25 days.

- The Interest-Free Benefit: If you pay your entire statement balance in full by the due date, you generally avoid paying any interest on the purchases made during that billing cycle. This is a key advantage of using credit cards responsibly.

- Losing the Grace: If you carry any portion of your balance past the due date, you typically lose the grace period on new purchases for that billing cycle and potentially subsequent ones until the balance is cleared. This means new transactions can start accruing interest from the day they are made.

Minimum Payments: The Path to Maximum Interest

- Making only the minimum payment required by your credit card issuer is the most expensive way to pay off your debt.

- Minimum payments are often calculated as a very small percentage of your balance (e.g., 1-3%) plus accrued interest and any fees. This results in a large portion of your payment going towards interest, with very little applied to reduce the actual principal debt.

- As our credit card interest calculator will illustrate, relying on minimum payments can mean being in debt for many years, sometimes decades, and paying multiples of your original balance in interest.

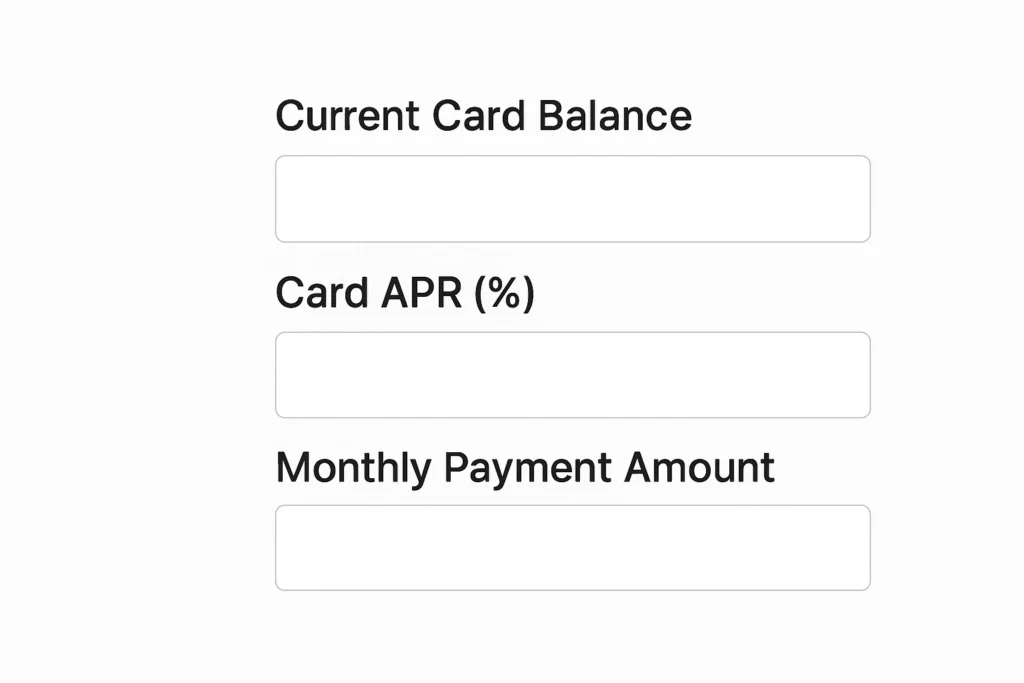

How to Use This CC Interest Calculator (The “How”)

Our cc interest calculator is designed to be user-friendly and provide clear insights into your credit card debt. To get the most accurate results, you’ll need a few pieces of information from your latest credit card statement:

- Current Credit Card Balance: Enter the total outstanding amount you currently owe on the credit card.

- Annual Percentage Rate (APR %): Find the current purchase APR on your statement. If your card has different APRs for purchases, balance transfers, or cash advances, use the APR that applies to the majority of your balance you’re trying to calculate for.

- Monthly Payment Amount: This is where you can experiment:

- Start by entering your current minimum payment (usually shown on your statement) to see the long-term cost.

- Then, input a fixed monthly payment amount you could make (e.g., $50, $100, $200) to see how paying more impacts your debt.

- Alternatively, some calculators allow you to input a desired payoff time (e.g., 12 months, 24 months) and will calculate the monthly payment needed.

Once you provide these details, the cc interest calculator will typically output:

- Estimated Time to Pay Off Debt: How many months and/or years it will take to clear your balance with the specified monthly payment.

- Total Interest Paid: The estimated total amount of interest you’ll pay over the life of the debt with that payment plan.

- Total Amount Repaid: The sum of the original balance (principal) plus the total interest paid.

- (Optional but helpful): An amortization schedule or chart showing the breakdown of each payment into principal and interest over time.

Interpreting Your Results: What the Numbers Mean for Your Wallet

The output from the credit card interest calculator isn’t just numbers; it’s a powerful look into your financial future. Here’s what to look for:

- The Shock of Minimum Payments: For most people, calculating the outcome of making only minimum payments is a wake-up call. You’ll likely see it takes an incredibly long time to pay off the debt and the total interest paid can be several times the original balance.

- The Impact of Extra Payments: This is where the tool becomes truly empowering. Notice how even a small increase in your monthly payment (e.g., an extra $25 or $50) can dramatically shorten your repayment period and slash the total interest you pay by hundreds or even thousands of dollars.

- Visualizing Your Freedom: Seeing a concrete payoff date can be highly motivating. It turns an overwhelming debt into a manageable goal with a finish line.

- Experiment for Strategy: Play around with different payment amounts. What’s the highest payment you can realistically afford? How quickly does that get you out of debt? This helps you build a concrete debt reduction strategy.

Strategies to Reduce Credit Card Interest & Pay Off Debt Faster

Armed with the insights from the cc interest calculator, it’s time to take action. Here are effective strategies to minimize the interest you pay and accelerate your journey out of credit card debt:

- Always Pay More Than the Minimum: This is non-negotiable if you want to save money. Any amount above the minimum directly attacks your principal balance faster.

- Freeing up cash for higher payments starts with a good budget. Learn more in our How to Make a Budget Guide or explore the Zero-Based Budgeting Guide.

- Utilize Debt Repayment Strategies (Snowball or Avalanche):

- Debt Snowball: List debts from smallest balance to largest. Pay minimums on all but the smallest, attacking it with extra funds. Once cleared, roll that payment (plus extra) onto the next smallest. Great for psychological wins. Dive deeper with our Debt Snowball Method Guide.

- Debt Avalanche: List debts from highest APR to lowest. Pay minimums on all but the highest APR debt, aggressively paying it down. Then move to the next highest. Saves the most on interest mathematically.

- Consider a Balance Transfer Credit Card:

- Many cards offer 0% introductory APRs for a set period (e.g., 12-18 months) on balances you transfer from other high-interest cards. This allows all your payments during the promo period to go towards principal.

- Caveats: There’s usually a balance transfer fee (3-5% of the transferred amount). You typically need good to excellent credit to qualify. Crucially, have a plan to pay off the balance before the 0% period ends and the regular (often high) APR kicks in.

- Explore Debt Consolidation with a Personal Loan:

- If you have good credit, you might qualify for a personal loan with a lower fixed interest rate than your credit cards. You use the personal loan to pay off your credit card balances, leaving you with one manageable monthly payment.

- For more details, see our guide on understanding Personal Loans. This is a key strategy discussed in How to Get Out of Credit Card Debt.

- Negotiate a Lower APR:

- Call your credit card company and ask if they can lower your APR, especially if you have a good payment history with them or if your credit score has improved. It doesn’t hurt to ask.

- Stop Adding to the Debt:

- While you’re actively trying to pay down a credit card, avoid making new purchases on it. Switch to using a debit card or cash to prevent the balance from growing.

- Increase Income or Cut Other Expenses:

- Look for ways to boost your income (side hustle, overtime) or reduce spending in other budget categories to free up more money for aggressive debt repayment.

- For ideas on reducing expenses, check out Tips for Frugal Living.

Why Do Credit Card Companies Charge Interest Anyway?

Credit card issuers are financial institutions in the business of lending money. They make money primarily through:

- Interest Charges: On balances carried by cardholders.

- Interchange Fees: Fees paid by merchants every time a customer uses a credit card for a transaction.

- Cardholder Fees: Annual fees, late fees, balance transfer fees, cash advance fees, foreign transaction fees, etc.

Interest charges compensate the issuer for the risk of lending money (that some borrowers might not repay) and are a core part of their profit model.

The Hidden Dangers of Unchecked Credit Card Interest

Ignoring high credit card interest can seriously undermine your financial health:

- The Debt Treadmill: High interest means your payments barely dent the principal, making it feel like you’re running in place.

- Erosion of Purchasing Power: Every dollar paid in interest is a dollar you can’t use for savings, investments, or other goals.

- Financial Stress & Anxiety: Carrying significant high-interest debt is a major source of stress.

- Limited Future Opportunities: A high debt load and potentially damaged credit can make it harder to qualify for mortgages, car loans, or even rent an apartment.

- Building a solid financial foundation is key. Our Beginner’s Guide to Personal Finance can help.

Conclusion: Take Control with the Credit Card Interest Calculator

The journey from credit card debt to financial freedom begins with understanding. A cc interest calculator is more than just a tool for numbers; it’s a window into the true cost of your debt and a map towards a more secure financial future. By visualizing the impact of interest and the power of strategic repayments, you can shift from feeling overwhelmed to feeling empowered.

Don’t stop at just calculating. Use the insights gained from this tool to formulate an aggressive repayment plan. Whether it’s by making more than the minimum payment, choosing a debt reduction strategy like the snowball or avalanche method, or exploring options like balance transfers or consolidation loans, every proactive step you take brings you closer to your goal. You have the power to minimize interest and conquer your credit card debt – start today!

Frequently Asked Questions (FAQ) about CC Interest Calculators

How accurate is a credit card interest calculator?

Most online cc interest calculators provide a very good estimate based on the information you input (balance, APR, payment). However, they typically assume a fixed APR and consistent payments. Real-world scenarios can vary slightly due to compounding methods, potential APR changes (if variable), or changes in your payment amounts. They are excellent for planning and comparison.

What’s the most important number to input into a cc interest calculator?

All inputs (current balance, APR, and your planned monthly payment) are crucial for an accurate picture. However, your APR has a massive impact on how much interest you’ll pay, and your monthly payment amount dramatically affects how quickly you’ll pay off the debt and the total interest incurred.

Can this calculator tell me what my minimum payment will be?

Some advanced calculators might estimate a minimum payment, but our primary focus here is to show the impact of fixed payments, especially those above the minimum. Your credit card statement will always show your exact minimum payment due, which is usually a small percentage of your balance plus interest and fees.

How can I reduce my credit card APR to save on interest?

You can try calling your credit card issuer to request a lower APR, especially if your credit score has improved or you have a history of on-time payments. Alternatively, if you have good credit, you might qualify for a balance transfer to a card with a 0% introductory APR or consolidate debt with a lower-interest personal loan.

If I always pay my credit card balance in full every month, do I need this calculator?

If you consistently pay your entire statement balance in full by the due date, you generally avoid paying interest altogether, so this specific calculator would be less relevant for your current habits. However, it can still be a useful educational tool to understand how interest would accrue if you started carrying a balance, reinforcing the benefits of your excellent payment strategy!