Let’s start with the basics: Personal finance is simply the management of your money and financial decisions. It covers everything from how you earn, spend, save, invest, and protect your money throughout your life. Feeling a bit overwhelmed by bills, confused about saving, or maybe even intimidated by the idea of investing? You are definitely not alone. Many people feel lost when it comes to managing their finances, but here’s the good news: taking control is absolutely possible, and it doesn’t require a fancy degree. This beginner’s guide to personal finance is designed to cut through the noise, break down the essentials into simple steps, and empower you to build a solid financial foundation. Get ready to gain confidence and finally feel in charge of your financial future!

Table of Contents

Why Understanding Personal Finance is Non-Negotiable (Even if it Seems Scary!)

Ignoring your finances won’t make money problems disappear. In fact, it usually makes them worse. Getting a handle on personal finance isn’t just about getting rich (though building wealth is a nice side effect!); it’s about:

- Reducing Stress: Financial worries are a major source of anxiety. Understanding and managing your money brings peace of mind.

- Achieving Your Goals: Whether it’s buying a home, traveling, retiring comfortably, or starting a business, solid finances pave the way.

- Making Informed Decisions: From choosing a bank account to deciding on insurance, financial literacy helps you make choices that benefit you.

- Building Security: Knowing you have savings for emergencies or future needs creates a vital safety net.

- Gaining Freedom: Ultimately, good personal finance gives you more choices and control over your life.

Think of it like learning to navigate. Without a map (your financial plan) and understanding how to read it (financial literacy), you’re just drifting. This guide is your map and compass.

The 5 Core Pillars of Personal Finance for Beginners

Personal finance can seem vast, but it boils down to five key areas. Mastering these pillars provides a comprehensive framework for managing your money effectively. Let’s break them down:

Pillar 1: Budgeting & Tracking – Know Where Your Money Goes

- What is Budgeting?

- Simply put, a budget is a plan for your money. It’s an estimate of your income and expenses over a set period (usually a month). It’s not about restricting yourself; it’s about telling your money where to go, instead of wondering where it went.

- Why Budget? The Power of Awareness

- Gain Control: Stops impulse spending and helps you live within your means.

- Reach Goals Faster: Allows you to intentionally allocate money towards savings or debt payoff.

- Identify Waste: Reveals where you might be overspending unconsciously (that daily $5 coffee adds up!).

- Reduce Financial Stress: Knowing you have a plan provides security.

- Simple Budgeting Methods for Beginners (Find Your Fit!)

- The 50/30/20 Rule: A popular starting point. Allocate 50% of your after-tax income to Needs (rent, groceries, utilities), 30% to Wants (dining out, hobbies, entertainment), and 20% to Savings & Debt Payoff.

- Zero-Based Budgeting: Every single dollar of income is assigned a job (spending, saving, debt). Income minus expenses equals zero. Requires more detail but offers maximum control.

- Envelope System (Cash Focused): Allocate cash into labeled envelopes for different spending categories (groceries, gas, entertainment). When the envelope is empty, stop spending in that category. Great for visual learners and curbing overspending.

- Budgeting Apps: Tools like Mint, YNAB (You Need A Budget), Pocket Guard, or your bank’s app can automate tracking and categorization (some may have fees or be US-centric, look for local alternatives if needed).

- Tracking Your Spending: The Crucial First Step

- You can’t make an effective budget if you don’t know where your money is actually going. For a week or even a month, track every single expense. Use a notebook, spreadsheet, or an app. This awareness is often eye-opening!

Pillar 2: Saving Money – Building Your Financial Foundation

- The Importance of Saving: Paying Yourself First

- Saving isn’t just something you do with leftover money; it’s a crucial allocation. It’s about setting aside money today for your future self, your goals, and unexpected events. The concept of “paying yourself first” means treating savings like a bill – automate it!

- Building an Emergency Fund: Your Financial Safety Net

- This is arguably the most important first savings goal. An emergency fund is money set aside specifically for unexpected events like job loss, medical bills, or urgent car repairs.

- Why it’s critical: It prevents you from going into debt or derailing other financial goals when life throws a curveball.

- How much? Aim for 3-6 months’ worth of essential living expenses. Start small ($500-$1000) if that seems daunting, and build from there. Keep it in a separate, easily accessible savings account (like a high-yield savings account – HYSA).

- Saving for Short-Term & Long-Term Goals

- Beyond emergencies, you’ll save for specific goals:

- Short-Term (1-3 years): Vacation, new laptop, down payment on a car.

- Medium-Term (3-10 years): Down payment on a house, wedding.

- Long-Term (10+ years): Retirement, children’s education.

- Having clear goals makes saving more motivating.

- Beyond emergencies, you’ll save for specific goals:

- Where to Keep Your Savings (Beyond Under the Mattress!)

- Traditional Savings Accounts: Offered by most banks, safe (FDIC/equivalent insured), but typically offer very low interest rates.

- High-Yield Savings Accounts (HYSAs): Often offered by online banks, FDIC-insured, and typically offer significantly higher interest rates (APY) than traditional accounts. Excellent for emergency funds.

- Money Market Accounts (MMAs): Bank accounts that may offer slightly higher rates than savings and sometimes come with check-writing or debit card access. Also insured.

- Tips to Save More Money Consistently

- Automate It: Set up automatic transfers from your checking to your savings account each payday.

- Cut Unnecessary Expenses: Review your budget (see Pillar 1!) and identify areas to trim (subscriptions, dining out less).

- Increase Your Income: Consider side hustles, negotiating a raise, or selling unused items.

- Save Windfalls: Put bonuses, tax refunds, or gifts directly into savings or towards debt.

Pillar 3: Managing Debt – Understanding & Tackling What You Owe

- Good Debt vs. Bad Debt: Not All Debt is Created Equal

- Good Debt (Potentially): Debt used to acquire assets that may increase in value or increase your earning potential. Examples include affordable mortgages, student loans (if leading to higher income), or small business loans. Usually has lower interest rates.

- Bad Debt: High-interest debt used for consumption or depreciating assets. Examples include credit card debt, payday loans, and car loans with high rates. This debt can quickly spiral out of control.

- Understanding Interest Rates (APR): The Cost of Borrowing

- The Annual Percentage Rate (APR) is the yearly cost of borrowing money, expressed as a percentage. High APRs mean you pay significantly more over time. Always know the APR on any debt you have.

- Strategies for Paying Off Debt (Choose Your Method)

- Debt Snowball: List debts smallest to largest (regardless of interest rate). Make minimum payments on all except the smallest, throwing extra money at that one. Once paid off, add its payment amount to the next smallest. Provides quick psychological wins.

- Debt Avalanche: List debts highest interest rate to lowest. Make minimum payments on all except the highest-APR debt, attacking that one aggressively. Once paid off, move to the next highest APR. Mathematically saves the most money on interest over time.

- Choose the method that motivates YOU most. The best plan is the one you stick with.

- The Importance of Your Credit Score

- Your credit score is a three-digit number representing your creditworthiness (how likely you are to repay borrowed money). Lenders use it to decide whether to approve loans/credit cards and at what interest rate.

- Why it matters: A good score saves you money (lower interest rates), makes getting approved easier (loans, apartments), and can even impact insurance rates or job prospects.

- How debt affects it: Paying bills on time is crucial. High credit card balances hurt your score. Managing debt responsibly builds a positive credit history. You can usually check your credit report for free annually from designated agencies (like via AnnualCreditReport.com in the US, check local equivalents). The US Consumer Financial Protection Bureau (CFPB) also has excellent resources on credit reports and scores.

Pillar 4: Investing Basics – Making Your Money Grow

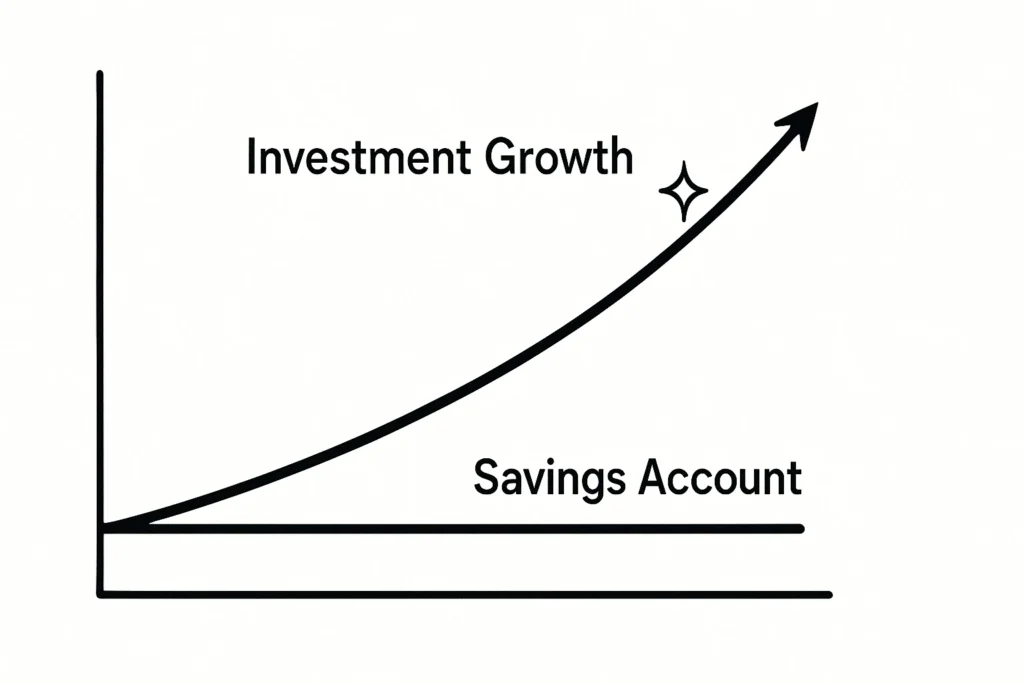

- Why Invest? Beating Inflation & Building Wealth

- Saving is crucial for safety, but due to inflation (the gradual increase in prices over time), the purchasing power of cash decreases. Investing aims to generate returns higher than inflation, allowing your money to grow significantly over the long term.

- Investing vs. Saving: Understanding the Risk/Reward Trade-off

- Saving: Focuses on preserving capital (keeping it safe). Low risk, low potential return. Best for short-term goals and emergency funds. Typically FDIC insured.

- Investing: Focuses on growing capital. Involves taking on risk (potential to lose value) for the potential of higher returns. Best for long-term goals (5+ years, ideally longer). NOT FDIC insured.

- Simple Investment Options for Beginners (Keep it Simple!)

- Disclaimer: This is for educational purposes only, not investment advice.

- Index Funds / ETFs (Exchange-Traded Funds): These are baskets of investments (like stocks or bonds) that track a market index (e.g., the S&P 500). They offer instant diversification (spreading risk) and typically have very low fees. Often recommended for beginners.

- Retirement Accounts: Tax-advantaged accounts like 401(k)s (often employer-sponsored with matching contributions – free money!) or IRAs (Individual Retirement Accounts) are excellent vehicles for long-term investing.

- Getting Started: You can often open a brokerage account online with very little money. Many brokers now offer fractional shares, allowing you to buy parts of expensive stocks/ETFs. Robo-advisors automate investment management based on your goals and risk tolerance, often with low minimums.

- The Magic of Compound Interest

- Albert Einstein supposedly called it the eighth wonder of the world! Compound interest is when your investment earnings start generating their own earnings. Over long periods, this creates exponential growth. Starting early, even with small amounts, makes a huge difference.

Pillar 5: Protecting Your Finances – Insurance & Risk Management

- Why Insurance Matters: Managing Life’s “What Ifs”

- Insurance is about transferring risk. You pay a premium (a regular fee) to an insurance company, and in return, they agree to cover specific financial losses if certain unexpected events occur. It protects your savings and assets from being wiped out by unforeseen circumstances.

- Key Types of Insurance for Beginners (The Essentials)

- Health Insurance: Crucial for covering potentially massive medical costs.

- Auto Insurance: Legally required in most places if you own a car; covers accidents.

- Renters or Homeowners Insurance: Protects your belongings and provides liability coverage in your dwelling.

- Disability Insurance (Often Overlooked): Replaces a portion of your income if you become unable to work due to illness or injury. Arguably one of the most important types.

- Life Insurance (Consider if others depend on your income): Provides a payout to beneficiaries upon your death.

- Review Your Coverage Periodically

- Life changes (marriage, kids, job changes) mean your insurance needs change too. Review your policies annually or after major life events.

Setting SMART Financial Goals: Your Personal Roadmap

Knowing the pillars is great, but you need direction. Setting SMART goals turns vague wishes into actionable plans:

- Specific: Clearly define what you want to achieve (e.g., “Save $1,000,” not just “Save money”).

- Measurable: How will you track progress? (e.g., Track savings account balance).

- Achievable: Is the goal realistic given your income and timeline? Start small if needed.

- Relevant: Does the goal align with your values and overall financial picture?

- Time-bound: Set a deadline (e.g., “Save $1,000 for an emergency fund in the next 6 months“).

Examples for Beginners:

- Track all expenses for one month.

- Create a basic budget using the 50/30/20 rule by next month.

- Save $50 per paycheck towards a $1,000 emergency fund, aiming to reach it in 10 months.

- Pay off a specific $500 credit card balance in 5 months by paying $100 extra each month.

Essential Tools & Resources for Beginners

You don’t have to do this alone! Leverage these resources:

- Budgeting Apps/Software: Tools like Mint, YNAB, Goodbudget, or even simple spreadsheets help automate tracking and planning. Many banks also offer built-in budgeting tools.

- Online Financial Calculators: Search for calculators for compound interest, debt payoff, mortgage estimates, and retirement savings to visualize scenarios.

- Reputable Financial Education Websites: Government sites like the Consumer Financial Protection Bureau (CFPB) (https://www.consumerfinance.gov/) offer unbiased information on banking, credit, debt, and more. Reputable financial news sites and dedicated personal finance blogs can also be valuable (always check for bias).

- Books: Many excellent personal finance books cater to beginners (e.g., “I Will Teach You to Be Rich” by Ramit Sethi, “The Simple Path to Wealth” by JL Collins, “Your Money or Your Life” by Vicki Robin). www.reddit.com www.reddit.com

Common Mistakes Beginners Make (And How to Avoid Them)

Learn from common pitfalls:

- Not Having a Budget: Flying blind financially rarely leads to good destinations. Fix: Start tracking & budgeting!

- Lifestyle Inflation: Automatically increasing spending every time your income rises, preventing significant wealth building. Fix: Intentionally allocate raises towards savings/debt/investing.

- Ignoring High-Interest Debt: Letting costly debt linger eats away at your financial progress. Fix: Prioritize paying down high-APR debt aggressively.

- Waiting Too Long to Invest: Missing out on valuable compounding time due to fear or thinking you need a lot of money. Fix: Start small, start early, focus on low-cost index funds.

- Not Having an Emergency Fund: Being forced into debt when unexpected expenses arise. Fix: Make building at least a starter emergency fund ($1k) priority #1.

- Analysis Paralysis: Getting so overwhelmed by options that you do nothing. Fix: Start with one simple step. Progress over perfection.

Conclusion: Taking Control – Your Journey Starts Now

Mastering personal finance is a journey, not a destination. This beginner’s guide to personal finance has laid out the core pillars: understanding your cash flow through budgeting, building security through saving, tackling obligations by managing debt, growing wealth through investing, and managing risk through protection.

Don’t feel you need to tackle everything at once. Pick one area – maybe tracking your spending or starting that emergency fund – and commit to taking the first step today. Building good financial habits takes time and consistency, but the rewards – reduced stress, increased security, and the freedom to pursue your dreams – are absolutely worth it. You can take control of your money. Your journey to financial confidence starts now.

Frequently Asked Questions (FAQ) for Personal Finance Beginners

Where’s the absolute best place for a complete beginner to start with personal finance?

The most impactful starting point is usually tracking your expenses. You need to understand where your money is currently going before you can make an effective plan (budget) to direct it where you want it to go. Awareness is key!

How much money should I be saving each month?

A common guideline is the 50/30/20 rule: aim to save/pay off debt with 20% of your after-tax income. However, the “right” amount depends heavily on your income, expenses, goals, and debt situation. The most important thing is to start saving something consistently and increase it as you can. Automating your savings helps tremendously.

Is learning personal finance difficult? It seems so complex!

It can seem complex initially, but the basics are quite straightforward! Don’t try to learn everything overnight. Start with the fundamentals in this guide (budgeting, saving, understanding debt). Focus on one step at a time. Many great resources simplify concepts. It’s more about building consistent habits than needing complex knowledge.

What’s more important: paying off high-interest debt or saving/investing?

Generally, paying off high-interest debt (like credit cards with 15%+ APR) should be the priority after establishing a small starter emergency fund (e.g., $1,000). The interest you save by eliminating that debt is often a higher “return” than you could safely earn through saving or conservative investing. Once high-interest debt is gone, you can aggressively ramp up saving and investing.

Do I need a lot of money to start investing?

Absolutely not! This is a common myth. Many brokerage firms have no account minimums, and with the availability of fractional shares, you can often start investing in diversified index funds (ETFs) with as little as $5 or $10. The key is to start early and be consistent, letting compound interest work its magic over time.

What’s the first step you are going to take after reading this guide? Share your commitment or biggest takeaway in the comments below – inspiring others helps us all! If this beginner’s guide to personal finance was helpful, please share it with friends or family who are starting their own financial journey. Keep learning, keep growing, and take charge of your financial future!