Do you ever feel like you’re just drifting when it comes to your money? Maybe you’re earning well, paying bills, even saving a little, but lack a clear sense of direction or a strategy for reaching your bigger life goals? If you’ve found yourself wondering what is a financial plan and whether you need one, you’re asking a vital question for your future well-being. In today’s complex economic landscape, having a roadmap for your money isn’t just for the wealthy; it’s an essential tool for anyone seeking security, control, and the ability to achieve their dreams.

Many people ask, “what are financial plans?” or “what is in a financial plan, really?” It sounds complex, maybe even intimidating, or like something only for the wealthy. But the truth is, creating a financial plan is one of the most empowering steps anyone can take, regardless of income level. This guide is designed to demystify the process completely. We’ll break down exactly what is the financial plan concept, explore its crucial components, explain why having one is game-changing, walk you through the steps of how to create a budget and integrate it, and discuss the tools (including software for financial planning) available to help you build a roadmap to your financial dreams. Get ready to move from financial uncertainty to confident control.

Table of Contents

More Than Just Numbers: Why You Absolutely Need a Financial Plan

Before diving into the components, let’s understand why taking the time to create a financial plan is so incredibly valuable. It’s the difference between drifting and intentionally steering towards your desired future.

- Gain Clarity and Direction: A plan forces you to articulate what you truly want financially – both short-term and long-term. This clarity becomes your compass, guiding spending, saving, and investment decisions.

- Achieve Your Goals More Effectively: Wishing won’t make goals happen; planning does. A financial plan outlines the specific steps, savings targets, and investment strategies needed to turn your aspirations into reality within a defined timeframe.

- Reduce Financial Stress and Anxiety: Financial uncertainty is a huge source of stress. Knowing where you stand, where you’re going, and that you have a strategy to handle potential bumps provides immense peace of mind and a sense of control.

- Make Informed Decisions: Big life choices often have big financial implications. Your plan provides the context and data needed to evaluate options (career changes, major purchases, relocation) confidently.

- Optimize Your Resources: Are you saving enough? Is your money invested appropriately? Are you paying unnecessary fees or interest? A plan helps ensure your resources are working efficiently towards your goals.

- Prepare for the Unexpected: Life is unpredictable. A solid financial plan includes contingency planning, like building an emergency fund and having adequate insurance coverage, making you more resilient when facing unforeseen events.

- Align Spending with Values: It helps ensure you’re allocating your money towards things that genuinely matter to you, rather than frittering it away on things that don’t bring lasting value.

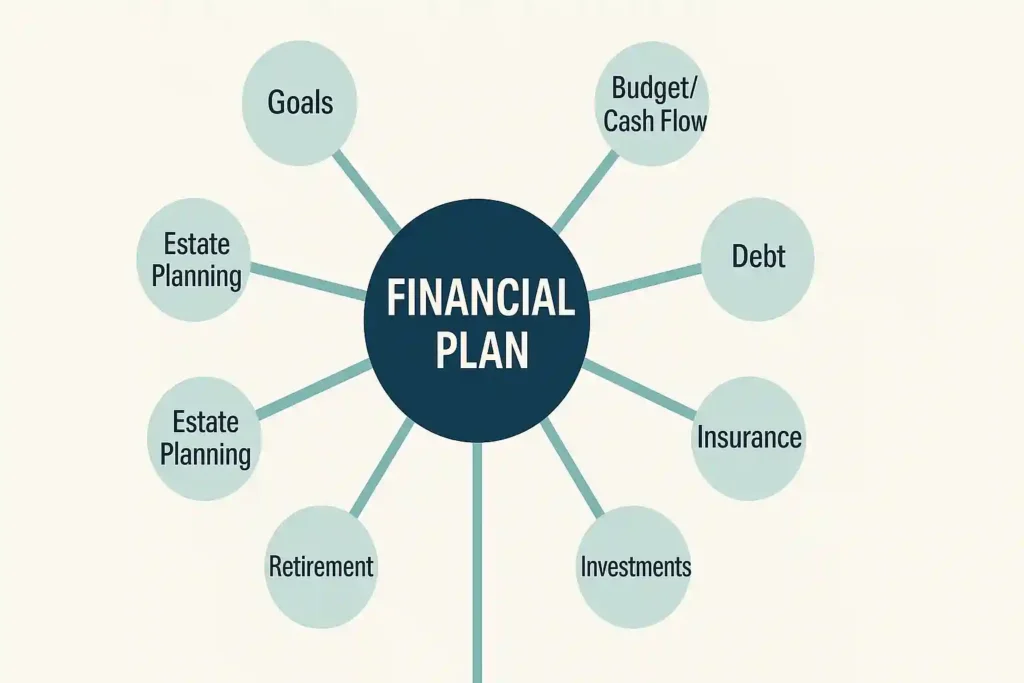

The Anatomy of a Comprehensive Financial Plan: What’s Inside?

So, what is in a financial plan? While plans vary based on individual complexity and goals, a truly robust and valuable plan typically addresses these key areas, giving you a 360-degree view of your financial life:

1. Clearly Defined Financial Goals (The ‘Why’)

- Foundation: This is where it all starts. What specific, measurable, achievable, relevant, and time-bound (SMART) goals do you have?

- Categorization: Break them down:

- Short-Term (1-3 years): Building an emergency fund, paying off high-interest debt, saving for a vacation.

- Mid-Term (3-10 years): Saving for a house down payment, funding a car purchase, starting a business.

- Long-Term (10+ years): Retirement savings, funding children’s education, achieving financial independence, leaving a legacy.

- Prioritization: You likely can’t tackle everything at once. Prioritize your goals based on importance and urgency.

2. Net Worth Statement (Your Financial Snapshot)

- What it is: A calculation of your assets (what you own – cash, savings, investments, property equity, valuable possessions) minus your liabilities (what you owe – loans, credit card debt, mortgage).

- Why it matters: It provides a clear picture of your current financial position and serves as a benchmark to track progress over time. Calculating this annually is a key part of reviewing your financial plan.

3. Budgeting and Cash Flow Analysis (Where Your Money Goes)

- The Engine: Understanding your income versus your expenses is fundamental. How do you create a budget for this? By tracking!

- Components: Detailed tracking of all income sources and all spending categories (fixed expenses like rent/mortgage, variable expenses like groceries/utilities, discretionary spending like entertainment/dining out).

- Goal: Ensure your income covers expenses and allows for planned savings towards your goals (often aiming for Income – Expenses/Savings = 0, like in zero-based budgeting). This answers “how can I make a budget” within the larger plan.

4. Debt Management Strategy (Tackling Liabilities)

- Assessment: Listing all outstanding debts, including balances, interest rates (APRs), and minimum payments.

- Plan: Outlining a specific strategy for paying down debt, especially high-interest debt like credit cards. This might involve methods like the Debt Snowball or Debt Avalanche.

5. Risk Management and Insurance Coverage (Protection)

- The Safety Net: Assessing potential risks (illness, disability, death, property damage, liability) and ensuring you have adequate protection through insurance.

- Types: Health insurance, disability insurance (income protection), life insurance (especially if others depend on your income), property and casualty insurance (home, auto), potentially liability/umbrella insurance.

- Goal: Protect your assets and financial stability from catastrophic events. Insurance products, regulations, and typical coverage needs vary significantly by country and individual circumstances. Consulting with an independent insurance professional licensed in your area is often wise.

6. Investment Strategy (Growing Your Wealth)

- The Growth Engine: Defining how you will invest your savings to reach long-term goals, considering your risk tolerance (how comfortable you are with potential market fluctuations), time horizon (when you need the money), and specific objectives.

- Components:

- Asset Allocation: Determining the mix between different asset classes (e.g., stocks/equities, bonds/fixed income, real estate, cash equivalents) based on your risk profile and timeline.

- Account Types: Utilizing appropriate accounts, including tax-advantaged retirement accounts (like 401(k)s, IRAs in the US; ISAs, SIPPs in the UK; RRSPs in Canada; various pension pillars across Europe – highly country-specific) and taxable brokerage accounts.

- Investment Selection: Choosing specific investments (e.g., mutual funds, ETFs, individual stocks/bonds) that align with your strategy and diversification goals.

- Disclaimer: Developing an investment strategy involves risk. This component often benefits from professional advice tailored to your situation and local market regulations. General educational resources like Investor.gov (https://www.investor.gov/) provide foundational knowledge (US-focused but principles often apply globally).

7. Retirement Planning (Your Long-Term Future)

- Vision: Defining what retirement looks like for you – desired lifestyle, location, travel plans, and target retirement age.

- Calculation: Estimating how much money you’ll need to fund that lifestyle, considering inflation and potential healthcare costs.

- Strategy: Determining how much you need to save consistently (often 15%+ of gross income is recommended, but depends on age and goals), maximizing contributions to appropriate retirement accounts available in your country, and aligning your investment strategy with your retirement timeline.

8. Estate Planning (Your Legacy)

- Looking Ahead: Planning for what happens to your assets and dependents if you pass away or become unable to manage your affairs.

- Components: Depending on complexity and location, this may involve creating a Will, establishing Trusts, designating beneficiaries on accounts, setting up Powers of Attorney for finances and healthcare, and potentially strategies to manage estate taxes (if applicable).

- Disclaimer: Estate laws are complex and vary dramatically by country, state, or even region. This part of a financial plan absolutely requires consultation with qualified legal professionals specializing in estate planning in your specific jurisdiction.

How to Create Your Financial Plan: Process & Options

Now that you understand what is in a financial plan, how do you actually put one together?

1. Assess Your Current Financial Situation (Gather Data)

- Collect all relevant documents: bank statements, investment account statements, loan documents, insurance policies, pay stubs, recent tax returns.

- Calculate your current Net Worth (Assets – Liabilities).

- Track your spending for 1-2 months to create an accurate picture of your current budget/cash flow. Use apps, spreadsheets, or a notebook.

2. Define Your Financial Goals (SMART)

- List your short, mid, and long-term goals.

- Make them Specific, Measurable, Achievable, Relevant, and Time-Bound. Quantify amounts and deadlines whenever possible. Prioritize them.

3. Develop the Plan Strategies

- For each component outlined above (Debt, Insurance, Investments, Retirement, etc.), determine your initial strategy based on your current situation and goals.

- Example: Debt Strategy = Use Debt Avalanche method, targeting highest APR credit card first. Investment Strategy = Contribute X% to retirement account, invest in diversified low-cost index funds. Insurance Strategy = Review disability coverage, increase if needed.

4. Choose Your Approach: DIY vs. Professional Advisor

- The DIY Financial Plan:

- How: You research, learn, and build the plan yourself using tools like spreadsheets, budgeting apps, investment platforms, and online calculators. Requires significant time and self-education.

- Pros: Minimal cost, deep understanding of your own finances, complete control.

- Cons: Time-intensive, steep learning curve for complex topics (investing, insurance, estate planning), potential for costly mistakes or overlooked risks, emotional biases can interfere. Best suited for simpler financial situations or those with strong financial literacy.

- Working with a Professional Financial Advisor/Planner:

- How: You hire a qualified professional to guide you through the process, develop strategies, and potentially help implement and monitor the plan. Look for credentials relevant to your country (e.g., CFP® in the US and other regions, specific national certifications) and understand their fee structure (fee-only fiduciaries are often recommended as they minimize conflicts of interest).

- Pros: Access to expertise and experience, objective advice, saves significant time and effort, personalized strategies, accountability. Can handle complex situations effectively.

- Cons: Cost (fees vary widely), requires finding a trustworthy advisor you connect with.

- Finding Help: Reputable sources like the Consumer Financial Protection Bureau (CFPB) offer guidance on selecting financial professionals, with principles often applicable globally: https://www.consumerfinance.gov/ask-cfpb/how-do-i-find-a-financial-adviser-en-1850/

- Hybrid Approach: Start DIY with budgeting and goal setting, then consult an advisor for specific complex areas like investment strategy or retirement projections.

Tools of the Trade: Software for Financial Planning & More

Whether DIY or working with a pro, various tools can help construct a budget and plan:

- Budgeting Apps & Software: Essential for tracking cash flow and managing spending categories (e.g., YNAB, Mint, Personal Capital (US), local banking apps, specialized budgeting software).

- Spreadsheet Software: Powerful for customization (Excel, Google Sheets). Ideal for creating detailed budgets, net worth statements, and goal tracking sheets. Many free templates exist online.

- Investment Tracking Platforms: Tools offered by brokerages or independent platforms help monitor investment performance, asset allocation, and progress towards investment goals.

- Comprehensive Software for Financial Planning: More advanced software (often subscription-based, some used by professionals but available to consumers) aims to integrate multiple aspects – budgeting, goal tracking, investment analysis, retirement projections – into one platform. Research options carefully based on features and cost.

- Online Calculators: Widely available for specific calculations (retirement needs, compound interest, loan amortization, college savings). Use calculators from reputable, unbiased sources.

- Professional Advisor Software: Advisors use sophisticated software for in-depth analysis, modeling complex scenarios (like tax implications or retirement withdrawal strategies), and generating detailed reports.

Keeping It Alive: Maintaining Your Financial Plan

Crucially, what is the financial plan if not a living document? It requires ongoing attention to remain relevant and effective.

- Why Regular Reviews Are Crucial: Your life isn’t static, and neither should your plan be. Income changes, goals evolve, families grow, market conditions shift, laws change. An outdated plan won’t guide you effectively.

- How Often? Plan a formal review at least once a year. Additionally, revisit key parts of your plan after any significant life event:

- Marriage, divorce, birth of a child

- Job change, significant income increase or decrease

- Major purchase (home, car) or sale

- Receiving an inheritance

- Major health changes

- Approaching a major goal (like retirement)

- What to Update: During reviews, update your net worth statement, review your budget performance against actuals, reassess your goals (are they still relevant? are timelines realistic?), check your investment allocation, review insurance coverage, and adjust savings/contribution rates as needed.

FAQs: Common Questions About Financial Plans

Let’s answer some frequently asked questions about what are financial plans and how they work:

- What is the main difference between budgeting and financial planning? Budgeting focuses on managing your income and expenses over a short period (usually monthly) to control cash flow. Financial planning is much broader and longer-term; it includes budgeting but also encompasses goal setting, net worth tracking, debt management, insurance, investments, retirement, and estate planning to create a comprehensive strategy for your entire financial life.

- At what age or income level should I create a financial plan? Ideally, as soon as you start earning an income! Even a simple plan focused on budgeting, saving for emergencies, and setting initial goals is beneficial early on. The complexity will grow with your income and life stage, but the habit of planning is valuable at any point. There’s no income level too low to benefit from basic financial planning.

- How detailed does my financial plan need to be? It depends on your situation’s complexity and your personality. A young person starting out might have a simpler plan focused on budgeting, debt, emergency fund, and basic retirement savings. Someone nearing retirement with multiple assets and complex goals will need a much more detailed plan covering investments, withdrawal strategies, insurance, and estate planning. Start with a level of detail you can manage and add complexity as needed.

- Can I create a financial plan myself, or do I need an advisor? You can create one yourself, especially if your situation is relatively straightforward and you’re willing to put in the time for research and learning (using software for financial planning can help). However, for complex areas like investment strategy, tax planning, insurance analysis, or estate planning, professional advice from a qualified advisor is often highly valuable and can prevent costly mistakes. Consider a hybrid approach if unsure.

- What’s the single most important part of a financial plan? While all components are interconnected, arguably the most crucial part is clearly defining your goals. Your goals provide the “why” behind all the other planning activities and dictate the strategies you need to implement. Without clear goals, the plan lacks direction.

- How much does getting a professional financial plan cost? Costs vary widely depending on the advisor’s fee structure (hourly, flat fee for a plan, percentage of assets managed), the complexity of your situation, and your location. Fee-only planners might charge anywhere from a few hundred to several thousand dollars/euros/pounds for a comprehensive plan. Always understand the fee structure upfront.

Your Future, Your Plan: Take the First Step Today

Understanding what is financial plan creation is the essential first step toward building the financial future you desire. It’s the process of moving from uncertainty and stress to clarity, control, and confidence. A well-crafted financial plan serves as your personalized roadmap, guiding your decisions and aligning your resources with what truly matters to you.

Whether you start by simply tracking your expenses, setting your first SMART goal, exploring software for financial planning, or seeking professional guidance, the most important action is to begin. Don’t let perceived complexity hold you back. Your financial future is worth planning for.

Call to Action:

Ready to take control and build your financial roadmap? Your first step this week: Calculate your current Net Worth OR track your spending diligently for the next 7 days. What’s the biggest question you still have about creating a financial plan? Share your thoughts or commitment in the comments below!

If this guide helped clarify what is in a financial plan, please share it with friends or family who could benefit from more financial direction! Consider exploring resources from consumer protection agencies like the CFPB (https://www.consumerfinance.gov/consumer-tools/financial-planning/) for more unbiased information.