Debt Management Demystified: Your Comprehensive Guide to Getting Out of Debt

Does the thought of your bills make your stomach clench? Do you feel like you’re constantly juggling payments, maybe even avoiding calls from numbers you don’t recognize? Living with overwhelming debt can feel like drowning, impacting your stress levels, relationships, and overall well-being. But here’s the crucial truth: you don’t have to face it alone, and there are effective ways to regain control. This guide is designed to demystify debt management. We’ll break down what it really means, explore practical strategies you can implement (from DIY methods to formal plans), help you understand the pros and cons, and guide you on how to find legitimate help if you need it. It’s time to stop treading water and start building a path towards financial freedom.

Table of Contents

Facing the Numbers: What is Debt Management, Really?

Before exploring solutions, let’s clarify what we’re dealing with and when professional help might be necessary.

Defining Debt Management: Beyond Just Paying Bills

Debt management isn’t just about making minimum payments. It’s a strategic approach to handling your debts in a way that allows you to pay them off efficiently and sustainably. This can involve:

- Creating a realistic budget.

- Developing a debt repayment plan (like the snowball or avalanche method).

- Negotiating with creditors (often facilitated by a credit counseling agency).

- Consolidating debts to simplify payments and potentially lower interest.

- Learning healthier financial habits to prevent future debt cycles.

Essentially, it’s about creating a structured plan to tackle your debt head-on, rather than letting it control your life.

Signs You Might Need Help Managing Debt (Red Flags)

Are you unsure if your debt situation requires a more structured approach? Look out for these common warning signs:

- You consistently only make minimum payments on credit cards.

- Your total debt (excluding mortgage) exceeds a significant portion of your annual income.

- You use credit cards to pay for essential living expenses (groceries, utilities).

- You frequently rely on cash advances or payday loans.

- You’re receiving calls or letters from debt collectors.

- You’re losing sleep over your financial situation.

- You don’t know the total amount you owe or your interest rates.

- You’ve been denied credit recently due to your debt load.

If several of these resonate, exploring debt management options is a wise step.

The Emotional Toll of Debt (It’s Not Just Financial)

It’s crucial to acknowledge that debt carries a heavy emotional weight. Stress, anxiety, shame, guilt, and relationship strain are common side effects. Recognizing this toll is important because effective debt management isn’t just about numbers; it’s also about alleviating that emotional burden and restoring peace of mind. Seeking help is a sign of strength, not weakness.

Your Toolkit: Common Approaches to Managing Debt

There isn’t a one-size-fits-all solution. The best approach depends on your specific situation, debt amount, income, and discipline level.

DIY Strategy 1: Budgeting & Expense Tracking (The Foundation)

- What it is: Understanding exactly where your money comes from and where it goes. This is the essential first step for any debt management approach.

- How it helps: Identifies areas where you can cut spending to free up cash for debt repayment. Provides a realistic picture of what you can afford to put towards debt each month.

- Tools: Budgeting apps (YNAB, Mint – availability varies), spreadsheets, or even simple pen and paper.

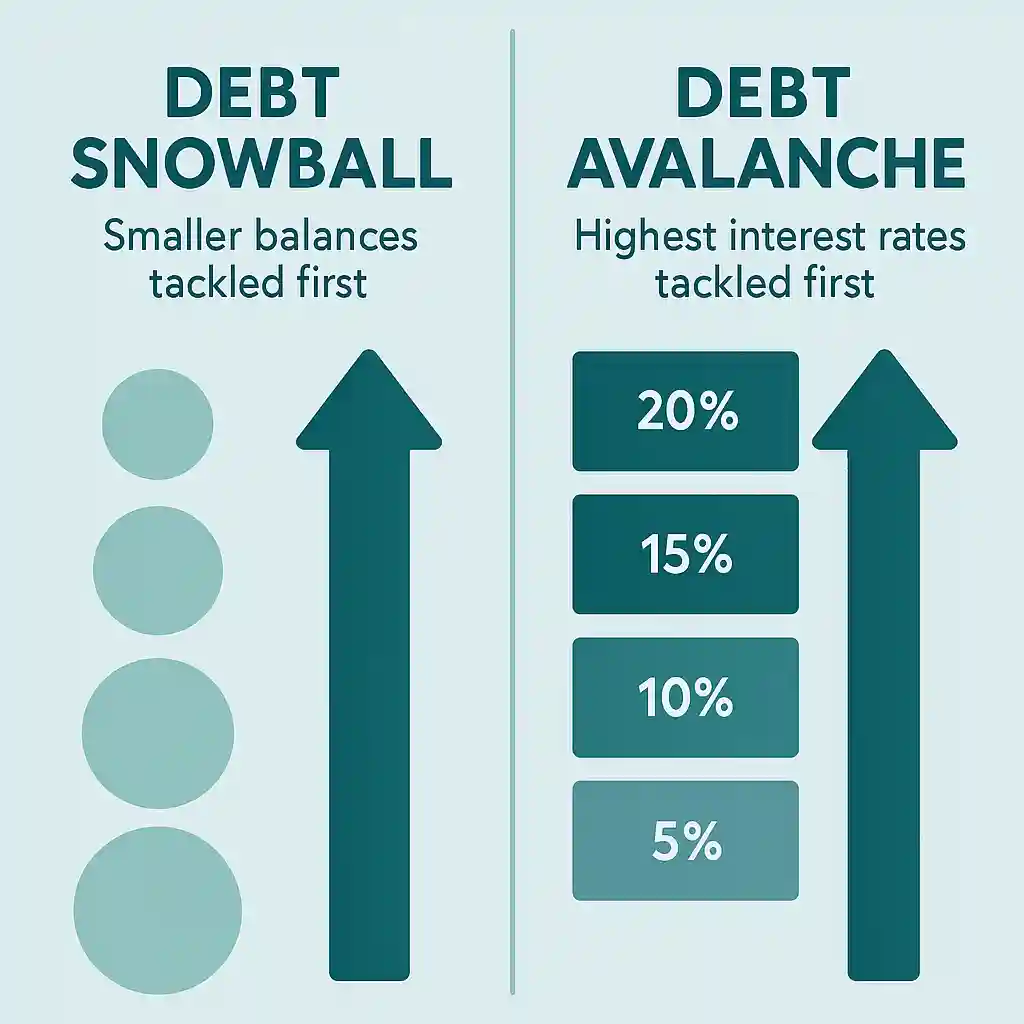

DIY Strategy 2: Debt Snowball Method (Motivational Wins)

- What it is: List your debts smallest to largest (regardless of interest rate). Make minimum payments on all debts except the smallest. Throw any extra money at the smallest debt until it’s gone. Then, take the money you were paying on the smallest debt (minimum + extra) and add it to the minimum payment of the next smallest debt. Repeat.

- Pros: Highly motivational due to quick wins as small debts are eliminated. Simpler psychologically for some.

- Cons: You’ll likely pay more interest overall compared to the avalanche method.

- Best for: People who need psychological boosts and quick wins to stay motivated.

DIY Strategy 3: Debt Avalanche Method (Interest Savings)

- What it is: List your debts from highest interest rate to lowest (regardless of balance). Make minimum payments on all debts except the one with the highest interest rate. Throw any extra money at the highest-interest debt until it’s gone. Then, tackle the debt with the next highest interest rate. Repeat.

- Pros: Mathematically saves you the most money on interest over time. The most financially efficient method.

- Cons: May take longer to get the first “win” (pay off a full debt), which can be less motivating for some.

- Best for: People who are disciplined and primarily focused on saving the maximum amount of money on interest.

Debt Consolidation (Loans & Balance Transfers) – Pros & Cons

- What it is: Combining multiple debts into a single, new loan or credit card balance.

- Debt Consolidation Loan: A personal loan used to pay off existing debts. You then make one monthly payment on the new loan.

- Balance Transfer Credit Card: Transferring high-interest credit card balances to a new card offering a 0% introductory APR for a specific period (e.g., 12-21 months).

- Pros: Simplifies payments (one bill instead of many), can potentially lower your overall interest rate (especially if moving from high-interest credit cards to a lower-rate loan), balance transfers offer an interest-free period to pay down principal aggressively.

- Cons: Doesn’t eliminate debt, just restructures it. Requires good enough credit to qualify for favorable rates/offers. Balance transfer cards often have transfer fees (e.g., 3-5% of the transferred amount) and high interest rates after the intro period ends. Doesn’t address underlying spending habits.

Formal Debt Management Plans (DMPs) via Credit Counseling

- What it is: A structured program offered by credit counseling agencies where you make one monthly payment to the agency, which then distributes funds to your creditors. The agency often negotiates lower interest rates or waived fees with your creditors. We’ll dive deeper into DMPs shortly.

- Pros: Structured plan, potentially significant interest savings, single monthly payment, professional guidance.

- Cons: Usually involves fees (setup/monthly), typically requires closing credit cards included in the plan, can temporarily impact credit score, requires commitment (often 3-5 years).

Debt Settlement (Risks & Considerations) – Distinguish Clearly

- What it is: Negotiating with creditors to pay a lump sum that is less than the full amount owed. This is typically done through for-profit debt settlement companies or sometimes attempted individually when severely delinquent.

- Key Difference: Unlike debt management (which aims to repay the full amount, often at better terms), debt settlement aims to pay less than owed.

- Major Risks: Severely damages your credit score, creditors are not obligated to settle, forgiven debt may be considered taxable income, high fees charged by settlement companies, potential for lawsuits from creditors. This is generally a much riskier option than debt management.

Bankruptcy (The Last Resort) – Brief Mention

- What it is: A legal process offering relief for overwhelming debt. Chapter 7 (liquidation) and Chapter 13 (repayment plan) are common types in the US (processes vary significantly by country).

- Consideration: Provides a fresh start but has serious long-term consequences for your credit and financial life. Should only be considered after exploring all other options with legal and financial counsel.

Deep Dive: Understanding Debt Management Plans (DMPs)

If DIY methods feel insufficient or overwhelming, a formal DMP through a credit counseling agency might be a good option.

How DMPs Work: One Payment, Lower Rates?

- Consultation: You meet with a certified credit counselor who reviews your finances, debts, and budget.

- Plan Creation: If a DMP is suitable, the counselor works with your creditors (typically unsecured debts like credit cards, medical bills, personal loans) to potentially lower interest rates, waive fees, and establish a fixed monthly payment schedule.

- Single Payment: You make one consolidated monthly payment to the credit counseling agency.

- Distribution: The agency distributes that payment among your creditors according to the agreed-upon plan.

- Duration: Plans typically last 3 to 5 years.

What Debts Can Be Included? DMPs generally focus on unsecured debts, such as:

- Credit cards

- Store cards

- Unsecured personal loans

- Medical bills (sometimes)

- Collection accounts

Secured debts (like mortgages or auto loans) are usually not included. Student loan inclusion varies and often requires separate handling.

Pros of Entering a DMP

- Simplified Payments: One predictable monthly payment.

- Reduced Interest Rates: Often the biggest benefit, saving significant money and allowing more of your payment to go towards principal.

- Waived Fees: Creditors might agree to waive late fees or over-limit fees.

- Stop Collection Calls: Creditors generally stop contacting you directly once you’re enrolled.

- Structured Path: Provides a clear roadmap and timeline for becoming debt-free.

- Financial Education: Reputable agencies include budgeting and financial education.

Cons of Entering a DMP

- Fees: Most non-profit agencies charge modest setup and monthly fees (these should be reasonable and disclosed upfront).

- Credit Card Closure: You’ll likely need to close credit card accounts included in the plan.

- Credit Score Impact: Enrolling in a DMP is often noted on your credit report and can initially lower your score, mainly due to closing accounts. However, consistently making payments through the DMP should help improve your credit over the long term compared to continued missed payments or defaults.

- Requires Discipline: You must make payments consistently for the duration of the plan.

- Not All Creditors Participate: While most major creditors do, some may not agree to the DMP terms.

Impact on Your Credit Score Explained

- Initial Dip Possible: Closing credit accounts reduces your available credit and can shorten your average account history, potentially lowering your score. A notation might appear indicating management through a counseling agency.

- Long-Term Positive Potential: Making consistent DMP payments demonstrates responsible repayment behavior. Reducing debt balances significantly improves your credit utilization ratio. Over time, successful completion of a DMP is generally viewed much more favorably than charge-offs, settlements, or bankruptcy.

Choosing Wisely: Finding Reputable Credit Counseling

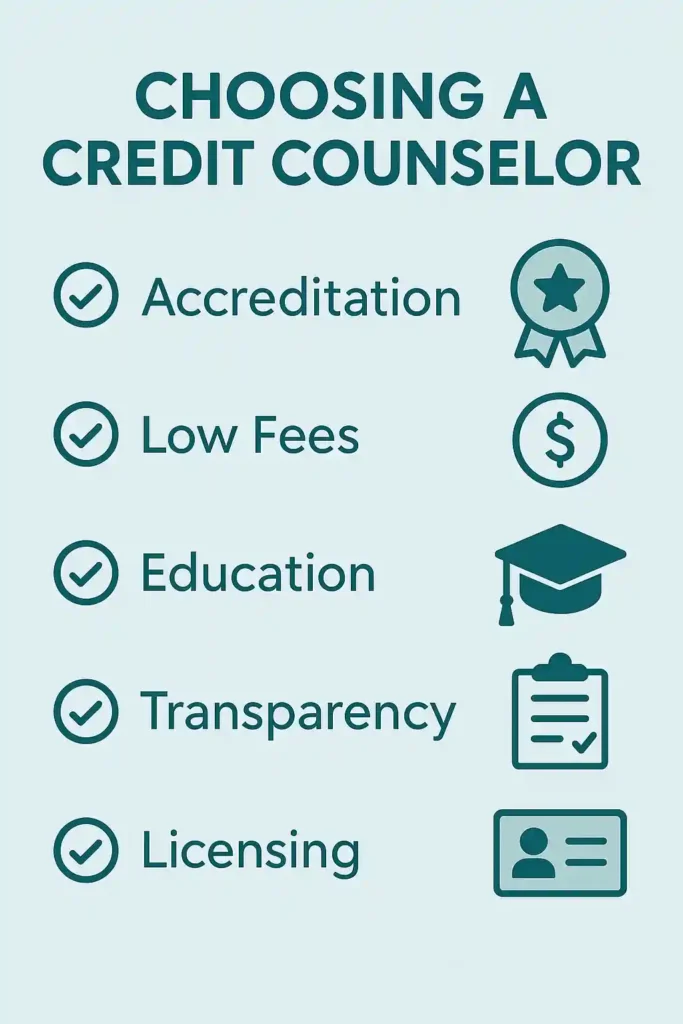

This is critical. Predatory companies exist, so due diligence is essential. Regulations and accredited bodies vary significantly by country. The advice below is general but check local resources. In the US, look for agencies accredited by bodies like the NFCC or AICCCA.

Non-Profit vs. For-Profit Agencies

- Non-Profit: Often preferred. Their mission is typically focused on education and helping consumers. Fees are generally lower and used to support operations. Many reputable DMPs are offered through non-profits.

- For-Profit: Includes debt settlement companies (high risk!) and other debt relief services. Approach with extreme caution. Their primary motive is profit, fees can be exorbitant, and some use misleading or harmful tactics.

What to Look For (Accreditation, Transparent Fees, Services Offered)

- Accreditation: Check for accreditation from recognized bodies (e.g., NFCC, AICCCA in the US; check equivalents in your region).

- Licensing/Registration: Ensure they are licensed or registered to operate in your state/province/country.

- Transparent Fees: Fees should be reasonable and clearly disclosed before you sign anything. Avoid companies demanding large upfront fees.

- Certified Counselors: Counselors should be certified and well-trained.

- Educational Resources: Reputable agencies offer financial education alongside debt management.

- Clear Contract: Read any agreement carefully before signing.

Red Flags: How to Spot Debt Relief Scams Be wary of companies that:

- Charge large fees before providing services.

- Guarantee they can remove accurate negative information from your credit report (they can’t).

- Tell you to stop paying your creditors immediately (this is often advice given by risky debt settlement companies, not reputable DMPs).

- Promise unrealistic results or “government-approved” programs that don’t exist.

- Don’t provide clear, written contracts or disclosures.

- Pressure you into making quick decisions.

- The US Federal Trade Commission (FTC) offers valuable consumer advice on spotting debt relief scams (https://consumer.ftc.gov/articles/choosing-credit-counselor). Check your local consumer protection agency resources as well.

Questions to Ask a Potential Credit Counselor

- What are your fees (setup, monthly)? Are they clearly stated in writing?

- Are your counselors certified? By whom?

- Are you accredited? By which organization?

- Are you licensed to operate in my region?

- How is my information kept confidential?

- What educational resources do you provide?

- How do you determine if a DMP is right for me? What are the alternatives?

- How will this plan impact my credit score?

Disclaimer: Regulations and agency availability vary significantly by country and region. Always verify credentials and understand the specific rules governing debt management and credit counseling in your location.

Clearing the Confusion: Debt Management vs. Settlement vs. Consolidation

These terms are often used interchangeably but mean very different things:

| Feature | Debt Management (DMP via Counseling) | Debt Consolidation (Loan/Balance Transfer) | Debt Settlement |

|---|---|---|---|

| Goal | Repay full debt, potentially at lower rates | Combine debts into one new loan/balance | Pay less than the full amount owed |

| How it Works | One payment to agency, distributes to creditors | Take out new loan/card to pay off old debts | Negotiate lump-sum payoff for less than balance |

| Who Offers | Credit counseling agencies (often non-profit) | Banks, credit unions, credit card companies | Debt settlement companies (often for-profit) |

| Credit Impact | Initial dip possible, potential long-term gain | Depends on new loan terms & payment history | Severe negative impact |

| Primary Benefit | Structure, lower interest, guidance | Simplified payments, potentially lower rate | Reduced total payout (if successful) |

| Primary Risk | Fees, requires commitment | Doesn’t solve spending habits, requires good credit | High risk, severe credit damage, may not work |

Which Path is Right for You? (Factors to Consider)

- Debt Amount & Type: DMPs work best for unsecured debt. Consolidation suitability depends on credit. Settlement is high-risk.

- Income & Budget: Can you afford the payments in any scenario?

- Credit Score: Good credit needed for favorable consolidation. DMP impact varies. Settlement damages credit severely.

- Discipline Level: DIY needs high discipline. DMPs offer structure.

- Risk Tolerance: Settlement is riskiest. DMPs and consolidation are generally safer.

The Journey: Navigating Life on a Debt Management Path

Getting on a plan is just the beginning. Success requires commitment.

Sticking to the Plan: Discipline and Communication

- Make Payments On Time: Crucial for DMP success and rebuilding trust with creditors.

- Track Your Budget: Continue monitoring spending.

- Communicate: If you face unexpected hardship (e.g., job loss), contact your counseling agency immediately to discuss options. Don’t just stop paying.

- Avoid New Debt: Resist the urge to take on new unsecured debt while on the plan.

Rebuilding Your Credit After Debt

- Monitor Your Credit Report: Check regularly for errors (you’re entitled to free reports – sources vary by country, e.g., annualcreditreport.com in the US).

- Use Credit Wisely: Once off the DMP or after managing debt, consider getting a secured credit card or small credit-builder loan and making consistent, on-time payments to rebuild positive history.

- Keep Utilization Low: Aim to use less than 30% (ideally less than 10%) of your available credit limit.

- Patience: Rebuilding credit takes time and consistent positive behavior.

Building Healthy Financial Habits for the Future

- Continue budgeting.

- Build an emergency fund (3-6 months of expenses) to avoid future debt cycles.

- Set financial goals (saving for retirement, house, etc.).

- Practice mindful spending.

Got Questions? Your Debt Management FAQ

Here are answers to some frequently asked questions:

- Is debt management the same as debt settlement? No. Debt management (especially via a DMP) aims to repay your full debt, often with better terms negotiated by a credit counselor. Debt settlement aims to pay less than you owe, which is much riskier and significantly damages your credit.

- Will using debt management hurt my credit score? Entering a DMP can initially lower your score because you might close accounts, and a notation may appear. However, making consistent payments and reducing your overall debt load through the plan should help improve your credit profile significantly over the long term compared to alternatives like default or settlement.

- How much does a debt management plan cost? Reputable non-profit credit counseling agencies typically charge a one-time setup fee (perhaps $0-$75) and a monthly fee (perhaps $25-$75), often on a sliding scale based on your budget. Fees should be reasonable and disclosed upfront. Be wary of high upfront fees. Costs vary by agency and region.

- Can I negotiate with my creditors myself instead of using an agency? Yes, you can try. You can call your creditors, explain your situation, and ask about hardship programs, lower interest rates, or payment plans. However, creditors may be more willing to offer significant concessions through an established credit counseling agency participating in a formal DMP.

- How long does a debt management plan typically last? Most DMPs are designed to be completed within 3 to 5 years (36 to 60 months).

- What happens if I miss a payment on my DMP? Missing a DMP payment can jeopardize your plan. Your creditors might revoke the concessions (like lower interest rates), and the agency might drop you from the program. Communicate with your agency immediately if you foresee trouble making a payment.

Take Control: Your First Step Towards Debt Freedom

Feeling overwhelmed by debt is incredibly stressful, but you have options, and you have the power to change your situation. Whether it’s implementing a DIY strategy like the debt snowball/avalanche, exploring debt consolidation, or seeking help from a reputable credit counseling agency for a debt management plan, the most important step is the first one. Acknowledge the situation, explore your options honestly, and commit to taking action.

Remember to do your research, especially when considering formal programs or agencies. Verify credentials, understand fees, and be wary of unrealistic promises. Check resources from trusted consumer protection bodies in your country or region (like the FTC or CFPB in the US) for guidance.

Call to Action:

What’s one action you can take this week to start managing your debt? Will you track your expenses for 7 days? List out all your debts? Research reputable non-profit credit counseling agencies in your area? Share your commitment or ask a question in the comments below!

If this guide provided clarity, please consider sharing it with someone who might be struggling with debt. You’re not alone, and help is available.