Let’s start with a definition: Comparing credit cards is the process of evaluating different credit card offers based on their features, terms, costs, and benefits to determine which card best suits your individual financial needs, spending habits, and goals. With hundreds of credit cards on the market, each a_dvertising tantalizing rewards, low introductory rates, or exclusive perks, choosing the right one can feel like navigating a minefield. Pick wisely, and a credit card can be a powerful financial tool; pick poorly, and you could end up with high fees or unmanageable debt. This comprehensive guide will teach you how to compare credit cards effectively in 2025, breaking down the critical factors to consider, helping you understand the fine print, and empowering you to select a card that truly works for you, not against you.

Disclaimer: While the core principles of comparing credit cards are universal, specific regulations (like those governing fees or consumer protections) and the types of rewards programs discussed primarily reflect the U.S. credit card market. Always review the terms and conditions applicable in your specific region.

Table of Contents

Why Comparing Credit Cards is Crucial (Don’t Skip This Step!)

It’s tempting to grab the first offer that lands in your mailbox or pops up online, especially if it dangles a flashy sign-up bonus. However, taking the time to compare options thoroughly can have significant long-term benefits:

- Save Money on Interest: Understanding and comparing Annual Percentage Rates (APRs) is vital if you ever carry a balance. Even a small difference in APR can mean hundreds or thousands of dollars saved over time.

- Minimize Fees: Credit cards can come with annual fees, balance transfer fees, foreign transaction fees, late fees, and more. Comparing helps you find cards with fee structures that suit your usage.

- Maximize Relevant Rewards: Not all rewards programs are created equal. Comparing helps you find a card that rewards your specific spending habits (e.g., travel, groceries, gas, cashback).

- Avoid Unsuitable Terms: Some cards have penalty APRs that skyrocket if you miss a payment, or very short 0% introductory periods. Comparing helps you understand these terms upfront.

- Get the Right Perks: From travel insurance to purchase protection, different cards offer different ancillary benefits. Choose one whose perks you’ll actually use.

- Protect Your Credit Score: Applying for too many cards randomly can hurt your credit score. A strategic comparison helps you apply only for cards you’re likely to be approved for and that fit your needs.

Step 1: Understand Your Needs, Spending Habits & Financial Goals

Before you even look at a single credit card offer, look at yourself. The “best” credit card is entirely subjective and depends on your individual situation. Ask yourself:

- Why do I want/need a credit card?

- To build credit history? See our Beginner’s Guide to Personal Finance for why this is important.)

- To make everyday purchases and earn rewards?

- To transfer a balance from a high-interest card?

- For travel perks?

- For emergencies only?

- What are my typical spending habits?

- Where do I spend most of my money (e.g., groceries, dining, gas, travel, online shopping)? This will help you identify relevant rewards categories.

- Do I travel frequently (domestically or internationally)?

- How do I plan to manage the card?

- Will I pay the balance in full every month (avoiding interest)? This is always the ideal.

- Do I sometimes carry a balance? (If so, APR is a top priority).

- Am I disciplined with spending? Explore Develop Financial Discipline.

- What are my financial goals?

- Saving money? Earning travel rewards? Paying down debt? Align your card choice with your Setting Financial Goals.

Answering these questions will help you narrow down the type of card that’s right for you. For example, if you always pay in full, rewards and perks might be more important than a low APR. If you carry a balance, a low ongoing APR is paramount.

Step 2: Check Your Credit Score & Report

Your credit score is a primary factor determining which credit cards you’ll qualify for and the interest rates you’ll be offered.

- Why it’s important: Issuers use your credit score to assess your risk as a borrower. Higher scores generally unlock cards with better rewards, lower APRs, and more valuable perks.

- How to check: In the U.S., you are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) once every 12 months via AnnualCreditReport.com. Many banks and credit card issuers also provide free credit score access (often FICO or VantageScore) to their customers.

- Understanding your score:

- Excellent Credit (e.g., 750-850 FICO): Access to premium rewards cards, best rates.

- Good Credit (e.g., 700-749 FICO): Wide range of good rewards and low-interest cards.

- Fair Credit (e.g., 650-699 FICO): Options become more limited; may qualify for cards with fewer rewards or higher APRs. Cards for building credit might be suitable.

- Poor/Bad Credit (e.g., below 650 FICO): Unsecured cards are hard to get. Secured credit cards are often the best starting point. If you’re just starting, our guide on Credit Card for Beginners might be helpful.

Knowing your credit standing prevents you from wasting time applying for cards you’re unlikely to get and helps you focus on suitable options.

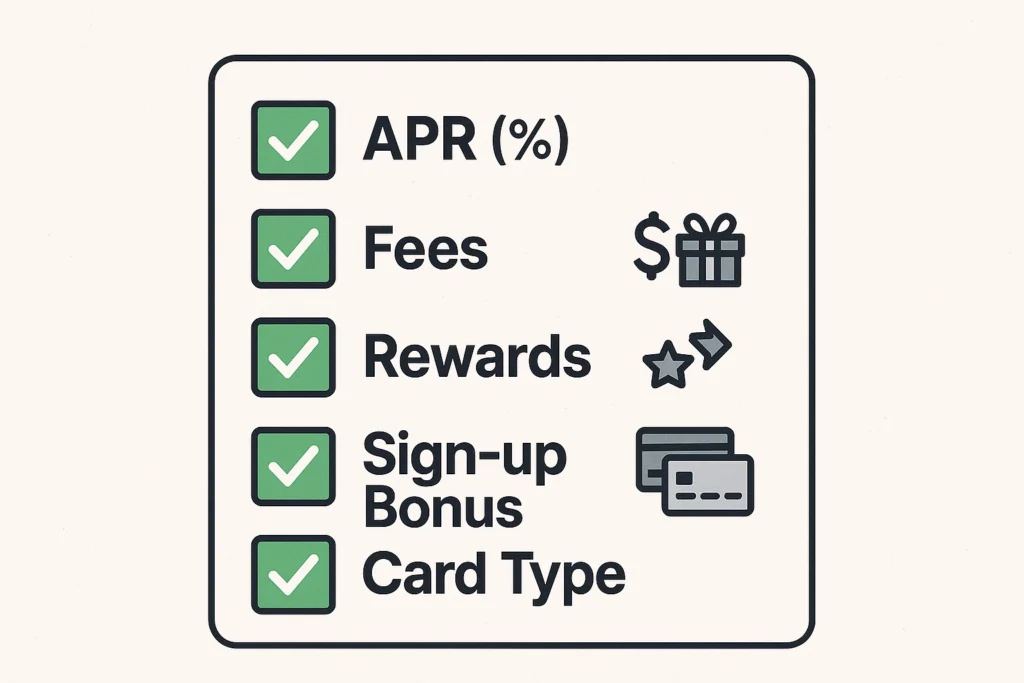

Step 3: Key Factors to Compare When Choosing a Credit Card

This is the core of how to compare credit cards. Evaluate each potential card against these critical factors:

1. Annual Percentage Rate (APR)

- Purchase APR: The interest rate applied to purchases if you carry a balance beyond the grace period. This is a crucial number if you don’t always pay in full. Rates can vary significantly.

- Introductory APR: Many cards offer a 0% or low introductory APR on purchases and/or balance transfers for a limited time (e.g., 6-21 months). This can be great for financing a large purchase or paying down debt. Crucially, always check what the APR reverts to after the intro period ends.

- Balance Transfer APR: The rate applied to balances transferred from other cards. Often comes with an introductory 0% period.

- Cash Advance APR: The (usually very high) rate charged if you use your credit card to get cash from an ATM. Interest often accrues immediately, with no grace period. Avoid cash advances if possible.

- Penalty APR: An extremely high APR that can be triggered if you make a late payment or go over your credit limit. Check the terms to see if this applies and how long it can last.

- Use our Credit Card Interest Calculator to see how different APRs impact your costs.

2. Fees

Fees can quickly negate any rewards earned if you’re not careful. Look for:

- Annual Fee: Some cards, especially premium rewards or travel cards, charge an annual fee. Evaluate if the card’s benefits and rewards will outweigh this cost for you. Many excellent cards have no annual fee.

- Balance Transfer Fee: Typically 3% to 5% of the amount transferred. Factor this into the cost-effectiveness of a balance transfer.

- Foreign Transaction Fee: A fee (usually 1-3%) charged on purchases made outside your home country. If you travel internationally, look for a card with no foreign transaction fees.

- Late Payment Fee: Charged if you don’t make at least the minimum payment by the due date.

- Over-Limit Fee: If you spend beyond your credit limit (though many issuers now decline such transactions unless you’ve opted into over-limit coverage).

- Cash Advance Fee: A fee for taking out cash, often a percentage of the advance or a flat amount, whichever is greater, in addition to the high cash advance APR.

3. Rewards Programs

If you plan to pay your balance in full each month, rewards can be a significant benefit. Consider:

- Cash Back: Straightforward. Earn a percentage back on purchases (e.g., flat 1.5%-2% on everything, or higher rates in specific bonus categories like groceries, dining, gas). Explore Top Cashback Credit Card options).

- Points: Earn points redeemable for travel, merchandise, gift cards, statement credits, etc. The value of points can vary depending on how you redeem them.

- Airline Miles: Earn miles with a specific airline or a flexible travel rewards program. Best for frequent flyers.

- Earning Rates: How many points/miles or what percentage cash back do you earn per dollar spent, both in bonus categories and on general spending?

- Redemption Value & Flexibility: How easy is it to redeem rewards? What are they worth? Are there blackout dates or restrictions for travel rewards?

- Caps & Expirations: Do rewards have earning caps or expiration dates?

- See our guide on the Best Rewards Credit Card for your spending style.

4. Sign-Up Bonuses / Welcome Offers

- Many cards offer attractive credit card sign-up bonus offers (e.g., “spend $3,000 in the first 3 months, get $200 cash back” or “earn 60,000 bonus points”).

- Evaluate:

- The value of the bonus (convert points/miles to an estimated dollar value).

- The spending requirement to earn it (is it achievable with your normal spending?).

- The timeframe to meet the spending requirement.

- Don’t overspend just to hit a bonus!

- Check out current Credit Card Bonus Offers.

5. Card Type

Match the card type to your primary need:

- Rewards Cards: (Cashback, Travel, Points) – Best if you pay in full monthly.

- Balance Transfer Cards: Focus on long 0% intro APR periods for balance transfers.

- Low Interest Cards: Aim for a consistently low ongoing purchase APR if you sometimes carry a balance.

- Secured Credit Cards: Require a security deposit; designed for building or rebuilding credit.

- Student Credit Cards: Easier to qualify for students new to credit.

- Business Credit Cards: For business expenses, offering specific business perks.

6. Other Benefits & Perks

Consider these extras, which vary widely:

- Travel insurance (trip cancellation, lost luggage, rental car CDW)

- Purchase protection (against damage or theft)

- Extended warranty protection

- Cell phone protection

- Airport lounge access, See Credit Card with Lounge Access)

- Concierge services

- Statement credits for specific purchases (e.g., streaming services, Global Entry/TSA PreCheck)

7. Credit Limit

While you won’t know your exact limit until approved, some cards are known for typically offering higher or lower starting limits. Consider if the potential limit meets your spending needs (but remember, don’t max it out!).

8. Issuer Reputation & Customer Service

Research the card issuer. Are they known for good customer service? How easy is it to manage your account online or via their app? Read reviews from reliable sources.

The Consumer Financial Protection Bureau (CFPB) provides excellent resources on how to shop for credit cards and understand terms: Visit CFPB’s Credit Card Page.

Step 4: Where to Compare Credit Cards

Once you know what you’re looking for, you can find and compare offers:

- Card Issuer Websites: Go directly to the websites of major banks and credit card companies (Chase, American Express, Citi, Capital One, Discover, etc.). They often have tools to filter cards by features or rewards.

- Your Bank or Credit Union: Check with your current financial institution. They may have special offers or relationship benefits for existing customers.

- Reputable Financial News & Review Sites: Sites like NerdWallet, Bankrate, The Points Guy, Forbes Advisor, etc., provide detailed reviews and comparisons. Be aware that these sites often earn commissions if you apply through their links, but they can be good sources of information if used critically. Focus on their factual breakdowns of features, fees, and APRs.

- Pre-qualification Tools: Many issuers offer pre-qualification tools on their websites. These allow you to see which cards you might be approved for with a soft credit inquiry (which doesn’t affect your credit score). This can help narrow your choices before a formal application.

Step 5: The Application Process & What to Expect

For a detailed walkthrough, see our guide on How to Apply for a Credit Card. Briefly:

- Choose your card based on your comparison.

- Apply online (most common) or sometimes in-branch.

- Provide personal information (name, address, SSN, income, employment).

- Consent to a hard credit inquiry (this can temporarily dip your score by a few points).

- Await a decision (can be instant or take several days/weeks).

- If approved, review your credit limit and APR. Activate your card upon arrival.

Common Mistakes to Avoid When Comparing Credit Cards

- Focusing Only on Rewards/Sign-Up Bonus: Ignoring high APRs or annual fees that negate reward value.

- Ignoring the Fine Print: Not understanding fees, penalty APRs, or how rewards are earned/redeemed.

- Applying for Too Many Cards at Once: Each application usually results in a hard inquiry, which can lower your credit score. Apply strategically.

- Underestimating the APR: If you carry a balance, the APR is one ofthe most critical factors.

- Choosing a Card That Doesn’t Match Spending Habits: Getting a travel card if you rarely travel, for example.

- Not Considering the Annual Fee vs. Benefits: Ensure you’ll use the perks enough to justify an annual fee.

The Federal Trade Commission (FTC) offers advice on choosing and using credit cards responsibly: Check FTC Consumer Advice.

Conclusion: Finding Your Perfect Credit Card Match

Learning how to compare credit cards is a vital financial skill. It’s not just about finding a card; it’s about finding the right card for your unique financial situation, spending patterns, and goals. By systematically evaluating APRs, fees, rewards, benefits, and aligning them with your personal needs and creditworthiness, you can transform a credit card from a potential debt trap into a powerful tool that builds your credit, protects your purchases, and even puts money back in your pocket.

Take your time, do your research, and choose wisely. The perfect card for you is out there.

Frequently Asked Questions (FAQ)

What are the top 3 most important things to compare on credit cards?

APR (Annual Percentage Rate): Especially if you might carry a balance.

Fees: Particularly the annual fee, but also foreign transaction, late payment, and balance transfer fees.

Rewards/Benefits Program: If you pay in full monthly, this determines the value you get back. If you don’t, a low APR often outweighs rewards.

Does checking pre-qualified credit card offers hurt my credit score?

No, checking for pre-qualified or pre-approved offers typically results in a soft credit inquiry, which does not affect your credit score. However, if you proceed to formally apply for a card after pre-qualification, that will usually trigger a hard credit inquiry, which can slightly lower your score temporarily.

How many credit cards should I have to compare?

There’s no magic number. It’s generally recommended to have a couple of different cards to build a healthy credit history and potentially maximize rewards in different categories. However, focus on quality over quantity. Don’t open cards you don’t need or can’t manage responsibly. For comparison, research 3-5 strong contenders that fit your initial needs assessment.

Is it better to choose a card with a high sign-up bonus or one with a lower ongoing APR?

If you always pay your balance in full each month, the sign-up bonus and ongoing rewards are more important than the APR (as you won’t pay interest). If you anticipate carrying a balance, a lower ongoing APR will almost always save you more money in the long run than a one-time sign-up bonus, even if that bonus seems large.

What if I have bad credit? How do I compare credit cards then?

If you have bad credit, your options will be more limited. Focus on comparing:

Secured credit cards: These require a security deposit. Compare the deposit requirements, annual fees (aim for none or low), and whether they report to all three credit bureaus (essential for credit building).

Credit builder loans (though not cards, they serve a similar purpose for credit building). * The likelihood of approval and the interest rates/fees if considering unsecured cards for bad credit (which often have very high costs).