Setting Financial Goals That Stick: Your Ultimate Guide to Achieving Them

Do you ever feel like you’re working hard, earning money, but somehow not really getting ahead? Maybe your finances feel a bit… directionless? It’s a common feeling. Without a clear destination, it’s easy to drift financially, spending without purpose and missing opportunities for growth and security. The antidote? Setting clear, meaningful financial goals.

This guide is your roadmap. Forget vague wishes like “I want to be rich.” We’re diving into a practical framework for defining what you truly want, setting financial goals you can actually achieve (using the powerful SMART system), and building actionable plans to make them a reality. Get ready to transform financial stress into financial purpose and start building the future you envision.

Table of Contents

The Power of Purpose: Defining Financial Goals

Let’s start with the basics. What exactly are financial goals, and why are they so essential for your financial health and overall well-being?

Beyond Wishing: What Makes a Goal a Goal?

A financial goal isn’t just a daydream; it’s a specific target related to your money that you plan to achieve within a certain timeframe. It has intention and requires action.

- Wish: “I wish I had more money.”

- Goal: “I will save $5,000 for an emergency fund within the next 12 months by automating a $417 transfer from my checking to my savings account each month.”

See the difference? A goal is concrete, measurable, and actionable.

The “Why”: How Financial Goals Provide Direction and Motivation

Think of your financial life as a journey. Without goals, you’re wandering aimlessly. Financial goals act as your compass and map:

- Direction: They tell you where you want to go, giving purpose to your saving, spending, and investing decisions.

- Motivation: They provide a powerful “why” behind your daily financial choices. It’s easier to skip an impulse purchase when you know that money is earmarked for your dream vacation or retirement fund.

- Focus: They help you prioritize what’s important and filter out financial noise or distractions.

- Progress Measurement: They allow you to track how far you’ve come, boosting confidence and reinforcing positive habits.

The Link Between Goals and Financial Well-being

Setting and working towards financial goals is directly linked to reduced financial stress and increased feelings of control and security. When you have a plan, you move from reacting to financial events to proactively shaping your financial future. This sense of agency is incredibly empowering.

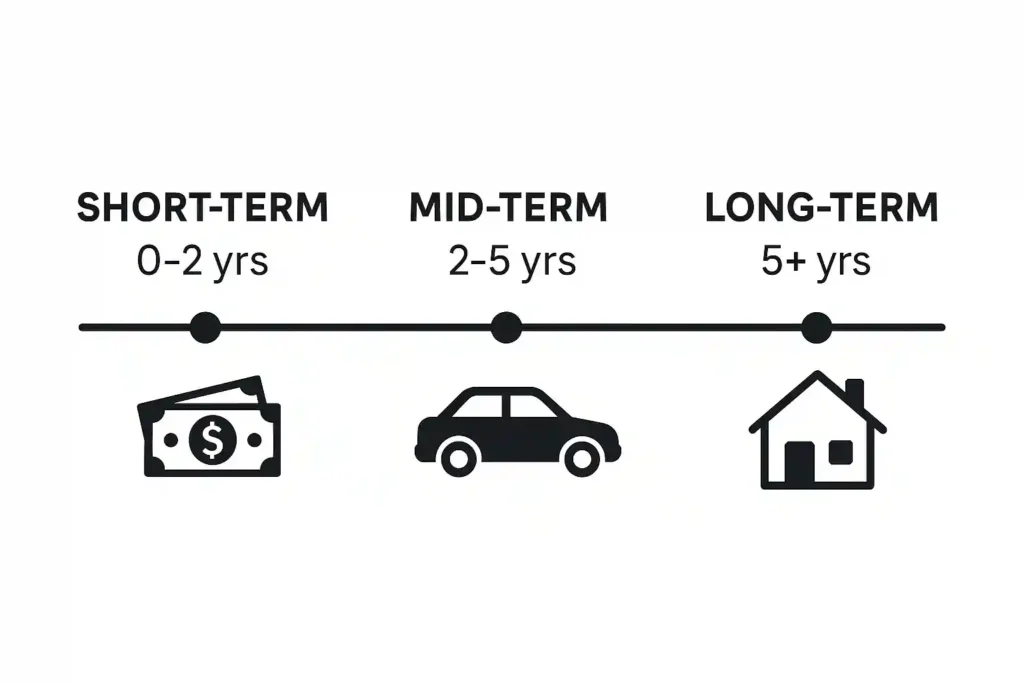

Short, Mid, and Long-Term: Categorizing Your Financial Aspirations

Not all goals are created equal in terms of timeline. Categorizing them helps you plan effectively and allocate resources appropriately.

Short-Term Financial Goals (Less than 1-2 Years): Quick Wins

These goals provide immediate focus and build momentum. They often involve smaller amounts or shorter saving periods.

- Examples:

- Building a starter emergency fund ($1,000 – $2,000).

- Paying off a small, high-interest credit card debt.

- Saving for a specific upcoming expense (e.g., holiday gifts, annual insurance premium, new laptop).

- Creating and sticking to a monthly budget for 3 consecutive months.

- Saving for a weekend getaway.

Mid-Term Financial Goals (2-5 Years): Building Momentum

These goals require more sustained effort and planning. They often bridge the gap between immediate needs and long-term ambitions.

- Examples:

- Saving a down payment for a car.

- Paying off student loans or larger debts.

- Saving for a significant vacation or sabbatical.

- Funding a planned home renovation project.

- Saving for startup costs for a small business.

- Building your emergency fund to cover 3-6 months of expenses.

Long-Term Financial Goals (5+ Years): The Big Picture

These are the major life goals that require long-term vision, consistent effort, and often involve larger sums of money and the power of investing.

- Examples:

- Saving for retirement (often the largest and longest goal).

- Saving for a down payment on a home.

- Paying off your mortgage early.

- Funding children’s education expenses.

- Achieving financial independence (having enough passive income to cover living expenses).

- Leaving a financial legacy or inheritance.

Understanding these categories helps you balance immediate needs with future aspirations.

Making It Happen: How to Set SMART Financial Goals

Okay, you know why goals matter and the different types. But how do you set goals that aren’t just vague ideas but concrete targets you can hit? Use the SMART framework.

S – Specific:

Clearly Define What You Want Vague goals lead to vague results. Get crystal clear.

- Not Specific: “Save more money.”

- Specific: “Save $10,000 for a down payment on a house.”

M – Measurable:

How Will You Track Progress? You need a way to know if you’re on track and when you’ve succeeded. Usually involves a number.

- Not Measurable: “Pay down debt.”

- Measurable: “Pay off my $3,500 Visa credit card balance.” ($3,500 is the measure).

A – Achievable:

Is It Realistic Given Your Situation? Your goal should stretch you but not be impossible. Consider your income, expenses, and timeline.

- Potentially Unachievable: “Save $1 million in one year on a $50,000 salary.”

- More Achievable: “Save $5,000 towards retirement this year by contributing $417 per month.” (Assess if $417/month is feasible within your budget).

R – Relevant:

Does It Align with Your Values and Overall Life Plan? Your goals should genuinely matter to you and fit into your bigger picture. Don’t set goals based on what others think you should do.

- Potentially Irrelevant: “Save for a luxury car” (if you actually value experiences over possessions and prefer public transport).

- Relevant: “Save $6,000 for a 3-month travel sabbatical next year” (if travel and experiences are high priorities for you).

T – Time-Bound:

Set a Target Date or Deadline A deadline creates urgency and provides a clear timeframe for planning.

- Not Time-Bound: “Start investing for retirement.”

- Time-Bound: “Open a retirement investment account and set up automatic contributions by the end of this month.” OR “Accumulate $500,000 in retirement savings by age 60.”

SMART Goal Examples in Action:

- Vague Goal: “Save for vacation.”

- SMART Goal: “(S) Save $2,400 for a trip to Italy (M) by saving $200 per month for the next (T) 12 months. (A) This fits my budget after cutting back on dining out, and (R) this trip is important for my personal enrichment.”

- Vague Goal: “Pay off debt.”

- SMART Goal: “(S) Pay off my $5,000 student loan (M) completely by (T) December 31st, 2026. (A) I will do this by adding an extra $150 per month to my minimum payment, which is feasible. (R) Eliminating this debt will free up cash flow for other goals.”

From Dream to Reality: Your Financial Goal-Setting Action Plan

Ready to set your own goals? Follow these steps:

Step 1: Reflect on Your Values and Vision (The Foundation)

- What truly matters to you in life? Security? Freedom? Experiences? Family? Helping others?

- What does your ideal future look like 1, 5, 10, 20 years from now?

- Your financial goals should be tools to help you live a life aligned with your values.

Step 2: Assess Your Current Financial Situation (Know Your Starting Point)

- Calculate your net worth (Assets – Liabilities).

- Track your income and expenses (create a budget).

- Understand your debt situation (amounts, interest rates).

- Review your current savings and investments.

- You can’t plan a route without knowing where you are on the map.

Step 3: Brainstorm Potential Goals (Short, Mid, Long-Term)

- Let yourself dream a little, then get practical. Write down everything you’d like to achieve financially across all timeframes. Don’t filter yet.

Step 4: Prioritize Your Goals (What Matters Most Right Now?)

- You likely can’t tackle everything at once. Which goals are most urgent or important?

- Consider dependencies (e.g., building an emergency fund before aggressively investing).

- Rank your brainstormed list. Focus on the top 1-3 goals initially.

Step 5: Apply the SMART Framework to Your Top Goals

- Take your prioritized goals and refine them using the SMART criteria (Specific, Measurable, Achievable, Relevant, Time-Bound).

Step 6: Break Down Large Goals into Smaller Milestones

- A $500,000 retirement goal can feel daunting. Break it down into annual savings targets, then monthly contributions. Saving a $20,000 down payment can be broken into saving $4,000 per year for 5 years, or $334 per month. This makes large goals feel less overwhelming and provides points to celebrate progress.

Step 7: Write Down Your Goals! (Make Them Concrete)

- Studies have shown that people who write down their goals are significantly more likely to achieve them. Put them somewhere visible – a journal, a whiteboard, a note on your computer desktop. This makes them real and keeps them top-of-mind.

Bridging the Gap: Tools and Tactics for Success

Setting the goal is step one; achieving it requires consistent action and the right tools.

Budgeting: The Control Center for Your Goals

- Your budget shows you where your money is going and how much you can realistically allocate towards your goals each month. It’s non-negotiable for goal achievement. Find a method that works for you (apps, spreadsheet, envelope system).

Automating Savings & Investments: Pay Yourself First

- Set up automatic transfers from your checking account to your savings or investment accounts right after payday. This removes temptation and ensures progress happens without relying solely on willpower. This is one of the most powerful strategies.

Choosing the Right Accounts (Savings, Investments – mention variability)

- Short-Term Goals (0-2 yrs): Use high-yield savings accounts (insured, stable value). See our guide on [Savings Accounts] ( <- If applicable, link internally ).

- Mid-Term Goals (2-5 yrs): High-yield savings, potentially Certificates of Deposit (CDs), or very conservative investments depending on risk tolerance and exact timeframe.

- Long-Term Goals (5+ yrs): Primarily investment accounts (brokerage accounts, retirement accounts like 401(k)s, IRAs – types vary by country) to leverage potential market growth and compounding. Investment choices depend on risk tolerance and timeline. Specific investment vehicles and tax implications vary greatly by country. Consult local resources or advisors.

Debt Management Strategies (If Debt is a Barrier)

- High-interest debt can sabotage your goals. Prioritize creating a plan to pay it down using methods like the debt snowball or avalanche. See our guide on [Debt Management] ( <- If applicable, link internally ).

Tracking Progress Regularly (Apps, Spreadsheets, Check-ins)

- Monitor your accounts. Use apps, spreadsheets, or a simple notebook to track how much you’ve saved/invested towards each goal. Seeing progress is highly motivating.

Staying Motivated & Overcoming Setbacks (Visualization, Accountability)

- Visualize Success: Regularly imagine achieving your goal and how it will feel.

- Find an Accountability Partner: Share your goals with a trusted friend, family member, or financial planner.

- Reward Milestones: Celebrate small wins along the way (with non-expensive rewards!).

- Revisit Your “Why”: When motivation dips, remind yourself why this goal matters to you.

- Learn from Setbacks: If you miss a savings target one month, don’t give up. Analyze why it happened and adjust your plan for next month.

Using Financial Planning Tools & Resources

- Many online calculators can help with retirement projections, loan payoffs, etc.

- Government resources like the Consumer Financial Protection Bureau (CFPB – https://www.consumerfinance.gov/) in the US offer unbiased information and tools for financial planning and goal setting. Investor.gov (https://www.investor.gov/) offers resources for aligning investments with goals. Check for equivalent consumer protection or investor education sites in your region.

Life Happens: Adapting Your Financial Goals Over Time

Your financial plan shouldn’t be set in stone. Life changes, and your goals should evolve too.

Why Regular Reviews Are Crucial (Annual Check-up)

- At least once a year (or semi-annually), sit down and review:

- Your progress towards existing goals.

- Your current financial situation (income, expenses, net worth).

- Whether your goals are still relevant and achievable.

- Market conditions or interest rate changes that might affect your plans.

When to Adjust Your Goals (Life Events, Income Changes)

- Major life events often necessitate goal adjustments:

- Getting married or divorced

- Having children

- Changing jobs or receiving a significant raise/pay cut

- Moving

- Experiencing unexpected windfalls or expenses

- Don’t be afraid to modify amounts, timelines, or even the goals themselves as your life circumstances evolve. Flexibility is key.

Celebrating Milestones Along the Way

- Achieving a financial goal, big or small, is a major accomplishment! Acknowledge your hard work and celebrate milestones. This reinforces positive behavior and keeps you motivated for the next step.

Common Questions About Setting Financial Goals

Let’s address some frequent questions:

- What are the most important financial goals to have? While priorities differ, foundational goals usually include: 1) Creating a budget you stick to, 2) Building an emergency fund (3-6 months of essential expenses), 3) Paying off high-interest debt, and 4) Saving consistently for retirement.

- How many financial goals should I focus on at once? It’s generally best to actively focus on 1-3 major goals at a time to avoid feeling overwhelmed. You can have others listed but prioritize where your extra money and attention go. Your foundational goals (budget, emergency fund, debt) often take initial priority.

- What if I don’t make a lot of money? Can I still set financial goals? Absolutely! Financial goals are for everyone, regardless of income level. Your goals will simply be scaled to your means. Even saving small amounts consistently makes a huge difference over time due to compounding. The habit of setting goals and saving is more important than the initial amount.

- How often should I check my progress towards my goals? For short-term goals, checking monthly might be appropriate. For long-term goals like retirement (especially if automated), checking quarterly or semi-annually is often sufficient to track progress without overreacting to short-term market fluctuations. Find a cadence that keeps you informed but not obsessive.

- What’s the difference between a financial goal and a budget? A budget is a tool for tracking income and expenses – it tells you where your money is going now. A financial goal is a target for where you want your money to take you in the future. Your budget is the tool you use to allocate funds towards achieving your goals.

Your Financial Future Starts Now

Setting clear, SMART financial goals is the difference between drifting aimlessly and purposefully navigating your financial journey. It transforms money from a source of stress into a tool for building the life you desire.

It might seem like a lot, but remember to start small. Define what matters most, assess where you are today, and set just one SMART goal to begin. Write it down. Break it into smaller steps. Automate your savings. The power lies in taking that first intentional step. You absolutely can take control of your financial future.

Call to Action:

What’s one financial goal – big or small – you’re going to define using the SMART framework this week? Share your goal or your biggest takeaway from this guide in the comments below! Let’s inspire each other.

Found this guide helpful? Please share it with anyone who might benefit from bringing more purpose to their finances!