Let’s begin with a clear definition: A student budget planner is a dedicated system or interactive tool designed to help students effectively track their diverse income sources (like loans, part-time jobs, and family help), manage their unique academic and living expenses, identify areas for savings, and ultimately gain control over their financial well-being during their studies. Feeling the classic student pinch where your loan disbursement seems to evaporate, or are you constantly choosing between textbooks and a social life? You’re definitely not alone. Managing money effectively while juggling studies can be a massive source of stress. This page features not just a guide, but also a place for a powerful student budget planner tool. We’ll explore why planning is crucial, how to use such a planner step-by-step, offer practical student money saving tips, and show you how to create a budget plan example for students that truly works for you in 2025.

Student Budget Planner

Monthly Income Sources

Monthly Fixed Expenses

Monthly Variable Expenses

Savings Goals

Expense Breakdown

Budget Summary (Monthly Equivalent)

Table of Contents

Why a Student Budget Planner is Your Best Friend in College

Navigating university life without a budget is like trying to sail across an ocean without a map or compass – you might stay afloat for a while, but reaching your destination efficiently (and without hitting too many icebergs of debt) is unlikely. A dedicated student budget planner isn’t about restricting your fun; it’s about empowering you with financial clarity and control.

Here’s why it’s indispensable:

- Reduces Financial Stress & Anxiety: Knowing where your money is coming from and where it needs to go significantly reduces worry about affording rent, food, or unexpected costs. Peace of mind is invaluable when facing academic pressures.

- Prevents Unnecessary Debt: By tracking income and expenses, you can see if you’re overspending and make adjustments before resorting to high-interest credit cards or overdrafts for everyday living. If credit card debt is already a concern, see our guide on How to Get Out of Credit Card Debt.

- Helps You Achieve Your Goals: Want to save for a spring break trip, a new laptop, a deposit on a post-grad flat, or just ensure you have enough for next semester’s books? A budget planner allocates funds towards these specific objectives. Learn more about Setting Financial Goals.

- Builds Essential Lifelong Financial Habits: The money management skills you develop as a student – tracking, planning, saving, making conscious spending choices – are foundational for long-term financial success. This ties into developing overall Financial Discipline.

- Enables Informed Decision-Making: Can you afford to go out three times this week? Is that unpaid internship feasible? Should you pick up more hours at your part-time job? Your budget provides the data to make smart choices rather than guessing.

- Maximizes Limited & Often Irregular Income: Student income (from loans, grants, part-time work, family) can be sporadic and limited. A planner ensures you make every pound, dollar, or euro stretch effectively throughout the term or academic year.

Understanding the Core Components of Your Student Budget

Before you can effectively use a student budget planner tool, you need to understand the key pieces of information that will feed into it.

Identifying Your Income: All Sources Count!

Your income as a student might come from various places and at different intervals. It’s crucial to list them all:

- Student Loans/Finance: Note the total amount you receive per disbursement (e.g., per semester or term) and when these funds arrive. For a deeper dive, see our Student Loans Guide.

- Grants, Scholarships, and Bursaries: Free money for your education – fantastic! Include the amounts and how often they are paid.

- Parental/Family Contributions: Any regular allowance or financial support from family.

- Part-Time Job Wages: Calculate your average net (after-tax) monthly or weekly earnings. If your hours vary, it’s often best to estimate conservatively.

- Personal Savings: Any money you’ve saved up before starting or during your studies.

- Other Income: Gifts, money from selling old textbooks, freelance gigs, etc.

Tracking Your Expenses: Where Does the Money Go?

This is often an eye-opening exercise. For a typical student, expenses fall into several key categories. Your budget planner should help you categorize these:

- Academic Expenses:

- Tuition & Course Fees (if not fully covered by upfront loans/grants)

- Textbooks & Course Materials (new, used, digital, rentals)

- Software, Lab Equipment, Art Supplies, etc.

- Field Trips or Project Costs

- Living Expenses (Fixed – often predictable):

- Rent (Halls of Residence or Private)

- Utilities (Electricity, Gas, Water – if not included in rent)

- Internet & Mobile Phone Plan

- Contents Insurance (for your belongings)

- Scheduled Loan Repayments (if any are due while studying)

- Essential Subscriptions (e.g., for specific software needed for studies)

- Living Expenses (Variable – fluctuate more):

- Groceries

- Transportation (Public transport passes, fuel if you have a car, occasional taxis)

- Household Supplies & Toiletries

- Laundry

- Personal & Social Expenses (Often “Wants”):

- Dining Out, Takeaways, Coffee Shops

- Entertainment (Cinema, Concerts, Pubs/Clubs, Streaming Services)

- Hobbies & Sports Club Memberships

- Clothing & Personal Shopping

- Gifts for friends/family

- Travel (non-essential trips home or vacations)

- Other Potential Expenses:

- Health & Wellness (Prescriptions, gym, unexpected medical/dental)

- Bank Fees or Overdraft Charges

Effective budgeting is a cornerstone of personal finance. Learn more in our Beginner’s Guide to Personal Finance).

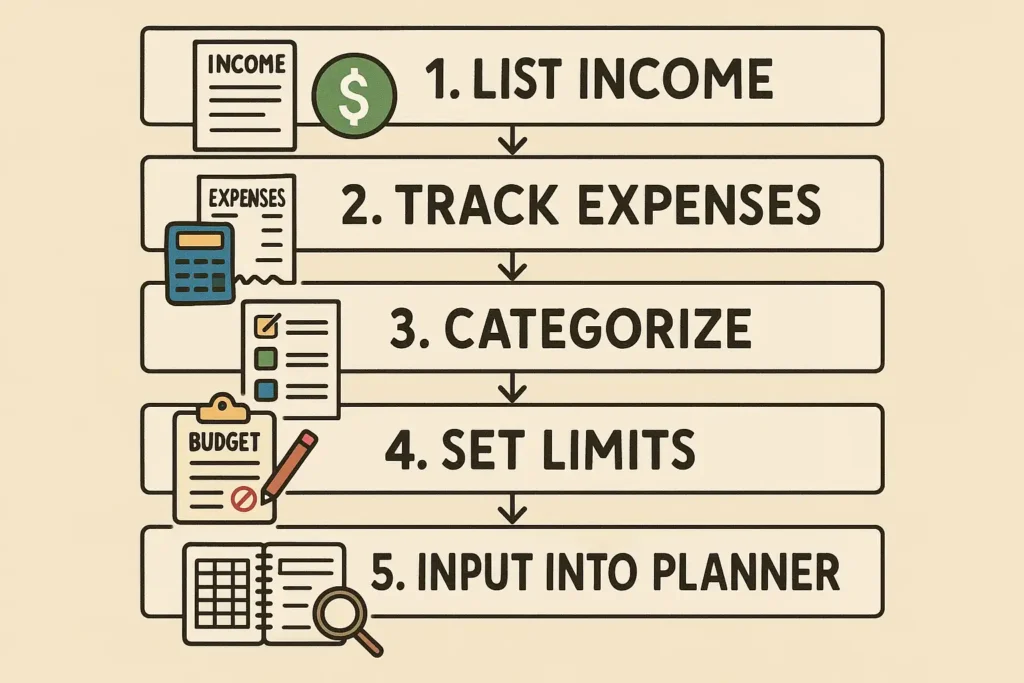

How to Use a Student Budget Planner Effectively (Step-by-Step)

Whether you use an interactive tool (like the one this page is designed for), a spreadsheet, or a notebook, the process of effective student budgeting follows these key steps:

Step 1: Gather All Your Financial Information

Collect bank statements, loan disbursement schedules, pay slips, scholarship letters, and receipts from the past month (or use your expense tracking data if you’ve already started). You need a clear picture of your income and spending patterns.

Step 2: Input Your Income Sources

Enter all your income into the planner. If your tool allows for different frequencies (weekly, monthly, per semester), use that feature. If not, you’ll need to normalize your income to a consistent period (usually monthly). For example, if you get a $2000 loan disbursement for a 4-month semester, your monthly income from that source is $500.

Step 3: List & Categorize Your Fixed Expenses

These are typically recurring expenses that stay roughly the same each month. Enter them with their amounts and frequency (if your tool supports it, otherwise normalize to monthly). Examples: Rent, phone bill, set loan payments, essential subscriptions.

Step 4: Estimate and Allocate for Your Variable Expenses

Based on your past spending (from tracking) and your desired spending limits, allocate amounts to your variable expense categories (groceries, transport, entertainment, etc.). This is where you have the most control to make cuts if needed. Again, normalize to a monthly figure.

Step 5: Set Specific Savings Goals

Don’t forget to “pay yourself first”! Allocate a portion of your income towards savings, however small. Define your goals:

- Emergency Fund: Essential for unexpected costs (e.g., aim for $500-$1000 or one month’s core expenses).

- Short-Term Goals: Next semester’s textbooks, a new laptop, a weekend trip.

- Long-Term Goals: Travel after graduation, deposit for a flat. Learn about different savings vehicles in our Guide to Savings Accounts).

Step 6: Analyze the Summary – The Moment of Truth!

Most budget planner tools will provide a summary:

- Total Monthly Income

- Total Monthly Fixed Expenses

- Total Monthly Variable Expenses

- Total Monthly Savings Allocations

- Net Balance (Income – All Outflows)

This final number tells you if you’re living within your means, have a surplus, or are facing a deficit.

Interpreting Your Budget Planner Results & Making Adjustments

The summary is where the real work begins.

What if You Have a Surplus?

Congratulations! This is a great position to be in. Consider:

- Allocating more to your savings goals.

- Paying down any high-interest debt faster (like credit card debt).

- Investing in skills or experiences that could boost future earnings.

- Allowing a little more for “wants” if your needs and savings are well-covered.

What if You Have a Deficit? (Expenses > Income)

Don’t panic! This is common, especially when first budgeting. You have two main levers:

- Reduce Expenses: This is usually the quickest fix. Scrutinize your variable expenses, particularly the “Wants” categories.

- Can you cut back on dining out or takeaways?

- Find cheaper entertainment options?

- Reduce non-essential shopping?

- Look for cheaper grocery alternatives or meal prep more? See Tips for Frugal Living.

- Can any fixed expenses be reduced (e.g., cheaper phone plan, finding a less expensive living situation next year)?

- Increase Income:

- Can you pick up more hours at your part-time job?

- Look for a higher-paying part-time job?

- Consider a side hustle (tutoring, freelancing, delivery services)?

- Are there additional scholarships or bursaries you can apply for?

Use your student budget planner to model different scenarios by adjusting expense limits until you achieve a balanced budget (or ideally, a surplus).

The Importance of Regular Reviews & Tweaks

A budget is not a “set it and forget it” document. Life changes, expenses fluctuate, and income might vary.

- Weekly Check-in: Briefly review your spending for the past week. Are you on track with your variable expense limits? This forms the basis of a good student weekly budget plan.

- Monthly Review: At the end of each month, compare your actual spending against your budgeted amounts in detail. Update your planner for the next month based on any learnings or upcoming changes.

Top Student Budgeting Tips to Maximize Your Plan

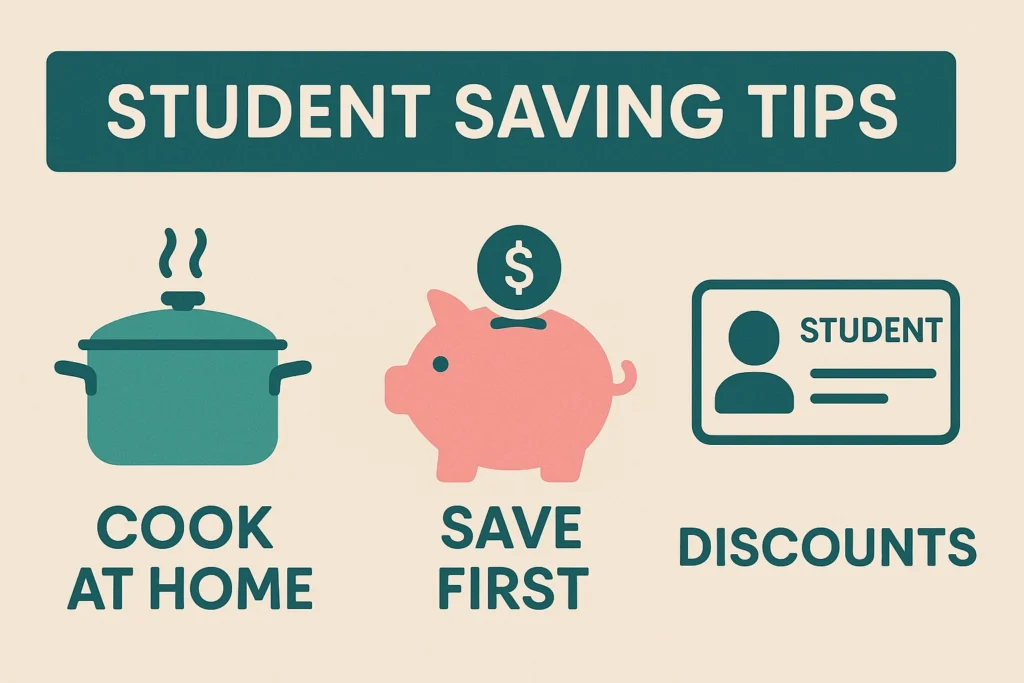

Beyond just using the planner, these student money saving tips can make a huge difference:

- The 50/30/20 Rule (Student Adaptation): As a guideline, aim to spend roughly 50% of your income on Needs (rent, essential food, transport, course costs), 30% on Wants (entertainment, social life, non-essential shopping), and allocate 20% to Savings & Debt Repayment. Adjust these percentages based on your unique student situation and priorities.

- Embrace Student Discounts: Your student ID is a goldmine! Always ask if there’s a student discount – for food, clothes, software, travel, entertainment, tech. Use discount platforms like UNiDAYS or Student Beans.

- Master Meal Prepping & Cooking: Eating out and takeaways are budget killers. Learn a few simple, cheap recipes. Cook in batches, pack lunches, and make your own coffee/tea.

- Track Small Expenses: Those daily coffees, snacks, or small online purchases add up significantly. Your budget planner will help highlight these “budget leaks.”

- Utilize Free Campus Resources: Your university likely offers free events, gym access, library services (books, movies, online journals), career workshops, and academic support – use them!

- Used is Good: For textbooks, buy used, rent, or use library copies. For clothes or household items, explore charity shops, online marketplaces, or student swap groups.

- Review Subscriptions Regularly: Are you really using all those streaming services, apps, or gym memberships? Cancel what you don’t need.

- Automate Savings: Set up an automatic transfer from your main account to a separate savings account each time you receive income (loan, wages). This aligns with the Pay Yourself First Method.

Common Student Budgeting Mistakes & How to Avoid Them

Learn from these common pitfalls:

- Not Tracking Spending: Guessing where your money goes is a recipe for overspending. Fix: Track diligently for at least a month.

- Underestimating Expenses: Forgetting irregular but significant costs like annual subscriptions, travel home, or society fees. Fix: List everything and average out larger, less frequent costs.

- Impulse Spending: Buying things on a whim without checking your budget. Fix: Implement a 24-hour rule for non-essential purchases.

- No Emergency Fund: Being forced into debt by unexpected events. Fix: Prioritize building even a small emergency fund.

- Not Reviewing or Adjusting the Budget: Treating your budget as static. Fix: Schedule regular weekly/monthly budget reviews.

- Trying to Be Too Restrictive: A budget that’s too harsh is hard to stick to. Allow for some “fun money” within reasonable limits.

- Peer Pressure Spending: Feeling obligated to spend money you don’t have to keep up with friends. Fix: Be honest about your budget; suggest cheaper or free social activities.

Beyond the Planner: Tools & Resources

While a comprehensive student budget planner tool (like the one ideally on this page) is fantastic, you can also utilize:

- Spreadsheet Software: Google Sheets (free) or Microsoft Excel allow you to create highly customized budget templates. Many free student budget templates are available online.

- Dedicated Budgeting Apps: Many mobile apps can help with tracking and budgeting, some offering student-friendly features or free versions. Check out our guides on the Best App for Budgeting and Best Free Budgeting App.

- University Financial Aid & Money Advice Services: Your university is a prime resource. They often have dedicated staff who can help with budgeting, understanding student finance, and accessing hardship funds if needed.

- Government Student Finance Websites: Official sites like StudentAid.gov (for U.S. federal aid) provide crucial information about loans and grants. Your country will have an equivalent.

- Reputable Financial Education Websites: Organizations like the Consumer Financial Protection Bureau (CFPB) or the National Endowment for Financial Education (NEFE) offer unbiased guides and tools.

- The CFPB (https://www.consumerfinance.gov/consumer-tools/managing-your-money/) has excellent resources for young adults and students on managing money.

Conclusion: Take Charge of Your Student Finances Today!

Mastering your money as a student is one of the most valuable skills you can acquire. A well-used student budget planner transforms from a simple tracking tool into your command center for financial decision-making. It empowers you to understand your income, control your spending, achieve your savings goals, and significantly reduce financial stress, allowing you to focus more on your studies and enjoy your university experience.

Remember, the perfect budget plan example for students is the one you create, personalize, and stick to. Start with the steps outlined here, utilize available tools and resources, and don’t be afraid to adjust as you go. Your journey to financial confidence and control begins now!

Frequently Asked Questions (FAQ) for Student Budgeting

How much should a typical student budget for food per month?

This varies widely based on location, dietary needs, and cooking habits. A student cooking most meals at home might budget $200-$400/month (or equivalent), while someone relying on meal plans or eating out more will spend significantly more. Track your own food spending for a month to get a realistic baseline for your budget.

How can I create a student budget with an irregular income (e.g., from a part-time job with varying hours)?

Budget based on your lowest anticipated monthly income. This ensures your essential expenses are covered. Any income earned above this baseline can then be allocated to variable “Wants,” extra savings, or paying down debt. Alternatively, average your income over the last 2-3 months and use that, but keep a small buffer for lower-income months.

What’s the best way for a student to track their expenses?

The “best” way is subjective. Options include:

Budgeting Apps: Many automatically categorize linked bank/card transactions.

Spreadsheets: Offers customization for manual tracking.

Notebook: Simple, manual, and forces awareness.

Envelope System (Digital or Physical): Allocates cash to categories. Choose the method you’ll consistently use.

Should students have an emergency fund? How much?

Yes, absolutely! Even a small emergency fund is crucial. Aim to start with $500-$1,000 (or local equivalent) to cover unexpected costs like a medical bill, urgent travel home, or essential tech repair. This prevents derailing your budget or going into debt for small emergencies.

What if my student budget planner shows I’m spending more than I earn (a deficit)?

Don’t panic! This is a common discovery. First, identify non-essential “Want” categories where you can cut back (e.g., dining out, entertainment, subscriptions). Next, look for ways to reduce “Needs” (e.g., cheaper groceries, more affordable transport). Finally, explore options to increase your income (more work hours, a side hustle). The goal is to adjust until your income meets or exceeds your planned outflows (including savings).