Do you ever track your spending, maybe even have a budget, yet still feel like money just… evaporates? You get to the end of the month and wonder where it all went, struggling to hit savings goals despite your best intentions. If you’re nodding along, you might be ready for a more intentional approach: zero-based budgeting. It sounds intense, but this method is one of the most powerful ways to gain crystal-clear awareness and absolute control over your finances.

Ready to ditch the financial mystery? This guide will thoroughly explain zero-based budget principles. We’ll cover exactly what a zero budget is, how it works step-by-step, weigh the pros and cons, and provide actionable tips to implement it successfully. Prepare to give every single dollar, euro, or pound a specific job and finally tell your money exactly where to go.

Table of Contents

Decoding the Zero Budget: Giving Every Dollar a Job

Let’s start by demystifying this popular budgeting method.

Explain Zero-Based Budget: The Fundamental Rule (Income – Expenses = 0)

The core concept of zero-based budgeting (ZBB) is simple yet powerful: Your total income minus your total expenses (including savings and debt payments) must equal zero for a specific period, typically a month.

This doesn’t mean you aim to have zero money left in your bank account. It means every single unit of currency you earn is assigned a specific purpose or category within your budget before the month begins. There’s no vague “leftover” money; every dollar has a name and a destination.

- Formula:

Total Monthly Income - (All Planned Spending + Savings + Debt Payments) = 0

Think of it like planning a mission for every soldier in your financial army.

https://www.investor.gov/introduction-investing/basics/what-financial-planning

How it Differs from Traditional Budgeting (vs. “Leftover” Budgeting)

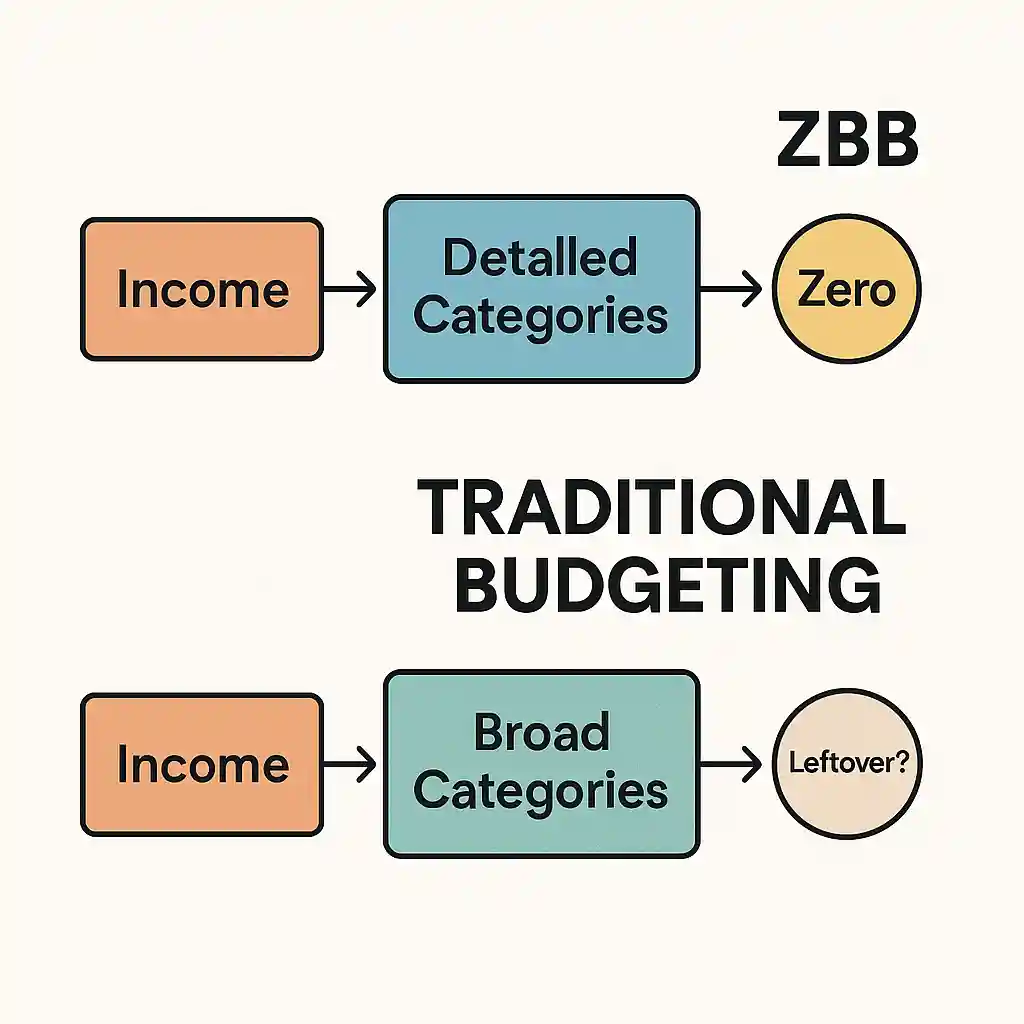

Many traditional budgeting approaches focus on tracking expenses against broad categories and seeing what’s “left over” at the end of the month (which often gets spent unintentionally). ZBB flips this:

- Traditional: Income – Expenses = Leftover (often spent or vaguely saved)

- Zero-Based: Income – Expenses (including planned savings/debt goals treated as expenses) = Zero (intentionally allocated)

ZBB forces you to be proactive and decide in advance how every bit of your income will be used to serve your priorities.

The Philosophy: Intentionality and Awareness

Beyond the math, ZBB is a philosophy rooted in:

- Mindfulness: Being fully aware of your income and outflows.

- Intentionality: Consciously deciding where your money goes based on your values and goals.

- Accountability: Holding yourself accountable for sticking to the plan you created.

It shifts you from passively observing your finances to actively directing them.

The Powerful Benefits of a Zero Budget Approach

Why go through the effort of assigning every dollar? The payoff can be significant.

- Benefit 1: Total Financial Awareness (No More Mystery Spending): Because every dollar is accounted for, you gain unparalleled clarity on where your money truly goes. This eliminates the “where did it all go?” feeling at month’s end.

- Benefit 2: Intentional Spending Aligned with Goals: ZBB forces you to prioritize. You must consciously decide how much goes to savings, debt, needs, and wants, ensuring your spending reflects what’s actually important to you.

- Benefit 3: Identifying and Cutting Wasteful Spending: When you meticulously track and assign funds, unnecessary subscriptions, forgotten fees, or areas of overspending become glaringly obvious and easier to cut.

- Benefit 4: Increased Control and Reduced Financial Anxiety: Knowing you have a plan and are actively managing your money provides a powerful sense of control, which often significantly reduces stress and anxiety around finances.

- Benefit 5: Adaptability Month-to-Month: While it requires planning each month, ZBB is inherently flexible. If your income or priorities change one month, you simply create a new “zero-based” plan reflecting those changes.

Weighing the Drawbacks: Potential Challenges of ZBB

While powerful, zero-based budgeting isn’t without its challenges.

- Drawback 1: It’s Time-Consuming (Especially Initially): Setting up your first 0 based budget requires significant effort: calculating income accurately, listing all expenses, tracking spending meticulously, and assigning every dollar. Ongoing monthly planning also takes more time than less detailed methods.

- Drawback 2: Requires Detail-Oriented Tracking: To make ZBB work, you need to track your spending against your budget categories fairly closely throughout the month to ensure you’re staying on plan and to inform the next month’s budget.

- Drawback 3: Can Feel Restrictive if Not Implemented Mindfully: If you create categories that are unrealistically tight or don’t budget for any fun/flexibility, ZBB can feel overly restrictive and lead to burnout. It’s crucial to build in realistic allowances for wants and buffer categories.

- Who It’s Best For: ZBB excels for:

- Individuals who feel their money disappears without a trace.

- Those struggling with overspending or impulse buys.

- People serious about aggressively pursuing savings or debt payoff goals.

- Detail-oriented individuals who enjoy granular control.

- Those with relatively stable monthly income (though it can be adapted).

- [H3] Who Might Prefer Other Methods:

- People seeking maximum simplicity (might prefer 50/30/20 or “pay yourself first” alone).

- Those with highly erratic income who find monthly zeroing-out stressful (though adaptations exist – see later section).

- Individuals who find detailed tracking tedious and unsustainable long-term.

Implementing ZBB: Your Practical Action Plan

Ready to create your first zero budget? Follow these steps systematically:

Step 1: Calculate Your Total Monthly Income (Net Pay)

- Determine your reliable, after-tax take-home pay for the month.

- If your income varies, use a conservative estimate (lowest expected amount) or average over several months (more on this later).

Step 2: List ALL Your Monthly Expenses (Fixed & Variable)

- Go through bank/credit card statements, receipts, and previous spending history. Be exhaustive!

- Fixed Expenses: Consistent amounts each month (Rent/Mortgage, loan payments, insurance premiums, set subscription fees).

- Variable Expenses: Fluctuate month-to-month (Groceries, utilities, gas/transport, dining out, entertainment). Use averages or realistic estimates based on past spending.

- Irregular Expenses: Occur infrequently but need planning (Annual memberships, gifts, holidays, car repairs, medical co-pays). Account for these using sinking funds (see next section).

Step 3: Track Your Spending (Refine Estimates)

- If you’re unsure about variable expense estimates, track your spending closely for a month before finalizing your first ZBB. This provides accurate data.

Step 4: Assign Every Dollar! (Income – Expenses = Zero)

- This is the core of ZBB. Start allocating your net income to your expense categories until the remaining balance is zero.

- Prioritize Needs First: Cover housing, food, utilities, transport, insurance, minimum debt payments.

- Allocate to Goals Next: Treat savings, investments, and extra debt payments as mandatory “expenses” in your budget. Assign specific amounts based on your goals.

- Allocate to Wants Last: Fill in discretionary categories (dining out, hobbies, fun money) with the remaining funds.

- Use a Buffer Carefully: Include a small “Buffer” or “Miscellaneous” category ($50-$100, or a small percentage) for unexpected small costs or minor overspending in other categories. This adds flexibility. Crucially, this buffer must also be subtracted to reach zero.

Step 5: Create Your Budget Document (Worksheet, App, Notebook)

- Record your plan. Options include:

- Spreadsheets (Excel, Google Sheets) – Highly customizable.

- Budgeting Apps with ZBB features (like YNAB – You Need A Budget).

- Pen and paper / Dedicated budgeting notebook.

- Choose the tool you’re most likely to use consistently.

https://www.consumerfinance.gov/consumer-tools/budgeting

Step 6: Track Throughout the Month & Adjust as Needed (Crucial!)

- Record expenses as they happen (or daily/weekly). Compare actual spending to your budgeted amounts.

- If you overspend in one category, you MUST adjust by reducing funds from another category to maintain the “zero” balance for the month. This forces conscious trade-offs.

Structuring Your Zero Budget: Categories and a Sample

Organizing your expenses makes Zero-Based Budgeting manageable.

Common Budget Categories:

Customize these to your life:

- Income: (List sources if multiple)

- Housing: Rent/Mortgage, Property Taxes, HOA Fees

- Utilities: Electricity, Gas, Water/Sewer, Trash, Internet, Phone

- Food: Groceries, Restaurants/Takeout

- Transportation: Car Payment, Gas/Fuel, Car Insurance, Maintenance/Repairs (Sinking Fund!), Public Transit

- Debt Payments: Student Loans, Credit Cards (Minimum + Extra), Personal Loans

- Savings Goals: Emergency Fund, Retirement Contributions, House Down Payment, Vacation Fund (Sinking Funds!)

- Insurance: Health, Life, Disability (if applicable)

- Personal Care: Haircuts, Toiletries, Gym Membership

- Entertainment: Movies, Concerts, Streaming Services, Hobbies

- Shopping: Clothing, Household Goods, Electronics

- Giving: Charitable Donations, Gifts

- Miscellaneous/Buffer: (Keep this small and track what goes here)

Incorporating Sinking Funds for Irregular Expenses

- For expenses that don’t occur monthly (car insurance paid semi-annually, holidays, car repairs), create “sinking funds.”

- Divide the estimated annual cost by 12 and save that amount each month in a dedicated category (or separate savings account).

- Example: Annual car insurance is $1200. Budget $100 each month (1200/12) into your “Car Insurance Sinking Fund. “When the Billis due, the money is already set aside.

Sample Zero−Based Budget Breakdown (Illustrative Example)

Important Disclaimer:

Please remember this is a highly simplified example using generic currency () and percentages based on a hypothetical Net Monthly Income of $4,000. Your actual income, expense categories, percentages, and currency will differ significantly based on your personal situation, location, and financial goals. Use this only as a conceptual guide.

| Category | Budgeted Amount | % of Net Income | Notes |

|---|---|---|---|

| Net Income | $4,000 | 100% | |

| EXPENSES | |||

| Rent/Mortgage | $1,200 | 30% | Housing Needs |

| Utilities (Elec/Gas/Water) | $150 | 4% | Variable Need |

| Internet/Phone | $100 | 3% | Fixed Need |

| Groceries | $350 | 9% | Variable Need |

| Transportation (Gas/Ins/Maint) | $300 | 8% | Variable Need (Maint. is Sinking Fund) |

| Min. Student Loan Payment | $150 | 4% | Fixed Debt Need |

| Min. Credit Card Payment | $50 | 1% | Fixed Debt Need |

| Health Insurance Premium | $200 | 5% | Fixed Need |

| Subtotal Needs/Fixed Debt | $2,500 | 62.5% | |

| GOALS (Savings/Extra Debt) | Treat as Expenses | ||

| Emergency Fund Savings | $200 | 5% | Building Safety Net |

| Retirement Contribution | $400 | 10% | Long-Term Goal |

| Extra Credit Card Payment | $150 | 4% | Accelerating Debt Payoff |

| Vacation Sinking Fund | $100 | 3% | Saving for Specific Goal |

| Subtotal Goals | $850 | 21.3% | |

| WANTS | |||

| Restaurants/Takeout | $200 | 5% | Discretionary |

| Entertainment/Hobbies | $150 | 4% | Discretionary |

| Personal Care/Shopping | $150 | 4% | Discretionary |

| Miscellaneous/Buffer | $50 | 1% | Flexibility |

| Subtotal Wants | $550 | 13.8% | |

| TOTAL EXPENSES + GOALS + WANTS | $3,900 | 97.5% | Incorrect – needs refinement see below |

| Mistake Check: $2500+850+550 = $3900. Needs to equal $4000. | Let’s adjust Wants or Goals slightly. | ||

| REVISED EXAMPLE | |||

| Restaurants/Takeout | $200 | 5% | |

| Entertainment/Hobbies | $150 | 4% | |

| Personal Care/Shopping | $200 | 5% | Increased by $50 |

| Miscellaneous/Buffer | $50 | 1% | |

| Subtotal Wants (Revised) | $600 | 15% | |

| TOTAL ALLOCATED (Rev.) | $4,000 | 100% | ($2500 + $850 + $600 = $4000) CORRECT |

Making Your 0 Budget Stick: Pro Tips & Tricks

Consistency is key for Zero-Based Budgeting (ZBB) success.

- Be Realistic, Especially at First: Don’t slash categories too drastically initially. Make gradual changes.

- Budget Before the Month Begins: Plan the upcoming month’s budget before the 1st.

- Track Spending Consistently: Find a rhythm (daily check-in, weekly review) that works for you.

- Use the Right Tools for You: Experiment with apps vs. spreadsheets to find what makes tracking easiest.

- Budget with a Partner (If Applicable): Requires teamwork, open communication, and shared goals.

- Review and Adjust Monthly: Your ZBB isn’t static. Review last month’s spending and adjust the next month’s plan based on actuals, changing priorities, or income shifts.

- Don’t Aim for Perfection, Aim for Progress: You’ll make mistakes. Learn and adjust. Consistency over perfection.

Adapting ZBB for Variable or Freelance Income

Zero-based budgeting can work with irregular income, but requires adaptation:

- Budgeting Based on Lowest Estimated Income: Create your baseline ZBB using your lowest expected monthly income. Cover all essential Needs first within this amount.

- Prioritizing Needs First When Income Arrives: As income comes in above your baseline, allocate it based on a pre-determined priority list (e.g., 1. Top up Emergency Fund, 2. Extra Debt Payment, 3. Boost Retirement, 4. Next Month’s Budget Buffer, 5. Fun Money).

- Using Windfalls Intentionally: Apply the same priority list approach to unexpected income like bonuses or gifts.

- The Importance of a Larger Buffer Category: A slightly larger miscellaneous/buffer category can help absorb income fluctuations or unexpected dips. Building ahead (saving for next month’s expenses this month) also helps smooth things out.

Zero-Based Budgeting FAQs

Let’s tackle common questions:

- Does zero-based budgeting mean I have $0 in my bank account? No! It means every dollar of income for the month is assigned a job (spending, saving, debt). You should still have money in your checking account for cash flow and definitely money in your savings/emergency fund accounts.

- Is zero-based budgeting too time-consuming? It takes more time upfront and requires consistent tracking compared to simpler methods. However, many find the initial time investment pays off immensely in control and awareness. It often gets faster with practice and the right tools.

- Can ZBB really help me save more money? Yes, significantly. By forcing you to account for every dollar and identify waste, it naturally channels more money towards savings and debt payoff goals compared to less intentional methods.

- What’s the best app for zero-based budgeting? YNAB (You Need a Budget) is specifically designed around ZBB principles. Other apps like Every Dollar, Good budget (virtual envelope system), or even customizable spreadsheets can also work well. The “best” app is the one you’ll use consistently.

- How often do I need to make a zero-based budget? Ideally, you create a new zero-based plan each month before the month begins, as income and expenses can fluctuate.

Gain Total Control with Zero-Based Budgeting

Zero-based budgeting is more than just a spreadsheet; it’s a powerful system for bringing complete awareness and intentionality to your financial life. By giving every dollar, euro, or pound a specific job before the month starts, you transform from a passive observer of your finances into an active, empowered director.

Yes, it requires more effort and detail than other methods. But the rewards – identifying hidden spending, accelerating progress towards goals, reducing financial stress, and gaining true control – are often well worth the investment. If you feel like your money has a mind of its own, implementing a zero budget might be the key to finally telling it exactly where to go.

Call to Action:

Are you ready to give every dollar a job? Try creating a simple zero-based budget for just one upcoming week as an experiment. What do you anticipate being the biggest challenge? Share your thoughts or ask questions about ZBB in the comments below!

If this guide helped explain zero-based budgeting clearly, please share it with others seeking more control over their personal finances!